The oil rally yesterday was driven by the conflict in Yemen as the Saudi’s led an attack – with the support of its Gulf Arab allies – against the Houthi rebel group, which is thought to have Iranian backing. The Shia militia group has seized large parts of Yemen and forced President Abd Rabbu Monsour to flee the capital, which appears to have been the final straw for the countries Sunni neightbours. The attack, which began with air raids, is likely to be followed by a ground invasion as more countries join the effort to defeat the Houthi rebels.

While this is unlikely to have an impact on oil supplies, what we saw yesterday is an additional risk premium being priced in because of the potential for further escalation. More than 3.8 million barrels pass through the Bab el-Mandeb Strait off the coast of Yemen and as long as this conflict continues, there are going to be growing fears that this will be impacted.

Fortunately, the glut in oil supplies at the moment has capped any significant risk premium being added to prices. Oil has been in contango for quite a while now which has led to a record amount of offshore storage, to the point that availability is fast running out. As long as we continue to see such an excess in oil supplies, geopolitical risk premiums should remain fairly low. Only when we see a serious risk to supplies either due to conflict in the middle east or production being cut should we see higher risk premiums being added.

The fact that we’re seeing a small decline in prices today does not mean that traders are no longer concerned about the conflict, it’s simply a correction because yesterday’s rally was a little overdone. Despite being more than 1% down on the day, the fact that Brent crude hasn’t even broken below the mid-point of yesterday’s open and close levels is a technical signal that this is merely a correction. If the conflict continues, we could see further gains next week.

The final fourth quarter GDP reading for the US will be released ahead of the opening bell on Wall Street and we’re expecting it to be revised slightly higher to 2.4%. Any number above this would be welcomed by the markets, although I wonder by how much. It’s been a disappointing first quarter in the US and annualised growth is expected to be below 2%. Whether the US can bounce back strongly from such a disappointing first quarter is likely to be a far bigger concern than whether we see a minor revision to fourth quarter growth.

As will the views of Fed Chair Janet Yellen. She is due to speak later on in the day at the Federal Reserve Bank Conference and these events can quite often turn into a discussion on the state of the economy and what it means for monetary policy. The Fed dropped its forward guidance at its latest policy meeting last week, leaving to less certainty about when the first rate hike will come. This could make the markets more sensitive to comments made by Yellen going forward and therefore investors will be following her comments today very closely.

The S&P is expected to open 4 points lower, the Dow 28 points lower and the Nasdaq 3 points lower.

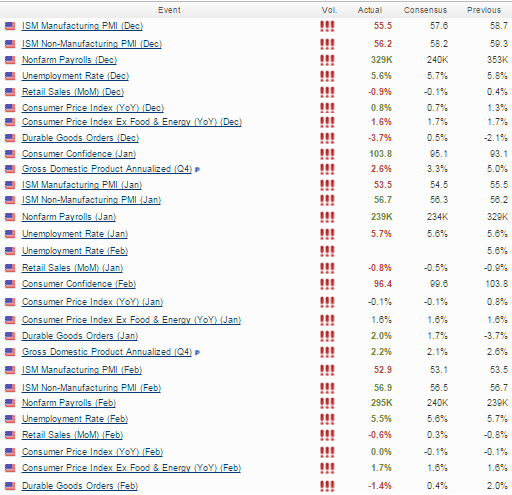

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.