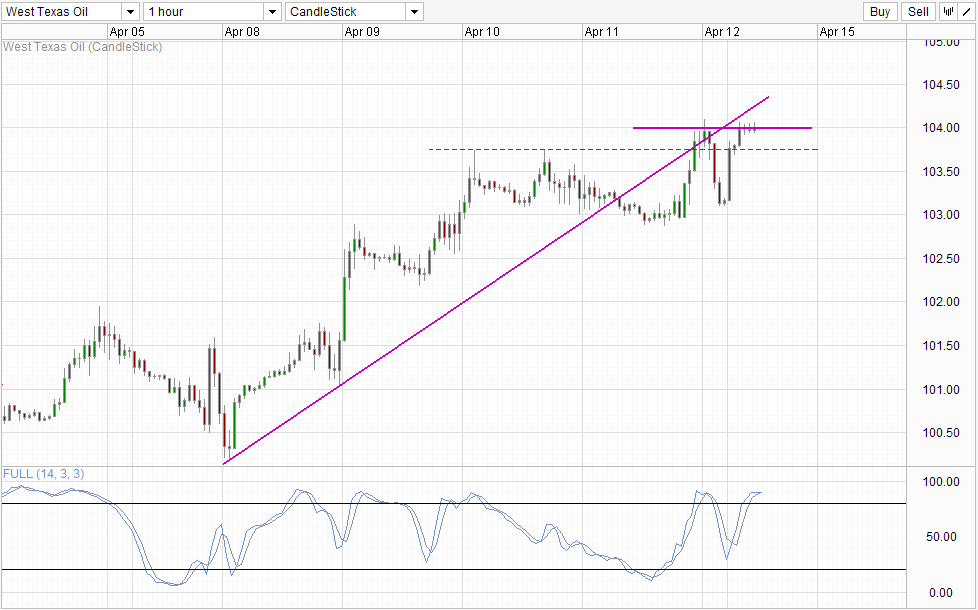

Prices of Oil climbed on escalating conflict in Ukraine, but we remain trading below the 104.0 round figure resistance that has held strongly before sending prices down back to low 103 levels last Friday. Also, prices are trading below the rising trendline, suggesting that bullish momentum that has been in play since 8th April is being partially negated. When we take into consideration the fact that Stochastic readings are heavily Overbought with Signal line converging towards the Stoch curve, the likelihood of a bearish signal moving forward is high – suggesting that a move lower is likely.

However, conservative traders should wait until there are proper evidence of a bearish reversal before committing. A break of 103.0 is preferred but at the very least we should see prices trading below 103.8 as confirmation of strong bearish pressure.

Daily Chart

The need for bearish confirmation becomes even more imperative when we look at Daily Chart which suggest that price is on track to test 105.0 resistance. Stochastic readings are within the Overbought region but there is actually divergence between Stoch/Signal lines which suggest that bullish momentum is actually building up. A break of 105.0 resistance may be unlikely but that may bring little comfort for short-sellers if they short right now and price does climb up $1 higher in the near term.

Fundamentally, global trade and manufacturing activities are lower than expected, and without the fear of war it is unlikely that Oil can maintain current elevated levels. That being said, the recent decline in stocks seemed to have mellowed and the contagion is not as serious as we think with Asian stocks currently trading higher than Friday’s close. If this recovery continue to gain traction, we may be able to see WTI prices staying afloat even if Ukraine manage to quell all the unrest peacefully without further bloodshed.

More Links:

Gold Technicals – Marching Towards 1,330 On Sound Of Ukraine Unrest

Week In FX Europe – BoE To Judge Slack Before Hike

Week In FX Americas – A Tough Few Sessions Being A Dollar Bull

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.