Betting against US Treasury’s this year is turning out to be rather an expensive undertaking for some. Since early last month many investors and traders have been betting against US bond prices rallying. However, Ms. Yellen seems to have thrown a “cat amongst the pigeons” especially since she has signaled that the Fed was not in a rush to lift interest rates, two weeks after suggesting the opposite at the bank’s March 19 meeting.

Yellen indicated last week that the US economy continues to face uncertainty and while inflation remains low would support the Fed to take its time in reducing monetary stimulus. This would certainly keep the IMF happy. Its head, Christine Lagarde has been rather vocal on how important it was to keep the “wheels greased.” For some, reducing stimulus too soon could stunt any growth that has already been seen.

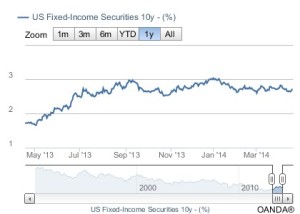

The surprising resilience of US treasuries has investors re-adjusting their forecasts for higher borrowing costs as lackluster US job growth, geopolitical concerns and EM turmoil push treasury yields toward their 2014 low.

Bond prices are starting this week edging higher, mostly on the back of a small percentage of investors and dealers booking some well-earned profits on short-sell positions. Others prefer to buy some product on the cheap after last week’s deep pullback, as they remain skeptical whether the pace of the US economy would accelerate. Depth and market liquidity remains questionable on this Easter Monday as many overseas markets remain shut for the holidays.

New US debt sales this week should keep the market in check, especially with supply becoming more abundant. The US Treasury department is scheduled to auction $96b of new-product (2’s, 5’s and 7-years). Recent upbeat consumer spending and manufacturing data has “brightened market sentiment towards economic growth” and naturally reduce the markets demand for the safe-haven government bond.

The fixed income market is pricing the Fed phasing out bond purchases in Q4 and pricing in rate hikes in the middle of 2015.

Content is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Business Information & Services, Inc. or any of its affiliates, subsidiaries, officers or directors. If you would like to reproduce or redistribute any of the content found on MarketPulse, an award winning forex, commodities and global indices analysis and news site service produced by OANDA Business Information & Services, Inc., please access the RSS feed or contact us at info@marketpulse.com. Visit https://www.marketpulse.com/ to find out more about the beat of the global markets. © 2023 OANDA Business Information & Services Inc.