Central Bank RBNZ delivered the rate hike that all bullish traders were looking for, raising its Official Cash Rate by 25 basis points to 2.75%. This pushed NZD/USD above the 0.85 round figure resistance and more importantly the previous high seen on 7th Mar, demonstrating a bullish breakout.

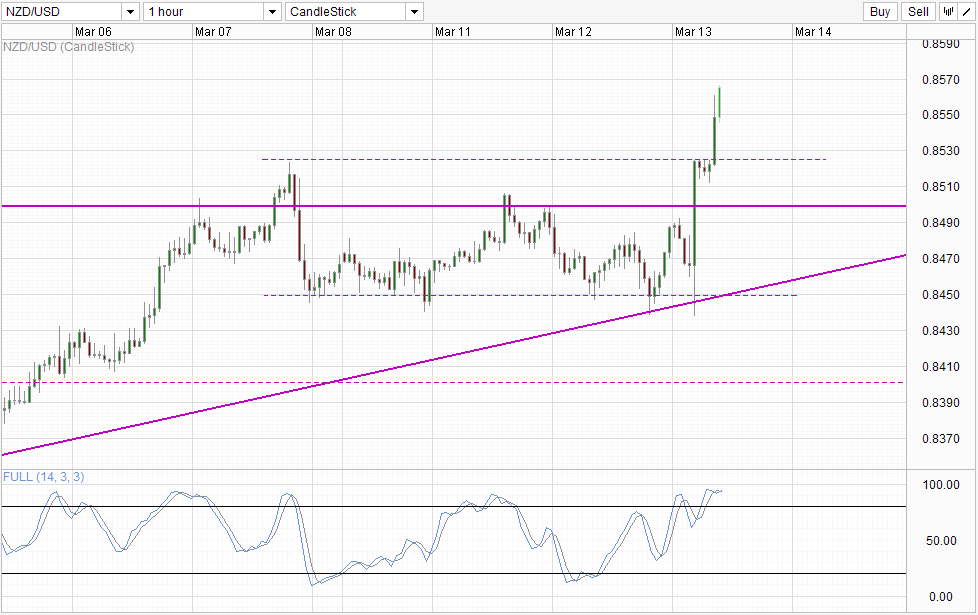

Hourly Chart

This may seem inane as it is obvious that NZD/USD will rally should RBNZ hike interest rates, but it should be noted that this rate hike has been widely expected and it is reasonable to suspect that traders may have priced in such a scenario way ahead of time. Looking at recent history where prices of AUD and EUR did not really move when their respective central banks carried out rate changes as expected, the concern that NZD may not rally higher or perhaps even start to decline isn’t without basis.

The fears that bullish reaction will be muted became even more real when we realized that NZD/USD actually traded lower during early European hours and late US session when bears should be afraid to do anything with such a huge event risk just a few hours away. This suggest that bears may still be lurking around even though rate hike expectations are high. In fact, when the news of RBNZ raising interest rates was announced, prices actually started to decline steeply, pushing below 0.845 immediately before climbing up. Hence, to say that bullish breakout is a forgone conclusion is definitely incorrect.

That being said, bullish sentiment/momentum is certainly strong, and the fact that prices has cleared the 0.8525 resistance 4 hours after the rate hike announcement is a strong testament to current bullish momentum. Nonetheless, bullish traders need to be aware of the lurking bears moving forward and significant pullbacks back towards 0.8525 or even 0.85 cannot be ignored.

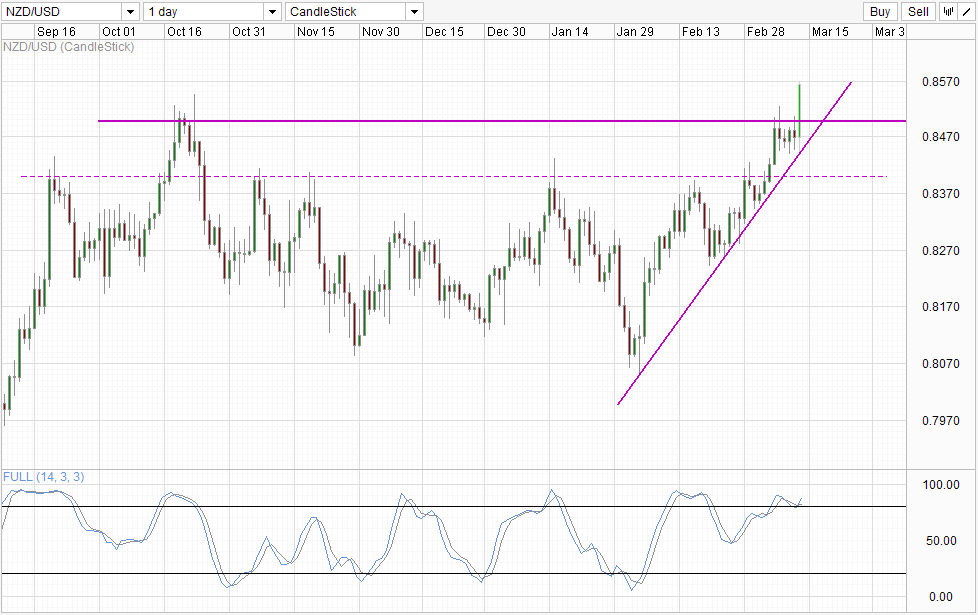

Daily Chart

The same could be said for Daily Chart price action. Even though a clear breakout is happening right now, it is still considered risky for traders to go long right now if they haven’t done so previously. Entry opportunities will only appear after pullbacks have occurred, with the post pullback reaction/degree of pullback helpful to determine if this breakout is indeed genuine and more importantly will it have further legs to run higher.

Fundamentally, for all the reasons (and we do have good reasons) for NZD to get stronger, rallies in NZD/USD will continue to remain iffy as USD is not an easy pushover. Hence, traders who want to participate in the NZD rate hike narrative will be much better served seeking currencies that are heading in the opposite direction instead.

More Links:

GBP/USD – Little Movement Ahead of US Key Releases

USD/CAD – US Dollar in Holding Pattern As Markets Await Key Numbers

USD/JPY – Steady in Cautious Trading

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.