European indices are eyeing a strong start to the week, following a positive close in Wall Street on Friday and similarly strong session in Asia overnight.

Friday’s late surge came as a result of some more dovish comments from Fed Chair Janet Yellen, who stressed that any hike in interest rates will be very gradual and the first may be “warranted later this year”, making a June hike seem even more unlikely. She also referred to “secular stagnation” as a possible risk to the US which would force the Fed to remain very accommodative. This is a worrying scenario in which low growth and interest rates become the norm, as we’ve seen in Japan for the last 20 years. In a consumer driven economy like the US, it would be disastrous.

Asian stocks received a further boost as China’s central bank governor Zhou Xiaochuan hinted at a further loosening of monetary policy. Zhou stressed that they must be vigilant on inflation which has been declining and could well enter deflationary territory. The People’s Bank of China has already been busy this year, cutting interest rates and the reserve requirement ration and Zhou’s comments seemed to back up the consensus view that more is coming.

While Zhou did recently warn that a too accommodative stance could undermine structural reforms, his latest comments clearly suggest that a bigger concern is the inflation trend and therefore I don’t expect them to hold back. Despite the worrying scenario that requires rate cuts, markets always respond well to the prospect of them as looser monetary policy tends to brighten the outlook for an economy and the additional liquidity it puts into the markets tends to inflate asset prices. It’s win win for an investor.

Investors spent much of last week being very cautious and despite the positive start that we’re expecting, I expect that to continue this week. There’s two things that investors are really focused on right now, the first rate hike from the Fed and first quarter earnings. I think it’s inevitable that at least one of these will prompt a larger correction in the markets, it’s just a case of which will be first.

Earnings season unofficially starts next week and given the poor data for the first quarter, bad weather, lower oil prices and a stronger dollar, I think companies may struggle to keep investors happy. As always, we’ve done our part in lowering the bar so much that you could crawl over it, but I don’t think it will be enough on this occasion. Companies are facing some very tough challenges and I think that will be evident in the coming weeks.

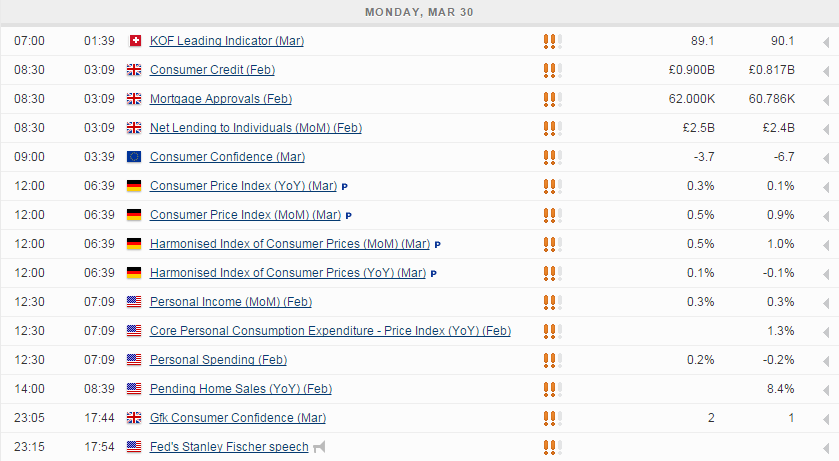

This week investors will be focused on the data and while there is plenty being released today, I don’t see anything that is likely to shake things up too much in the markets. The one that stands out is the core personal consumption expenditure price index – the Fed’s preferred measure of inflation – but the CPI figure which is released earlier tends to act as a shock absorber should we see any significant movement.

The FTSE is expected to open 29 points higher, the CAC 25 points higher and the DAX 43 points higher.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.