WTI Crude has been staying between 103.0 – 104.0 for most of the entire week, but prices suddenly shot up during early European session, pushing beyond the high of Monday and leading prices to the highest level since 6th March. This gain is certainly surprising given that latest inventory data from the American Petroleum Institute reflected a gain of 7.6 million barrels build up when analysts were expecting a similar report by the US Department of Energy to reflect a much smaller 2.25 million gain. Not only that, Chinese Industrial Production figures came in lower than expected once again, highlighting the slowdown in global manufacturing activities that has been observed in the past few months. This latest information should send WTI prices lower as well, but surprisingly prices stayed stable and barely budged.

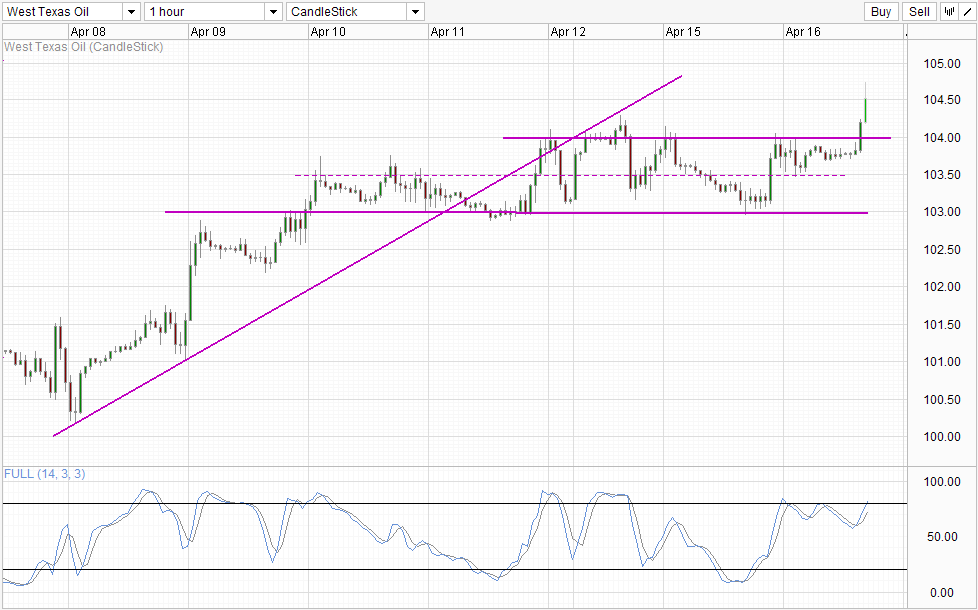

Hourly Chart

This should have flagged out that underlying sentiment in WTI Crude is bullish, but even then it would still be difficult to imagine prices breaking above 104.0 with strong follow-through when there is no catalysts in sight. Hence, there is a high likelihood that this jump in prices may be due to overzealous bulls, and the possibility of a quick reversal back towards 104.0 and potentially back to the Asian trading levels between 103.65 – 103.9 is high. Stochastic indicator agrees as Stoch curve has entered the Overbought region, favoring a bearish cycle moving forward.

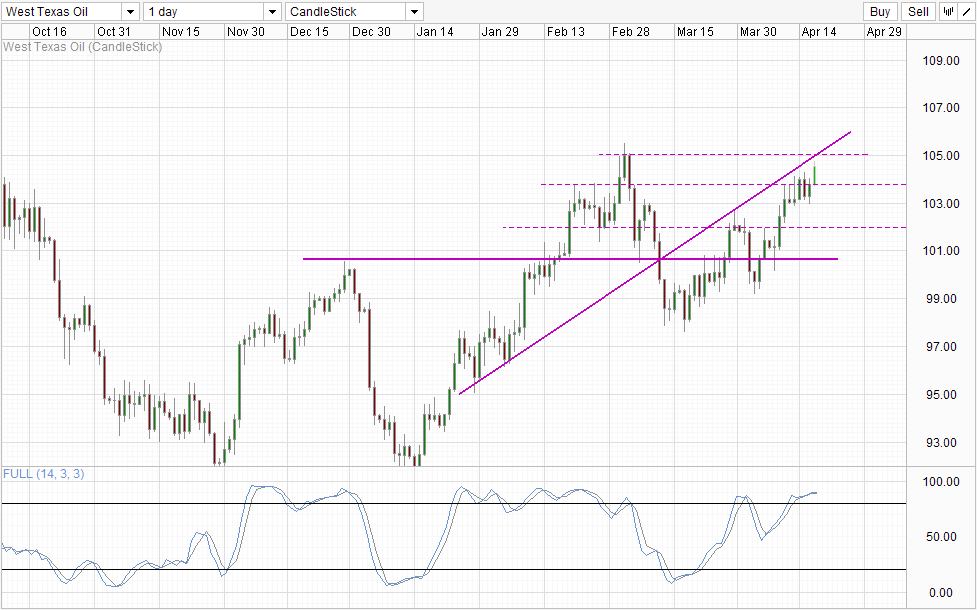

Daily Chart

Daily Chart concurs as prices are heading directly into the 105.0 and confluence with rising trendline, while Stochastic indicator are within the the Overbought region, favoring a bearish cycle or at least some form of bearish pullback in the near term. Without proper fundamental justifications for gains, it is likely that bullish sentiment may burn out fast, agreeing with what technicals are showing us.

Some traders may think that the ongoing Ukraine/Russia conflict may help to propel Oil prices higher, but that assertion may require a rethink. It was reported yesterday that Russian troops have actually entered Ukraine borders, but that did not trigger any fear in Stocks nor Gold. The same could be seen in Oil prices as well, which increase the suspicion that market may be jaded about this whole conflict and/or has priced in sufficiently of a war scenario. Hence, even if a war does break out, it is possible that gains in WTI will be muted, while downside risk of WTI will actually be greater as the potential for disappointment (e.g. no war occurring) is there.

More Links:

NZD/USD Technicals – Overall Bullish Bias Intact Despite 0.86 Broken, Weaker Inflation

Gold Technicals – 1,300 Broken As Bearish Momentum In Full Force

When Is The EUR To Choke?

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.