Kiwi Dollar enjoyed the same rally that most if not all risk correlated asset did yesterday following a strong rally in US stocks yesterday. However, unlike other assets NZD/USD managed to hold onto most of the gains, and even rebuffed additional bearish pressure coming from a a lower RBNZ 2-Year Inflation Expectation this morning, staying above the 0.832 soft support. This suggest that the underlying bullishness of NZD/USD is strong, and puts NZD/USD at a great position for larger than average gains should risk appetite enters back into play later during US session.

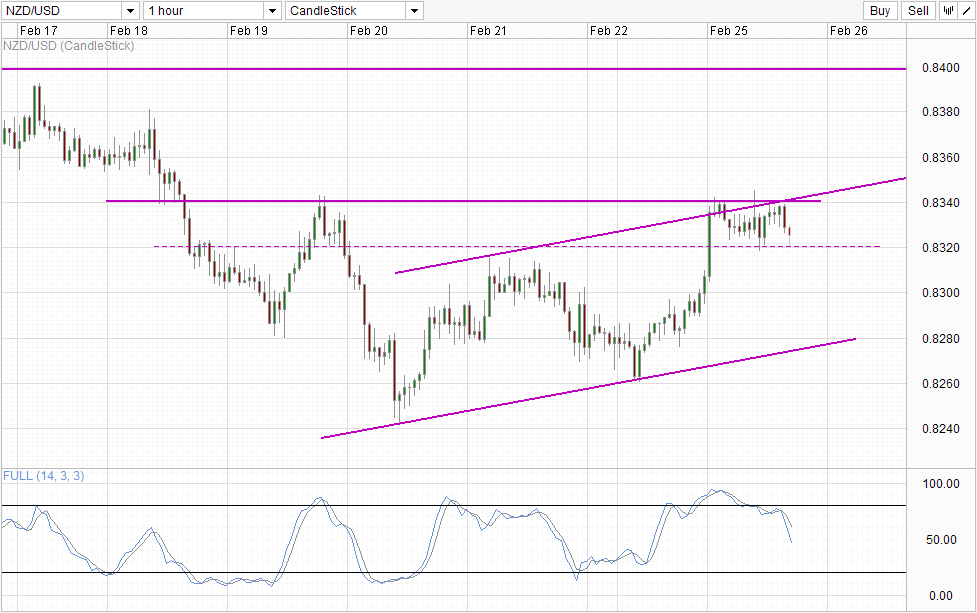

Hourly Chart

That being said, the risk of sell-off remains as the wheels of risk appetite has come off slightly. Asian stocks have pared most of their earlier gains; Hang Seng Index actually closed in the red while STI (which is still trading at the time of writing) is slightly negative at -0.01%. European Bourses are not performing well either. Both German DAX and FTSE 100 gapped lower and is trading at -0.44% and -0.51% respectively. US Futures are not doing as bad right now but certainly the risk is there.

Furthermore, technicals suggest that further sell-off is possible. For all the talks about NZD/USD’s bullishness, prices are firmly below the 0.834 resistance and has rebounded off Channel Top, opening up a move towards Channel Bottom. Stochastic readings agree as well with Stoch curve currently within a bearish cycle. Bearish confirmation (e.g. break of 0.832) will be needed for a show of bearish conviction but similarly bullish confirmation will be needed (e.g. break of Channel Top and 0.834) to ascertain that price is heading higher given all these conflicting information.

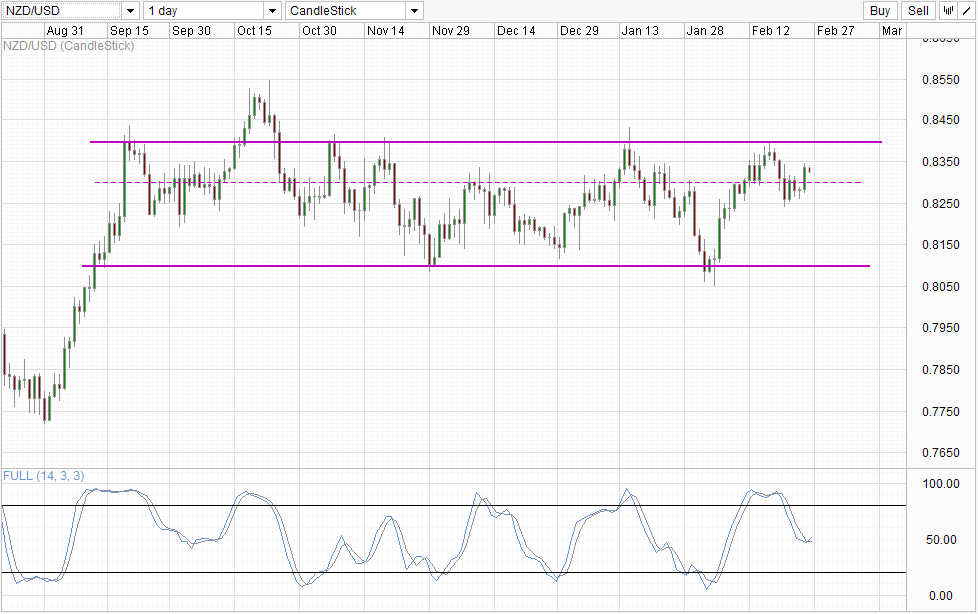

Daily Chart

Daily Chart is slightly more bullish than before though. Yesterday’s rally has temporarily negated bearish pressure arising from the bearish rejection of 0.84 round figure resistance. Stochastic readings have also pointed higher and has since crossed the Signal line. That being said, without breaking 0.84, 0.81 will remain as a possible bearish target as the bearish rejection will not be fully invalidated. However, traders seeking 0.81 outcome will need to wait for further confirmation (e.g. break of 0.825 round figure and confluence with recent swing low seen on 20th Feb) for stronger bearish conviction.

Fundamentally NZD/USD remains conflicted. RBNZ is expected to carry out rate hikes as early as March and further rate hiking will take place within the next 2 years, placing NZD on an upward trajectory. However, USD is also a prime target for gains this year as Fed will continue reduce current stimulus package. As such, we may see bouts of unexplained spikes and dips moving forward as speculators may come out unexpectedly focusing on either the NZD or USD narrative at different times without warning. This will add as further hindrance for directional movements in NZD/USD moving forward, and traders of NZD/USD will do well to seek additional confirmations every step of the way.

More Links:

GBP/USD – Pound Choppy At Start of Week

USD/CAD – Loonie Starts Off Week with Gains

AUD/USD – Little Movement As Aussie Flirts With 90 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.