WTI Crude climbed the most in 2 weeks, pushing all the way to $99.50 per barrel even though market appears to be much calmer towards the Russia/Crimea crisis. It would be easy to correlate the climb in WTI to the climb in US stocks as bullish sentiment was strong, but it should be noted that counterpart Brent Crude did not enjoy similar gains as WTI yesterday, instead falling to a low of 106.35 during early US session before climbing back to 107.0 thereabout subsequently. Hence, broad risk trend or fundamental economic factors is not an adequate explanation for yesterday’s rally.

Instead, it is clear that the factor was unique to WTI only, and we have the perfect explanation in the form of an announcement by Enterprise Products Partners LP that indicated they will more than double the capacity of their Seaway pipeline as early as 2 months time. This is an extremely good news for WTI as the oversupply situation has been plain for all to see. With this pipeline expansion that will allow delivery of more than 850,000 barrels of oil daily from Cushing, the demand for Cushing delivery will be higher and reduce the supply glut that has been keeping Brent at a premium to WTI.

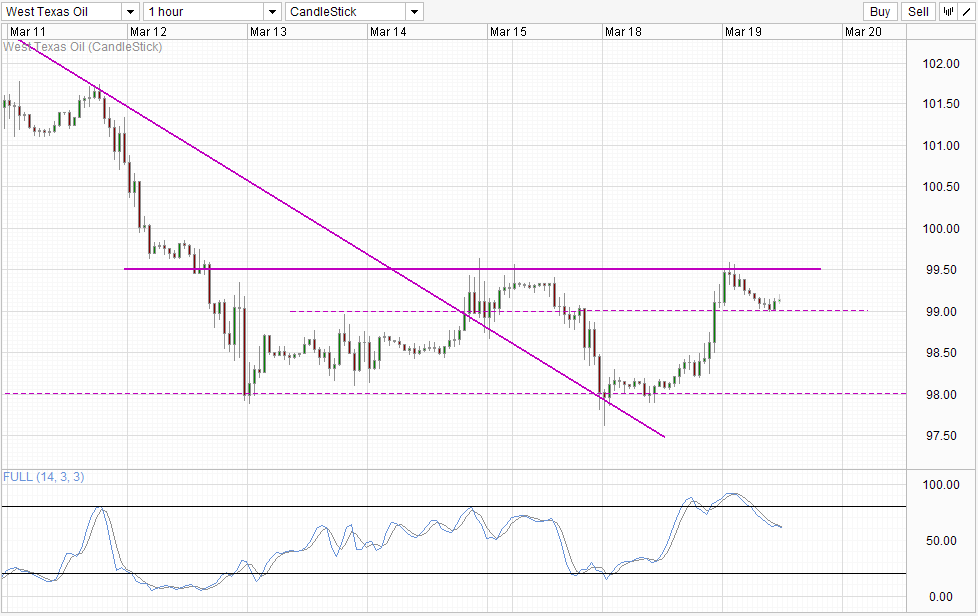

Hourly Chart

However, despite this, it should be noted that WTI is still not yet out of the bearish woods. This is because global factors do not justify Oil prices to be at such high levels. Global industrial growth rates remain low, and there have been many overestimation by Governments and policy makers on the pace of recovery. Case in point, Japan exports just released today was lower than expected once again, highlighting that global trade isn’t really as high as we think it is. Also, even though the Crimean crisis is still brooding, we are still far from an all out war and market is definitely calmer about the situation after Vladimir Putin said that Russia is not interested to divide Ukraine further. Whether there is any truth in his words, market is certainly buying it and that reduce yet another reason for prices in Oil to stay inflated. Hence, the Seaway development may only bring relatively short reprieve for slide in WTI, but we may be still be able to see Brent/WTI spread tightening in the next few days should the Seaway narrative continue to play on.

From a technical perspective, the failure to break 99.5 is a sign that broad bearish pressure is still in place. Even though prices are staying above 99.0, we are technically within a bearish cycle right now and hence it will not be difficult to imagine prices breaking the round figure and head lower to 98.0 or 98.5 support. Nonetheless, should 99.0 hold, we could see sideways movement between 99.0 – 99.5 which may allow for strong direction either way in the next few days depending on how fundamentals/geo-political risk play out.

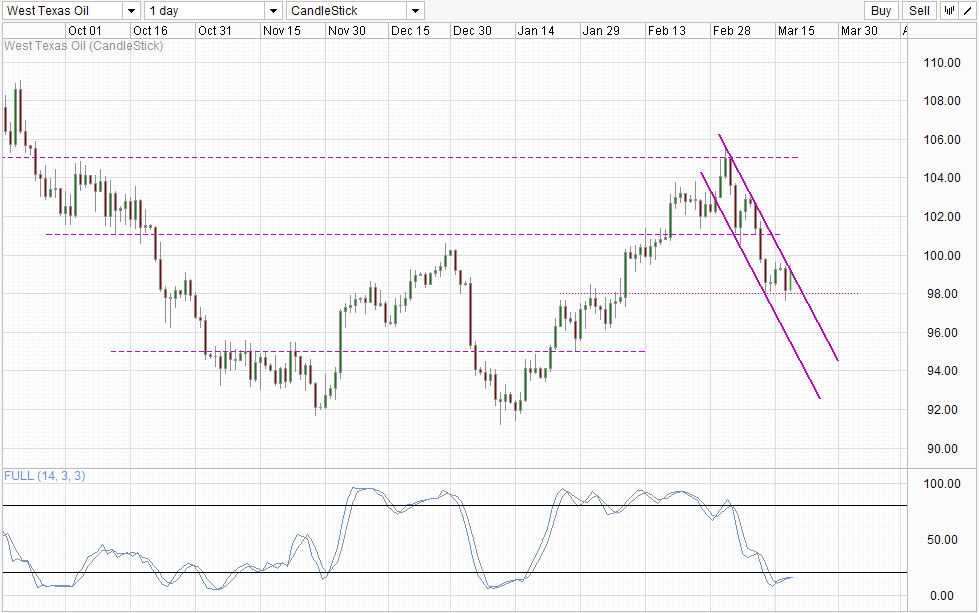

Daily Chart

Daily Chart is looking slightly more bullish though as prices appear to be testing Channel Top and should a break of Channel Top occur in conjunction with a Stoch bullish cycle signal, we could see strong momentum building up towards 101.0 and perhaps all the way towards recent swing high of 105.5. However, that would require strong fundamental support, and without which it is possible that prices may start to falter even before hitting 101.0.

As a side note, do not expect the Seaway pipeline bullish narrative to last long, as we’ve seen how the euphoria about Keystone XL pipeline stalling in the past. For long-term gains in Oil, a strengthening of global trade/manufacturing activity will be needed for a proper sustained push, but right now that scenario seemed to be elusive with mixed numbers coming week in week out.

More Links:

AUD/USD – Steady After RBA Minutes

USD/JPY – Yen Shows Gains As Crimea Crisis Continues

EUR/USD – Stable As German, Eurozone Economic Sentiment Slide

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.