US futures are pointing to the downside ahead of the open on Tuesday as investors take a cautious stance in anticipation of what could be a rough earnings season. JP Morgan, Wells Fargo and Intel will all report on the first quarter today and given the wobbly start to the year in the US, a stronger dollar and the plunge in oil prices, I think it could be a really rough ride culminating in the first decline in earnings in six years.

In recent years we have become accustomed to expectations being lowered to the point that upside surprises came far more often than they should, aided primarily by cost cutting efforts driving earnings growth. With earnings seen declining in the first quarter, investors appear in no mood to be so forgiving and will instead seek assurances that the strong dollar – more of which is expected in the next 12 months – will not continue to erode earnings.

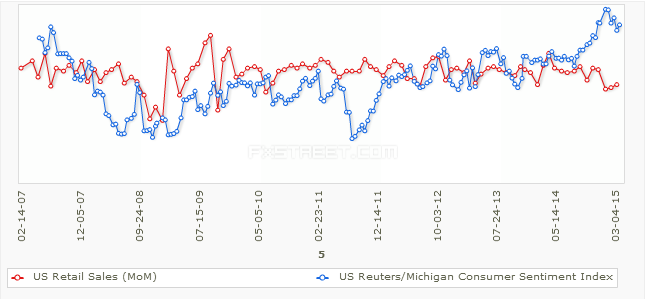

Consumer spending figures for December to February do not appear to suggest that retailers are yet benefiting from the plunge in oil prices, potentially as a result of the poor weather at the start of the year. If bad weather was behind the three months of declining retail sales, that should mean that consumers have a little extra cash stored away which should make retailers more optimistic about the coming quarters.

Retail sales for March are expected to rise by 1.1%, the first improvement since November, which is hopefully a positive sign of things to come. It may be a little late to provide a significant growth boost to the quarter but we saw the same thing last year and the economy performed extremely well in the following quarters. A good retail sales figure in March will certainly lift investors and make them much more optimistic going forward, especially considering how dependent the country is on the consumer.

The poor weather would explain the divergence being seen between consumer sentiment survey’s and actual spending and may suggest that it is going to pick up in the coming months.

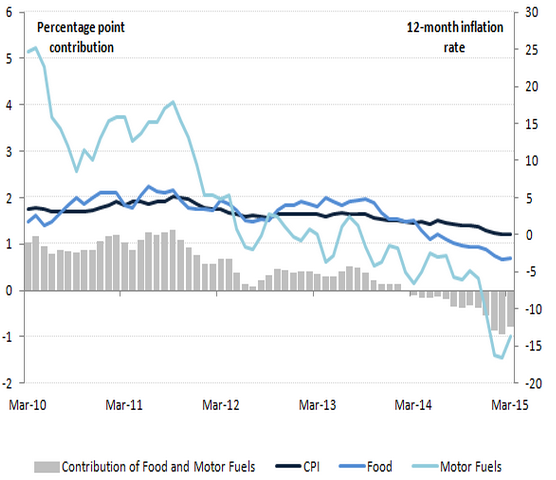

The UK saw no inflation in the economy for a second month as a decline in imported oil and food prices weighed heavily on the CPI reading. The government and Bank of England remain unconcerned about these low inflation readings as they deem it to be beneficial deflation rather than bad deflation, which comes when the consumer expects prices of non-essential goods falling and therefore delays purchases.

*The above chart was taken from the official report that can be found on the Office for National Statistics website.

Oil and food are essential products and therefore falling prices actually act as a kind of tax break to consumers while hopefully not changing their inflation expectations for the broader economy. If correct, we should see an ongoing improvement in consumer spending patterns over the course of this year before inflation begins to rise once again. The worry could be that wage growth remains low as businesses also look to take advantage of the low inflation environment which could have an impact on the long term trajectory of the recovery.

The decline in the core reading from 1.2% to 1% could be a concern to the BoE as it strips out the direct impact of lower oil prices. Unfortunately, it doesn’t take into account the indirect impact and therefore could continue to decline over the course of the year. This may be the biggest risk to consumer inflation expectations although as of yet, it doesn’t seem to be having a negative impact.

The S&P is expected to open 3 points lower, the Dow 33 points lower and the Nasdaq 13 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.