Sharp losses seen in AUD/USD this morning, with a majority of the dip attributable to the China HSBC/Markit Manufacturing PMI miss. Prices have since recovered from 0.905 to above 0.907, but bearish pressure remains in play as prices is now trading below the rising Channel, suggesting that bullish momentum has been broken.

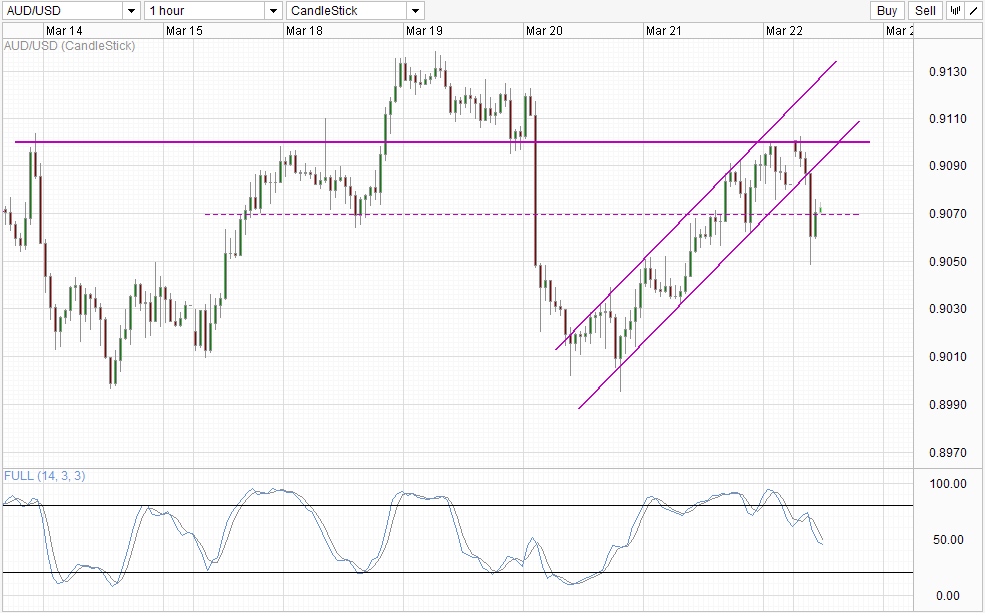

Hourly Chart

It should also be noted that prices actually started reversing this morning, after the failure to breach 0.91 resistance. Hence, it is possible that bullish momentum was already stopped short earlier, and is only excerberated by the weaker Chinese economic number. Stochastic indicator agrees with Stoch curve currently amidst a bearish cycle with enough space for a retest of 0.905.

Looking across Asian equities, it seems that overall sentiment is currently bullish. Nikkei 225 and Hang Seng Index are both clocking significant gains, while Australia’s own ASX index is back in black despite shedding 0.7% earlier. Whether we like it or not, stock prices appear to be immune to the Chinese data and the fact that AUD/USD being bearishly affected by this is a telling sign that sentiment for AUD/USD is bearish.

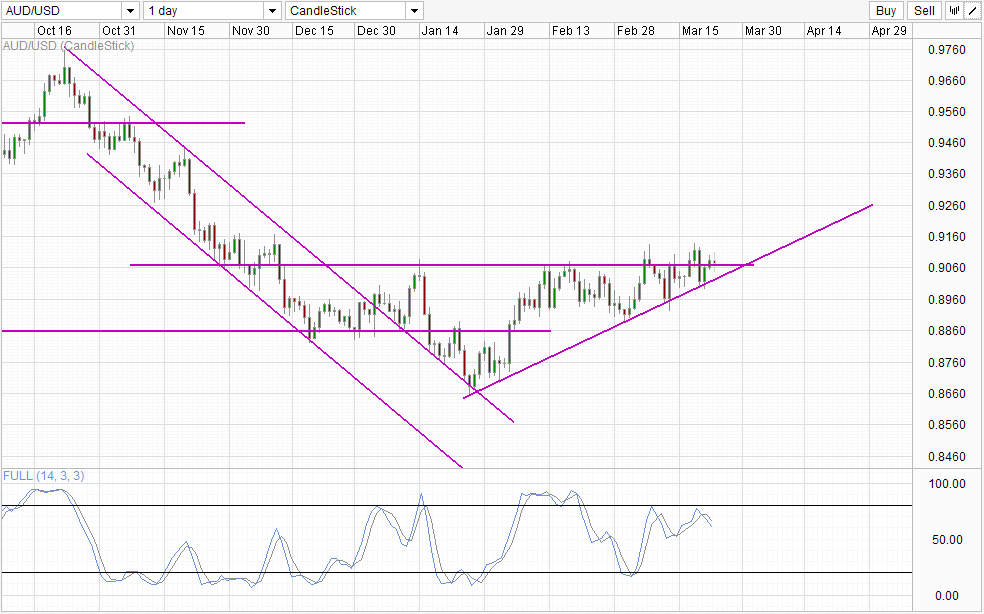

Daily Chart

Prices are less bearish on the Daily Chart though. By staying above 0.907, the possibility of a a bullish breakout remains, and even if prices does breaches below 0.907, rising trendline will provide adequate support that will keep AUD/USD afloat in the short-term. With recent strong employment numbers from Australia, the economic slowdown narrative in Australia is beginning to change. This notion is also seconded by central bank RBA who have stated their intention to stop slashing rates, which will help to attract carry traders back into AUD however little the numbers may be. Hence, there is some slight justification for AUD/USD to be higher, and we should not automatically assume that AUD/USD will simply drop all the way down.

Nonetheless, it should also be noted that USD remains highly bullish and has become even more so given what Yellen has said last week regarding rate hikes. Hence, even in the most bullish scenario for Australia’s economy, gains in AUD/USD may still be limited due to USD’s drag, and trend traders will definitely need to seek stronger confirmation for entries in either direction. Alternatively, if traders want to participate in the rebound of AUD, pairing AUD with another weaker currency may be a better bet compared to USD (or NZD and GBP for the matter) which is slated to strengthen due to Central Bank action.

More Links:

Week in FX Asia – Asian Currencies Feel Yellen Effect

Gold Technicals – Back Below 1,335 Despite Institutional Speculators Purchases

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.