US indices are expected to pare Friday’s heavy losses this morning, as the People’s Bank of China’s 100 basis point cut to the reserve requirement ratio offers support to the broader markets.

The cut was not enough to prevent Chinese shares ending in the red but when you consider the fact that on Friday, Shanghai Composite futures were down 6%, it has still providing a significant boost. There have been suggestions that the larger than expected cut was a desperation move from the PBOC to offset Friday’s moves in the futures market which came on the back of the China Securities Regulatory Commission (CSRC) announcement that it has tightened margin trading rules.

A cut to the RRR was pretty much priced in and more are still likely to come this year. We just weren’t expecting it to be 100 basis points and I think that had we not had the CSRC announcement on Friday, it wouldn’t have been. Regardless, more monetary stimulus in China is needed in order to manage the economic slowdown, with all of the data displaying signs of weakness.

This is only likely to provide temporary relief for US stocks which are facing a tough few weeks. More than 25% of S&P 500 companies are reporting on the first quarter this week and I’m not optimistic. Earnings season may have got off to a good start but it has included a lot of financial institutions which were expected to announce decent results. The ones we’re most interested in will be those with the biggest exposure to US dollar moves, with the strong dollar seen damaging exporters and large multi-nationals as their foreign profits are eroded by the currency moves.

This week is going to be a test of whether the bar has been lowered enough. I think earnings season could weigh heavily on US stocks in the coming weeks and the technicals suggest traders are anticipating the same thing. Last week’s failure to hold above 2,100 while making a second consecutive lower high following 25 February’s record high suggests to me that traders are feeling uncomfortable at these levels. I think a correction could be on the cards and if we see a break below 2,040, the S&P could slide back to 1,970, marking a 6.68% correction from last week’s highs.

A quieter week on the economic data side means these earnings are likely to be more heavily scrutinized. The situation in Greece is also going to continue to make headlines ahead of the eurogroup meeting on Friday. So far, Greek leader Alexis Tsipras has been both unwilling and unable to offer a list of acceptable reforms to the countries lenders in order to release the €7.2 billion bailout that was agreed as part of the extension earlier this year. Without the funds, Greece will default on its debt and could be forced out of the eurozone and in to a devastating financial crisis.

The S&P is expected to open 12 points higher, the Dow 121 points higher and the Nasdaq 24 points lower.

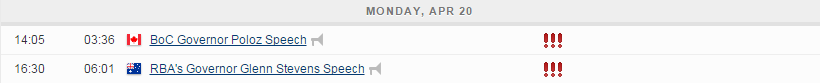

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.