Short-term momentum for EUR/USD is currently, but that is not stopping yet another mysterious rally yesterday which happened during New York afternoon – just like the one seen on Monday. As the rallies are definitely not fundamentally inspired (e.g. no news announcement during the period) and is clearly not inspired by any risk on/off flow (US stocks were relatively stable during the period), it is highly unlikely that the bullish momentum will be sustainable, and hence the decline which occurred subsequently is not a surprise.

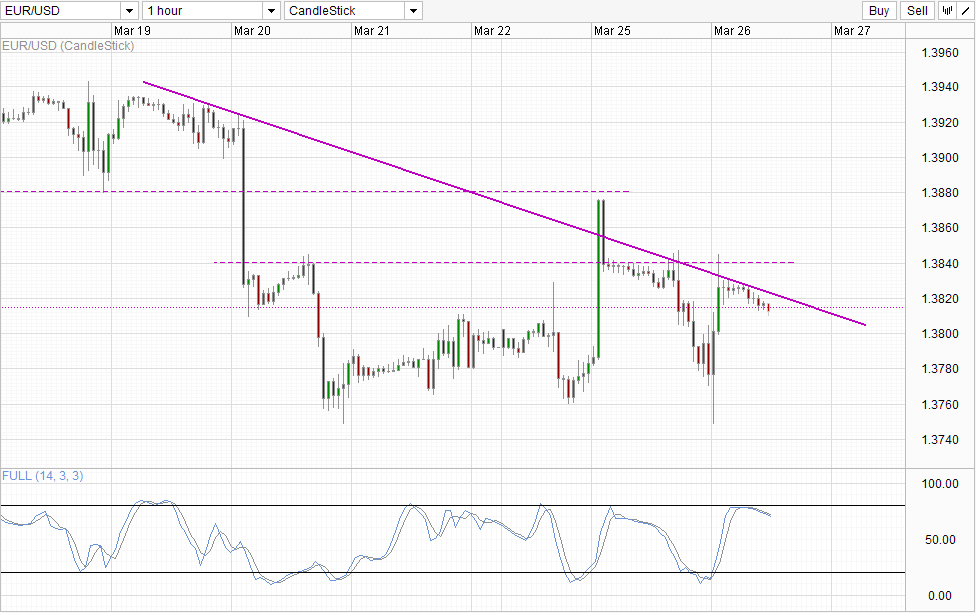

Hourly Chart

With Stochastic indicator showing a bearish cycle right now, coupled with the fact that prices failed to climb above the descending trendline, the likelihood of 1.3815 support breaking increases. 1.38 is the obvious immediate bearish target, but judging by yesterday’s bearish momentum a push towards 1.376 is within reach as well and we could even see further bearish extension if bearish momentum have yet to hit Oversold region.

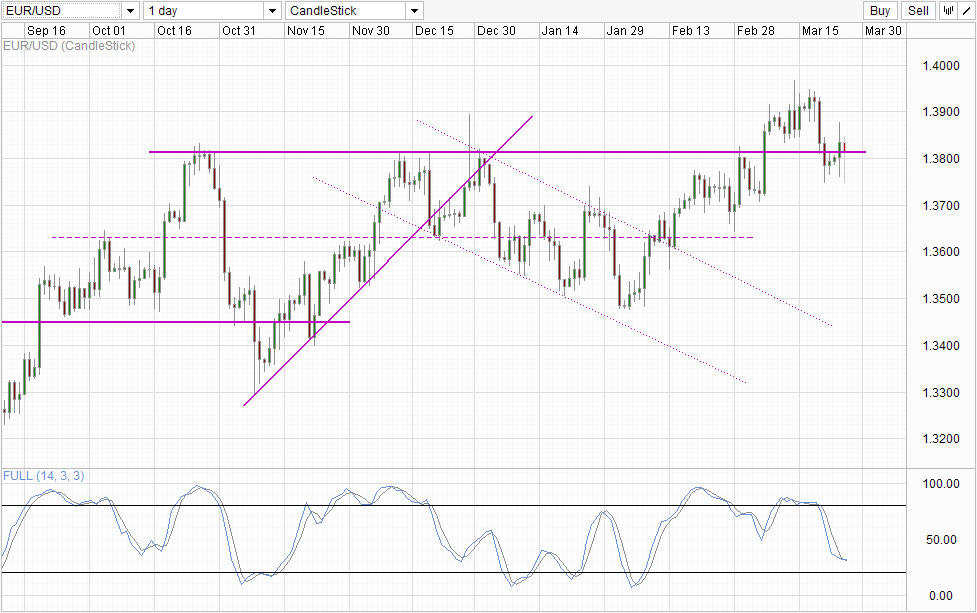

Daily Chart

Daily Chart favours neither bulls nor bears right now. Firstly, the break of 1.8315 should have triggered stronger bullish response but that didn’t happen, but the same charge could be levied against bears when bearish follow-through was limited even though the breakout has failed. Perhaps the biggest issue right now is that it’s hard to determine whether current price action is acting as a confirmation for the bullish breakout, or a confirmation that the breakout has failed as the point of reference for breakout can be as low as 1.38 and stretches all the way to 1.39. As such, we will need to wait for price action to develop further before there’s directional clarity.

More Links:

USD/JPY – Little Movement Ahead of Key US Data

AUD/USD – Steady As US Posts Mixed Data

GBP/USD – Slight Gains As British CPI Matches Expectations

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.