European futures are pointing to a mixed start on Friday as traders await the release of employment data from the UK and inflation figures from the Eurozone and the US.

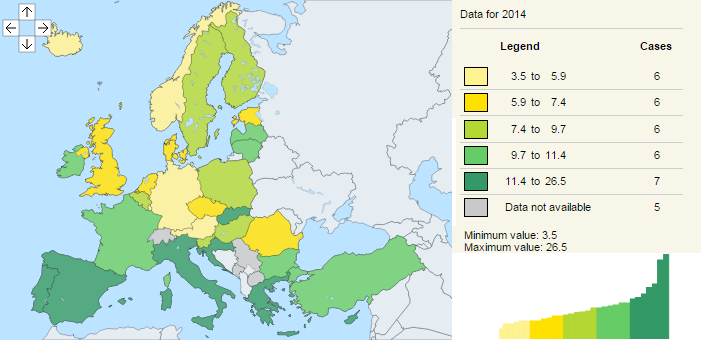

The UK elections are only a few weeks away now and throughout the election campaign there are a few topics that parties have been vigorously debating on, one of which is jobs. The UK boasted one of the lowest unemployment rates in Europe at the end of 2014 and it has fallen further since.

*The above images were taken from the eurostat website.

The unemployment rate is expected to have fallen again in February to 5.6%, the lowest level since July 2008 and well below the 2012 peak of 8.4%. While opposition leaders have criticised the quality of jobs created, in particular zero-hours contracts, the Conservatives will be keen to point out the low levels of unemployment in the UK and given the headlines today’s figure could make, it could make a difference in one of the closest fought elections in years.

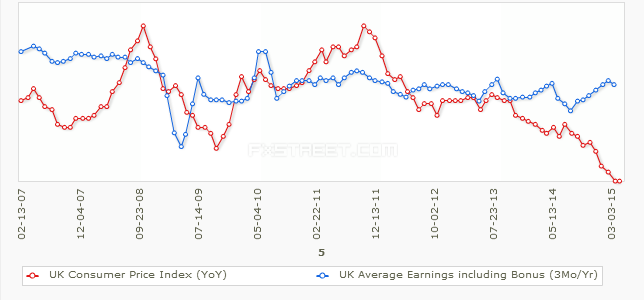

Average earnings data will also be released alongside the report and is expected to show wage growth remaining at 1.8% in the three months to February. While the figure itself is nothing to boast about, especially when compared to pre-recession levels, when the economy is experiencing zero inflation, it does represent solid real income growth, which could work in the Tories favour.

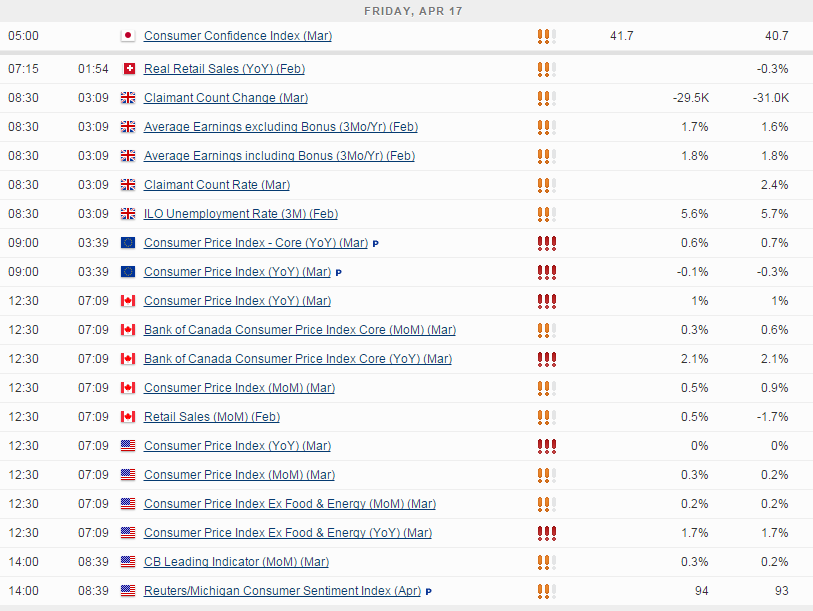

The final Eurozone CPI inflation reading will be released this morning and is expected to confirm that prices fell by 0.1% in March, while core prices rose by a meagre 0.6%. That technically leaves the eurozone in deflation for a fourth consecutive month although it does appear to be easing a little, which suggests it may not last long.

The weaker euro and recent oil price rise may provide further upward momentum in the coming months although any significant and sustainable inflation is probably still quite far away. Oil prices can cause temporary moves but austerity in the eurozone is going to continue to weigh on prices so even if it does battle its way out of deflation, it’s unlikely to be too far away for a while yet.

While the US may not have to worry about deflation, its inflation outlook does appear to be of enough concern to the Fed that it is likely to kick the can down the road and wait until at least September to raise interest rates. The Fed has stated that it needs to see more improvement in the economic data before it raises rates but with the country at full employment, I’m not entirely sure that’s true. If inflation wasn’t currently being driven lower by oil prices and more worryingly, other countries exporting deflation, I think rates would already have risen.

Inflation is expected to remain at 0% today although core inflation is seen at 1.7% and I’m sure it’s the latter that the Fed will pay more attention to. That said, it’s become clear that this is not the Fed’s preferred measure of inflation, so really we should just be viewing this as an indication of what the core personal consumption expenditure price index will tell us in a couple of weeks.

The FTSE is expected to open 2 points higher, the CAC 2 points lower and the DAX 22 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.