US futures are pointing to the downside ahead of the final session of the week. The latest US CPI reading is going to be a key focal point today, with the prospect of falling inflation clearly being behind the Fed’s unease when it comes to the first rate hike.

While Yellen may have suggested at previous press conferences that they want to see more improvement in the economic data before hiking rates, I think it’s quite clear that there remains only one barrier to higher rates and that’s the inflation outlook. The US is at full employment by the Fed’s own definition and wage growth is good and likely to improve as slack in the economy continues to ease.

There are, however, a couple of things that could weigh on inflation in the coming months and I think this is what the Fed is waiting on. Oil prices are only a temporary factor and only have a large impact on the inflation figures but there is a small threat that the direct impact on consumer goods could lead to lower inflation expectations, which would be dangerous. Imported deflation as a result of loosening monetary policy in the eurozone, China and Japan is another risk for the US, especially with the country being such a large importer of consumer goods.

If the Fed sees no impact of these on the inflation readings and, better yet, improving wage growth which suggests no risk of lower business inflation expectations, I think they will hike rates in September. The last thing the Fed wants is external factors driving down the inflation rate at a time when they’re hiking rates which naturally adds downside pressures.

It’s worth noting that the CPI figure is not the Fed’s preferred measure of inflation, but with that coming in a couple of weeks, it is the earliest indication we have of what that will be. This is why we can often see more of a market reaction to the CPI reading that the core personal consumption expenditure price index even though people know that the Fed’s tracks the latter more closely.

Reports that Chinese fund managers will be allowed to lend stocks for short selling is hammering stocks as we approach the US open. Futures on the Chinese indices are down more than 5% while the US is seen opening just shy of 1% lower and stocks in Europe are also being hit badly. What we’re seeing right now is a combination of panic and technical levels being wiped out and exacerbating the move lower.

I also don’t think it helps matters when people have spent the last week or so both preparing for and discussing the prospect of a correction. The S&P for example appears to be topping out and I think a 6-10% correction is easily on the cards. I would not be surprised to see 1,970 hit in the coming weeks.

The correction in the DAX is already well and truly underway, down now 5% on the week. The late March low of 11,620 now offers the next level of support for the DAX at which point we may see value hunters picking it up again.

People thought it would be earnings season that triggered this correction but it appears the Securities Association of China has beaten them to it.

The S&P is expected to open 14 points lower, the Dow 152 points lower and the Nasdaq 46 points lower.

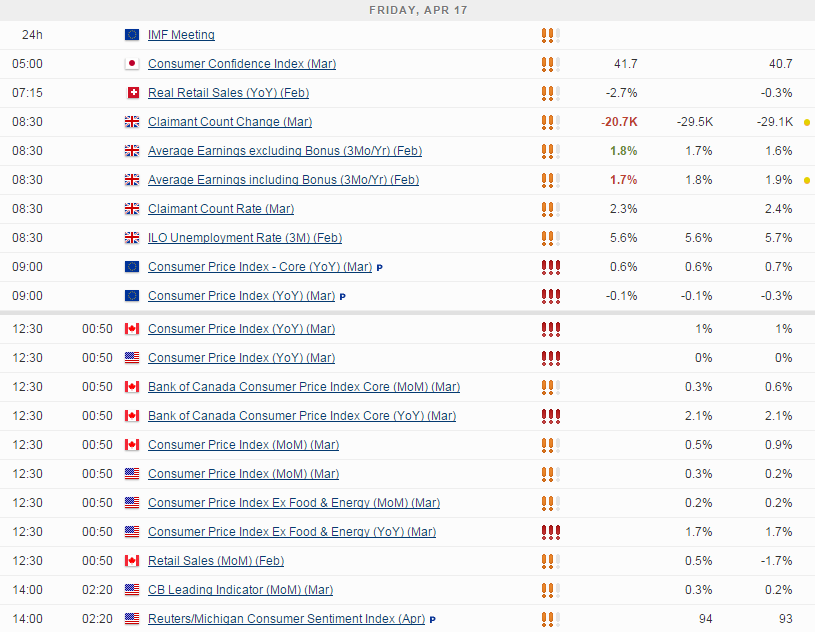

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.