With Greece’s new government still locked in talks with the Troika over its bailout program and both having very different ideas on how to resolve the country’s funding problems, the direction of the euro in the coming weeks really does appear to depend entirely on the outcome of these negotiations. Greece’s new Prime Minister Alexis Tsipras and Finance Minister Yanis Varoufakis are demanding a bridging agreement that would allow it to issue short term T-bills to cover its funding needs and allow negotiations to continue for a few more months. As Greece has already reached its limit on T-bill issuance, the ECB would need to approve this.

The Troika on the other hand appear unwilling to budge on their offer of an extension to the bailout, which already lies at €240 billion, and would require that the country stand by the current bailout agreement including reforms and spending cuts which has been deemed as “absurd” and “unacceptable” by Greek ministers. Given that they rose to power on promises the scrap the current bailout agreement and reverse some of the reforms and cuts that have been put in place, this is no surprise.

What if no bailout agreement is reached?

Greece’s bailout is due to expire at the end of this month and the Troika has given them until Friday to agree to the bailout extension. Should we not see this, the ramifications for Greece could potentially be severe and a “Grexit” a real possibility, albeit still an unlikely one in my opinion. I don’t see who would benefit from a Greek exit and while the contagion effect in the eurozone may be smaller than it was previously, there would undoubtedly be consequences, the size of which is unknown which is what worries investors so much.

From a Greek standpoint, a failure to reach an agreement would likely lead to the ECB cutting the country’s banks off from the Emergence Liquidity Assistance (ELA) program that is currently

preventing a catastrophic credit crunch and run on the banks. Should this happen, there’s a very real chance that we’d see a banking collapse in the country which would have dire consequences for the country and its businesses and would almost certainly lead to it defaulting on its debts, leaving the currency union and reintroducing the drachma. Needless to say, no one wants to see this and therefore I do believe an agreement will be reached but that will require both sides offering some concessions in order to appease the electorate in each of their countries.

An alternative outcome for Greece would be for the new government to seek financial support from other sources, most likely Russia, which is something Europe and the US will be desperate to avoid. Tensions between Russia and the West are extremely high right now as a result of Russia’s involvement in the eastern Ukraine and its annexation of Crimea. I can only imagine that the Eurozone would want to avoid seeing one of its own members seeking financial assistance from the enemy and being in Russia’s debt at a time when they have imposed sanctions on it. The inability to get its own house in order at a time when it is condemning the actions of others is at the very least extremely embarrassing and I’m sure Vladimir Putin would rather enjoy pointing this out.

What does this mean for the euro?

The euro has been under extreme pressure recently as the possibility of a “Grexit” have risen. Investors hate the unknown and that is exactly what we would be entering with the Eurozone if no deal can be agreed and Greece is forced to leave. We have seen some consolidation in EURUSD over the last month, following a very aggressive sell-off. The pennant that has formed on the daily chart

has almost completed and a breakout in either direction appears to be just around the corner. Typically, a pennant is a trend continuation pattern but there doesn’t appear to be a huge amount of

appetite for much more downside movement unless negotiations collapse completely. We’ve seen this so many times before, with negotiations going all the way to wire that I think people are expecting a deal to be done, which I expect would be bullish for the euro and probably explains the reluctance among traders to continue to sell.

Should we see a break below the pennant, I would expect 1.1100 to once again provide significant support. Given the fading selling interest and the rebound off this level a few weeks ago, I’m

beginning to think it would take a total collapse in negotiations for this level to be broken, but that doesn’t mean it can’t be tested again. A break of the pennant would also likely lead to the stochastic breaking below its trend line, suggesting that momentum is once again gathering to the downside and it would be interesting to see just how much momentum that would gather.

Until we see the pennant broken though I find it very difficult to be too bearish. A break above the pennant would make 1.15 and enormous level in my view. If this is broken I think we could see a significant push to the upside, but as with 1.11, I think this will only come if we get an agreement between Greece and the Troika.

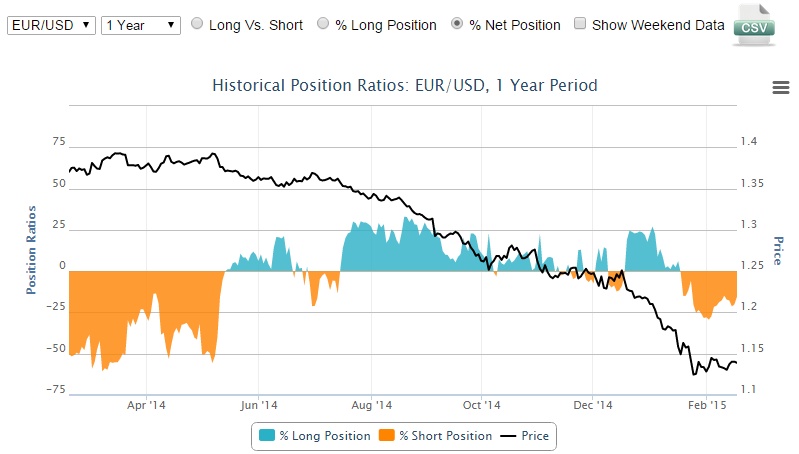

A look at the open orders of OANDA clients shows a lot of buying interest around the 1.13 level, which would suggest a strong belief that the pair has bottomed and this pennant will not break to the

downside. Further buy orders around 1.12 suggests clients are certainly becoming more bullish at these levels but I do wonder if it’s a little premature. With no solution yet to the Greek deal, I

think a move back towards 1.11 could be on the cards. Given the tendency for clients to become net long just as we’ve seen more selling in EURUSD, I wonder if the buying interest just below current levels may be a sign that history is about to repeat itself and the downtrend continue just as clients believe the pair has bottomed.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.