US futures are pointing to a stronger open again on Wednesday supported by another day of gains in oil prices which has so far provided a lift to stock markets in Europe.

Brent and WTI are on course for a fourth advancing session in five as the stabilisation in the dollar eases the pressure on commodity prices. At the same time, reports of production cuts in the US following the closure of large numbers of oil rigs could provide support for oil prices going forward, even with inventories continuing to grow.

The basic resources sector is also outperforming much of the market despite data overnight showing the slowest rate of growth in China in the first quarter since the start of 2009. This was accompanied by some pretty dismal industrial production, fixed asset investment and retail sales data, by the country’s own standards, which will only support the demand for more stimulus from the People’s Bank of China.

The prospect of more aggressive monetary stimulus from the PBOC this year looks to be responsible for much of the gains seen in Europe this morning and could carry through to the US session as well. Once again we find ourselves in the bad news is good news scenario in which investors are more concerned with feeding their addiction to liquidity than seeing economic improvements.

The ECB has been very active in the markets recently having launched its own quantitative easing program in March. Despite only being in the early stages of this 18-month stimulus program, we are already seeing some of the benefits of it, predominantly in the economic surveys. While these can be unreliable and reverse course rapidly, much of the confidence is being driven by a more upbeat view on exports as a result of the weakness in the euro. Given that the currency is expected to remain weak and probably depreciate further, I think the outlook for the euro area is looking a little more rosy.

In the press conference that follows the decision, ECB President Mario Draghi may look to quickly quash speculation that the central bank could look to end the QE program earlier than planned. I can’t imagine the central bank is actually considering that at this early stage, even if there were certain members against its implementation in the first place. This potentially makes the euro look a little heavy ahead of the press conference, especially with the rest of it likely being one of the quieter events.

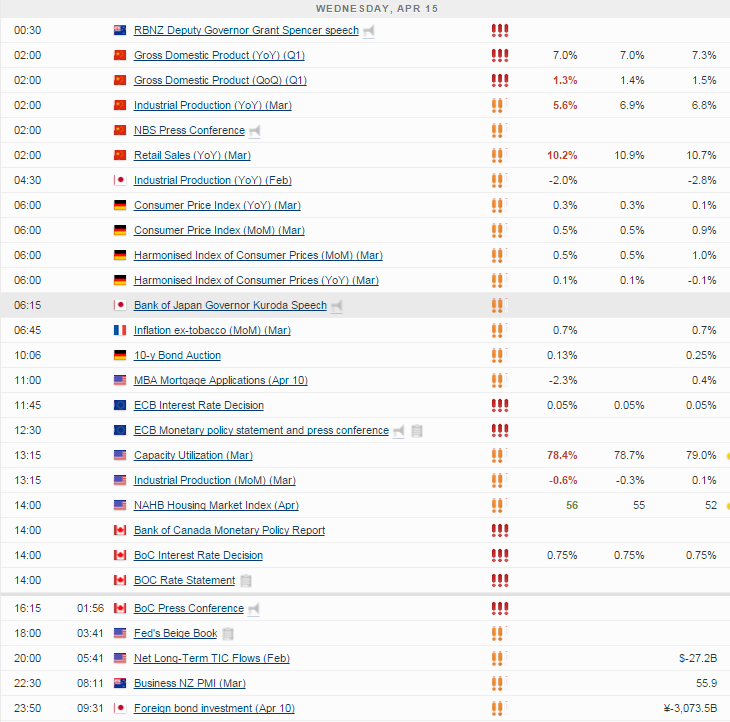

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.