A more dovish than expected FOMC on Wednesday provided a boost to equity markets in the US and Asia overnight and it appears to be filtering through to Europe as well, with futures pointing to a largely positive open on Thursday.

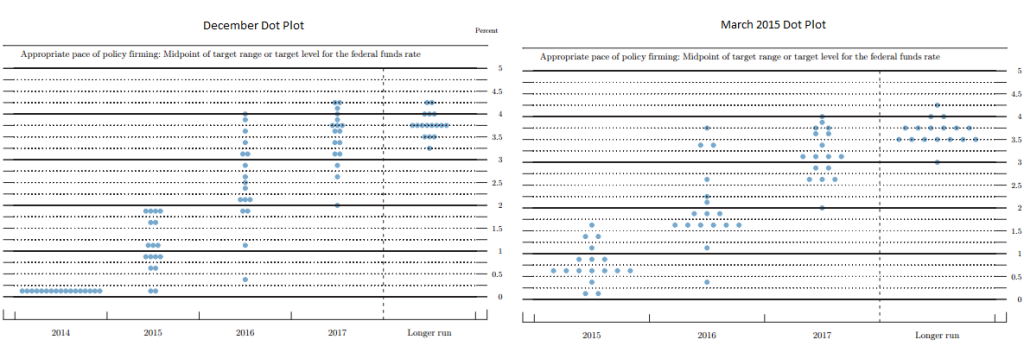

While the Federal Reserve opted to remove its pledge to be “patient” in raising interest rates, which effectively means a rate hike could come as early as June, its economic projections more than offset this and gave the impression of a more dovish stance than was expected. The dot plot highlighted the belief that rate hikes would be more gradual – median forecast for the end of 2015 fell to 0.625% from 1.125% in December for example – while forecasts for growth and inflation were both revised lower.

Leading into the meeting, the EURUSD short was looking a very crowded trade as if a June rate hike along with European Central Bank quantitative easing (QE) was entirely priced in. This gave the impression that there was much more upside risk in the pair and that really turned out to be the case as it rallied through 1.10 before settling around 107.50. I know we can expect volatility around these events but that was extreme even for the FOMC.

With US rate hikes appearing to be largely priced in and the first now unlikely to come until September – Chair Janet Yellen stressed that just because it was no longer pledging to be patient, it doesn’t mean they’ll now be impatient, in a hint that people shouldn’t just assume a rate hike will come in June – you have to think that any weakness in EURUSD will have to come from the European side and that failing talks between Greece and its creditors will be the main driver of this.

The EU summit gets underway and it looks as though Greece is once again going to be top of the agenda. Greek leaders have once again angered the country’s creditors by refusing to detail reform plans on a teleconference to finance ministers, instead insisting that higher level talks be held at this week’s summit.

This is not the first time its employed these delay tactics and it has drawn stark criticism from its creditors including the IMF which labelled Greece “the most unhelpful client” it has ever dealt with. While Greek leaders probably see this as hard bargaining, it is actually giving the impression that they don’t know what they’re doing. They’ve offered a list of reforms in the past that were very vague and rejected on account of a lack of detailed accounts. The result has been that the bailout extension that was agreed in principal has not yet been released and the ECB is doing to bare minimum just to keep the banks afloat.

I don’t have any confidence that today’s discussions will go any better and unless Greek Prime Minister Alexis Tsipras and the Syriza party get their act together, we may be faced with the very real possibility of a disorderly Greek exit. I think it’s becoming very clear now that we’ve moved on from hard bargaining to running out of ideas and if that is the case, the Greeks have two choices, accept what’s on offer or leave. Given the election promises that got Tsipras elected, that doesn’t fill me with hope.

The Swiss National Bank press conference this morning could be interesting following the events back in January which stripped the central bank and its governors of all their credibility. We have repeatedly heard from central bankers since black Thursday back on 15 January about the importance of credibility for a central bank and the SNB no longer has any. It may be interesting to see how CHF traders respond to the central banks comments and whether their words actually carry any weight.

Later on we’ll get some data from the US, including jobless claims, current account data and the Philly Fed manufacturing index but aside from that it may be a bit of a quieter day on the news front. As we saw last week though that doesn’t mean a lack of volatility and given the moves yesterday, I would be very surprised not to see more of a reaction today.

The FTSE is expected to open 17 points higher, the CAC 9 points higher and the DAX 12 points lower.

For a look at all of today’s economic events, check out our economic calendar.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.