European indices are expected to open lower on Thursday following rough sessions in the US and Asia overnight.

People have spent the last week trying to explain why US indices in particular have suffered over the last week, with some pointing to growing expectations of a summer rate hike and others highlighting the weakness in the dollar during the same period.

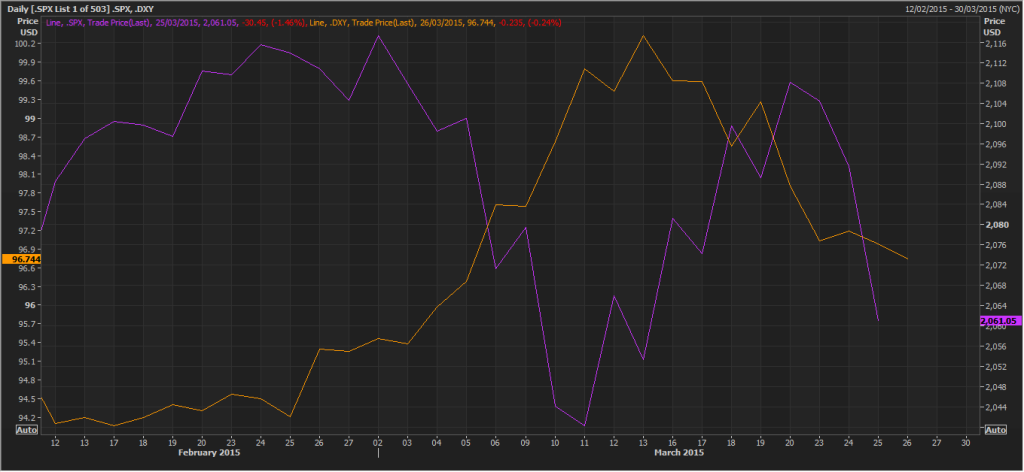

However, neither of these really check out because, if anything, since the last meeting rate hike expectations have been pushed out a little further with September now being the earliest that the Fed is likely to consider it. This has primarily what has weighed so heavily on the dollar. And the strong dollar was being blamed the week before for weighing on US indices as it makes exports less attractive and was seen as being damaging to first quarter earnings.

What we’ve actually seen over the last week is a decoupling in the relationship between the dollar and US indices and I think this has more to do with quarter and month end rebalancing ahead of what is expected to be a disappointing earnings season, than anything else. The weakness in the dollar has persisted simply because it was overbought beforehand and rate hike expectations have been pushed back.

*The above chart was taken from the Reuters Eikon terminal.

This all appears to have dented sentiment in Europe and Asia as well, although to an extent they are being supported by the loosening monetary policy being seen in both. In Europe, we’ve seen more of a stabilisation that an actual sell-off over the last week. European stocks are looking more attractive to investors since the ECB started its QE program due to the lack of yield on offer in the bond market. As a result, I think European stocks should be able to weather this storm without suffering much at all. Contrary to in the US, European earnings season could actually benefit from the weak euro and improvement in the economic data.

Saudi Arabia and its Gulf Arab allies have begun air strikes in Yemem against Houthi rebels who have driven the country’s Sunni President out of the capital. While there are few concerns that this will escalate into a larger war in the region that could have serious implications for oil prices, the risk has been heightened which is why we saw a small rally in Brent crude prices yesterday and may see a little more upward pressure in the coming days.

The conflict has the potential to act as a drag on oil supplies as most oil tankers from Arab producers must pass by the Yemen coastline in order to get through the Red Sea and Suez Canal.

Once again it isn’t going to be the busiest of days on the data front. The market will have high hopes for the Gfk consumer figure, released before the European open, following some very encouraging surveys from the eurozones largest economies recently.

UK retail sales will be monitored closely due to its importance to the UK economy. I don’t think we’ve seen the full benefit of lower oil prices on the consumer yet and therefore think sales could improve in the coming months and provide a real boost to spending ahead of the UK elections, although a small rise in prices recently may weigh slightly on sales at the moment.

The FTSE is expected to open 40 points lower, the CAC 22 points lower and the DAX 65 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.