European futures are pointing to a slightly positive start to the week following further discussions over the weekend between Greek Prime Minister Alexis Tsipras and German Chancellor Angela Merkel that investors hope will lay the foundations for a deal on Greek reforms in the coming weeks.

Whenever we hear about discussions taking place between Tsipras and Merkel, the feedback we hear tends to be quite positive and encouraging. Then we have a meeting of the eurogroup and Greece suddenly looks on the brink of default again. I’m not sure if Tsipras and Greek Finance Minister Yanis Varoufakis are playing a game of good cop bad cop here but whatever they’re doing, it’s baffling investors.

Greek officials will hold a teleconference with the Brussels group (the ECB, European Commission and the IMF – formerly known as the Troika and the Institutions – and the European Stability Mechanism (ESM)) today before meeting in person on Wednesday. Hopefully some real progress can be made during these discussions because at the moment, we appear to be counting down the weeks until Greece defaults and yet an agreement on reforms doesn’t even appear close.

Clearly Greece is on the verge on running out of cash as its was recently forced to call in cash reserves of public sector accounts in order to honour repayments and pay salaries and pensions. The problem is no one outside of Greece seems to know when exactly they will run out or what will happen if they do default and this creates a lot of uncertainty which investors hate.

There have been suggestions that Greece could default and not exit the eurozone, as we saw when haircuts were applied to privately held debt but this has not been confirmed by all parties. More so, there has been no confirmation about whether Greek banks would still have access to the emergency liquidity assistance (ELA) program from the ECB that is currently keeping them from collapse. You would imagine that the ECB would stand little to gain from withdrawing support and yet they now find themselves in a very difficult position as they effectively now decide whether Greece survives or spectacularly collapses.

Hopefully it will not come to that but for that to happen, Greece and its creditors will need to work towards a deal that pleases both parties. As it stands, neither appears willing to soften its stance but maybe it’s more a case of neither wanting to blink first and risk appearing weak. Unfortunately, one will have to do it soon or Greece will default which could start a vicious chain of events.

With the opening day of the trading week looking pretty quiet from an economic data perspective and earnings not offering much more in Europe, the focus will predominantly be on Greece again today. In the U.S. we’ll get the latest services PMI reading for April while Apple will report on the first quarter.

The FTSE is expected to open 1 point higher, the CAC 2 points higher and the DAX 35 points higher.

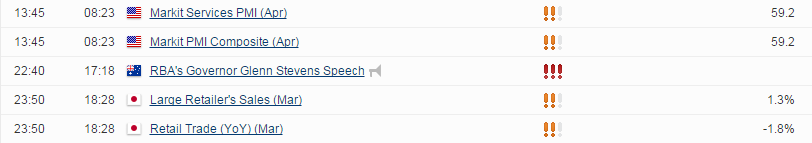

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.