Speculators remain bullish towards Gold according to US CFTC’s Commitments of Traders weekly report. Latest data reflected a jump in Net Long Non-Commercial Positions from 118k to 136k contracts. Open interest has also climbed from 415k to 420k, suggesting that the increase in Net Long position is not due to the disappearance of short-sellers, but a genuine increase in bullish speculators.

However, That did very little for market prices today. Prices dipped lower on open, continuing the mild declining trend that happened during Friday’s US session. It seems that market isn’t really convinced about the bullish prospect for Gold even though institutional speculators e.g. “smart money” seems to be betting for Gold to climb further. One reason could be due to the fact that momentum is bearish, falling significantly from the recent highs of 1,392 following the non-event of Ukraine/Russia conflict. Market is still discounting the “war premiums” given to Gold, and this has proved to be much stronger judging by how prices fell during US session on Friday even though Stock prices were actually trading lower – when safe-haven flows should have pushed Gold higher or at the very least kept prices above the 1,335 resistance turned support level.

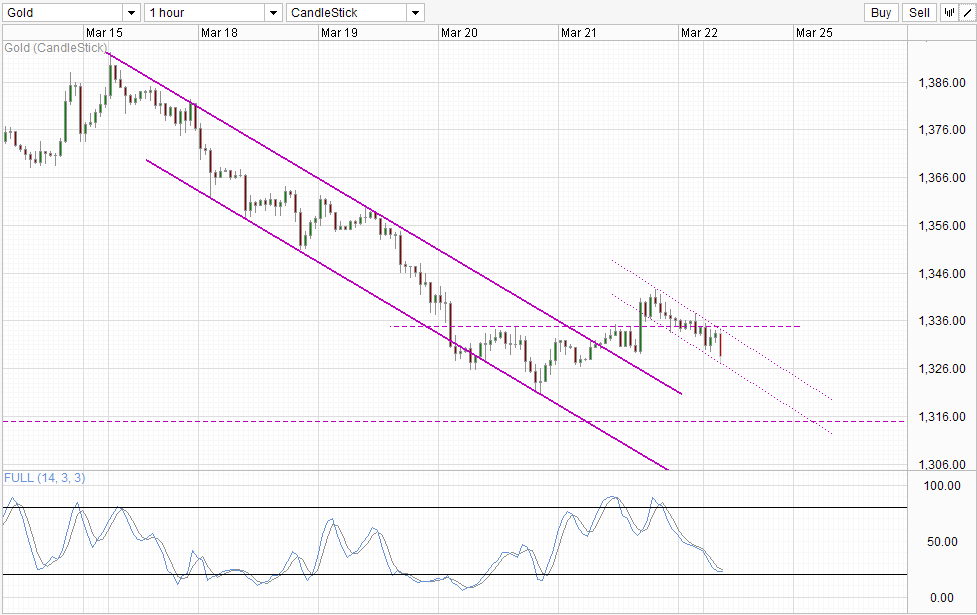

Hourly Chart

Hence, it is not surprising that market has chosen to continue shorting Gold, preferring to side with momentum for now. Case in point, a weaker than expected HSBC/Market China Manufacturing PMI failed to ignite prices higher this morning, with Gold prices continuing to look depressed. This is a strong support that market is bearish and is riding on momentum and not fundamentals right now. That being said, it is difficult to tell how far further can prices fall. Firstly, we are back within the consolidation zone seen on Thursday, and that is expected to provide support in the near term. Similarly, Stochastic readings are tapering flat and approaching Oversold region, favoring bullish pullback. This notion is echoed by the newly drawn descending Channel which price is currently trading within – where a slight rebound should be expected at the very least with Channel Top as target after tagging Channel Bottom.

That being said, we need to realize that COT numbers may not be a good representation of the entire market. Institutional speculators only account for around 5% of the entire market’s assets under management, and even though they may generate upwards to 30% – 40% of all trading volume, it still does not constitute the majority. Hence, there is still a chance that “smart money” is wrong and broad market will be able to out-muscle them and push prices lower. Given all these conflicting information, traders may wish to seek out stronger confirmation before participating. Should prices break the consolidation support zone, bears will be demonstrating strong bearish conviction and the likelihood of further bearish extension may be more likely.

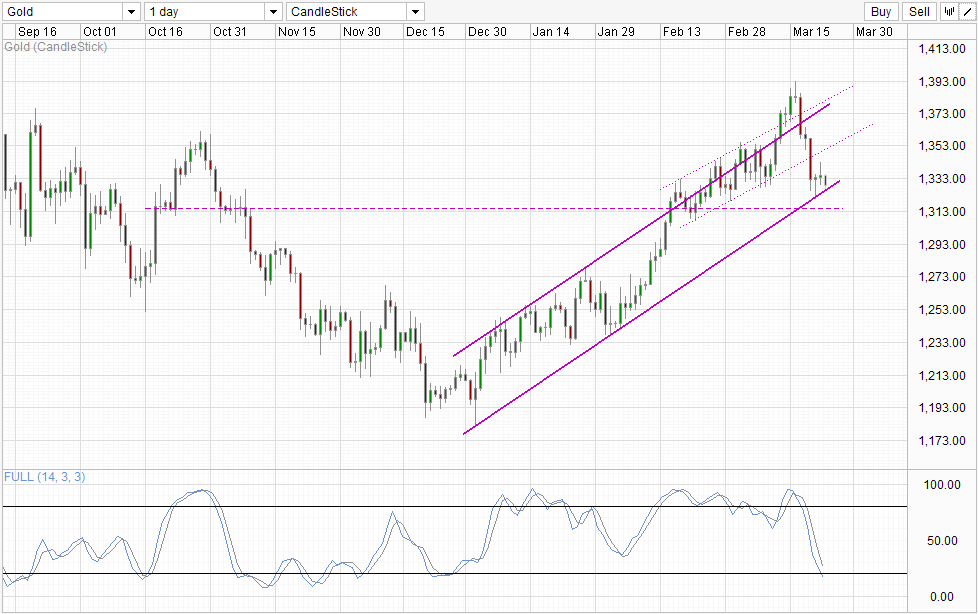

Daily Chart

Price action on the Daily Chart agrees, should we push lower in the short-term, rising Channel Bottom will break and the rising bullish momentum will be impaired. Without which, the likelihood of a bullish rebound towards Channel Top remains, which is concurred by Stochastic indicator which is Oversold currently, favoring a move back higher.

Long term fundamentals continue to favor a weaker Gold as well. Global economic growth is not as high as we want it to be, but certainly conditions are much better than 5 years ago. With interest rates of developed nations expected to climb steadily in the next 1-2 years, the need for inflation protection is also lower. Hence, the heyday of Gold may be over, and that will be yet another driving force to go against “smart money” for now.

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.