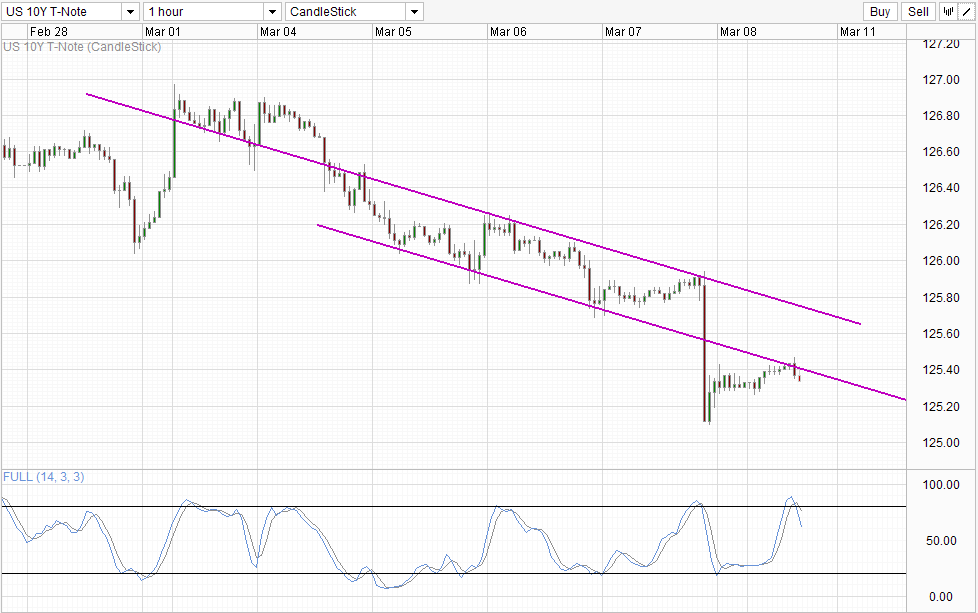

Bearish pressure continue to reign for US 10Y Treasury Note even though weak economic numbers over the weekend should have driven yields higher. To be fair, 10Y prices did rally higher but the magnitude of increase is minute compared to the slide seen in most risk correlated assets. For the most part prices did not even managed to push clear away from the rebound high post NFP Friday, while the latest bullish push that promised some headway got snuffed out quickly, with prices falling down relatively sharply after hitting resistance in the form of descending Channel Bottom. All these points to the fact hat bears are currently in charge, and should risk off sentiment dissipate, we could see strong bearish momentum rising.

Why the strong bearish sentiment though? Well, market is slowly coming to terms that QE taper is here to stay, and this will naturally lead to lower Treasury prices (higher yields) in the near future. Fed’s Plosser affirmed this thinking today as well, saying that the hurdle for changing pace of taper is high after stating that last Friday’s NFP numbers was “encouraging”. Whether we agree with Plosser’s view that the NFP number is good (economists consensus is that US economy will need to produce 190K jobs each month consistently to pull itself out of this crisis), it is clear that Fed will continue to taper unless the sky starts falling and that is not going to happen anytime soon.

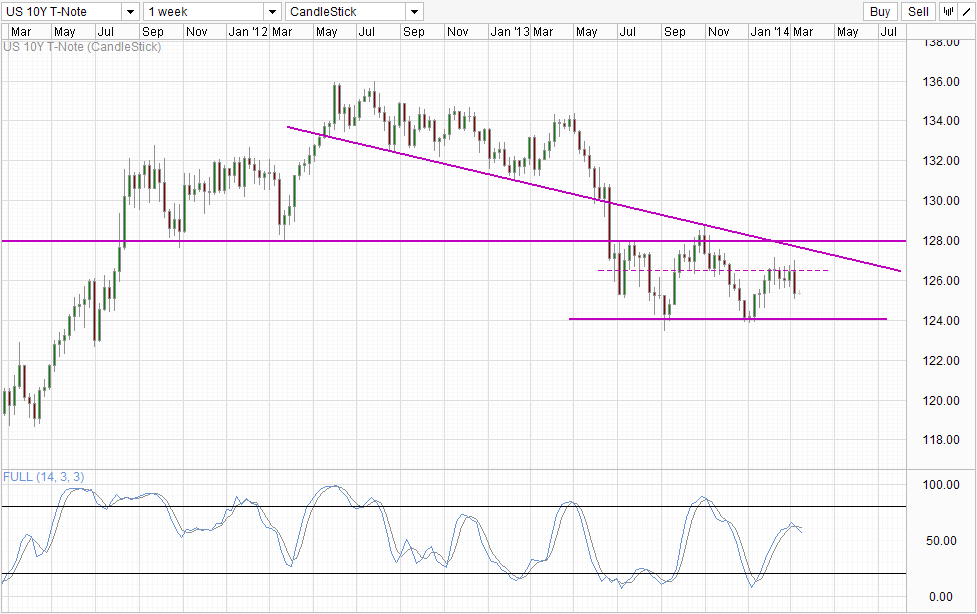

Weekly Chart

What does this mean for long-term direction? 124.0 is an obvious bearish target for now, but long-term wise we should be able to expect prices to break 124.0 support to head even lower which will translate to a break of 3.0% implied yield. Stochastic readings agree as well as it is likely that Stoch curve would have further space to run when 124.0 is broken. That being said, market sentiment is a very fickle thing. We have had 2 test of 124.0 in the past 6 months which both ultimately failed. The 1st test is more understandable as market was still relatively unsure whether Bernanke would really cut QE purchases during his final few months in charge. However, the 2nd failure is more inexplicable as tapering has already started. It is clear that 124.0 is a strong significant line in the sand that bulls are defending to the death and we should not expect an easy fight in the near term even though fundamentals support higher yields (lower prices) moving forward.

More Links:

NZD/USD Technicals – RBNZ Rate Hike Expectation Increases Future Downside Risk

GBP/USD – Resistance Level at 1.68 Looms Large

Gold Technicals – Strong Bears Seen In The Short-Run, Long-Run Uncertain

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.