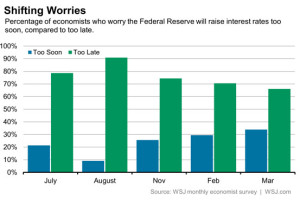

When The Wall Street Journal asked economists last August what worried them more – that the Federal Reserve would raise interest rates too soon or too late – the response was overwhelming. More than 90% of those asked said they feared the central bank would be behind the curve, meaning they would raise rates too late and risk spurring inflation or a financial bubble.

Their angst is shifting. The majority of economists still worry the Fed will be late to pull the low-rate punch bowl from the financial system party, but by much smaller margins than before. In the Wall Street Journal’s latest monthly survey of economists, released Thursday, more than a third of those surveyed said they feared the Fed would raise rates too soon, not too late.

First, Fed Chairwoman Janet Yellen might have proven to skeptics in the economics community that she’s not the mechanical “dove” committed to low interest rates that some expected her to be when she became the central bank’s leader last year. In the past six months, Ms. Yellen has engineered an end to the Fed’s bond buying program, otherwise known as quantitative easing. She has also shifted the Fed’s interest rate guidance away from making promises of continued low rates.

Second, economists might be second-guessing their own sense of the risks building in the economy. Inflation has run below the Fed’s 2% objective for 34 straight months. It’s getting harder and harder to say with a straight face that the Fed’s low rate and money printing policies are a threatening source of inflation pressure when the central bank has been below its own objective for so long.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.