Gas prices jumped higher after the latest report from Energy Information Administration (EIA) reflected yet another week of decline in inventories. This stretches the inventory drawdown to 7 straight weeks, the longest consecutive decline we have seen in years. The reason for the decline is clear – extreme cold weather increased consumption of Gas for heating, but production of Gas were disrupted due to the very same cold weather which has caused burst pipes and made workers unable to operate. This drove Gas prices to as above 5.50 2 weeks ago. Prices have since pared more than 10% of the gains but we are back within the ballpark of 5.00 round figure after yesterday’s report.

So where do we move from here? Well, the cold weather is never going to last forever, and the same could be said about production levels which will definitely improve as spring draws near. As such, the inventory drawdown will definitely subside which will drive prices back down eventually. Furthermore, it should be noted that market may have also priced in the cold weather factor already, with the past 7 weeks drawdown close to expectations with a few weeks actually coming in less than expected. Hence, the only way for price to further increase from here would be an unexpected furtherance of the cold weather and or disruption in production, which would be unpredictable and hence folly to based our trade decisions on.

There are other factors beside the clearing of weather that will drive prices down. Recently we’ve seen US utilities company starting to use more coal and less Gas due to the increase in gas prices. Hence, it is clear that users at the industrial levels are still highly price sensitive when it comes to Nat Gas. As such, the long-term bullish potential of Nat Gas become much lesser and it will be difficult to imagine Nat Gas being able to push much higher beyond current 5 dollars as demand for Gas will undoubtedly fall which will drag prices back down. There will be political pressures to lower Nat Gas prices as well. The Obama administration is keen to push for higher utilization rate for Nat Gas and has been actively encouraging firms to switch to Nat Gas which has less emissions. Expect policies to drive gas prices down if that is identified as one stickler that is preventing wider industrial usage.

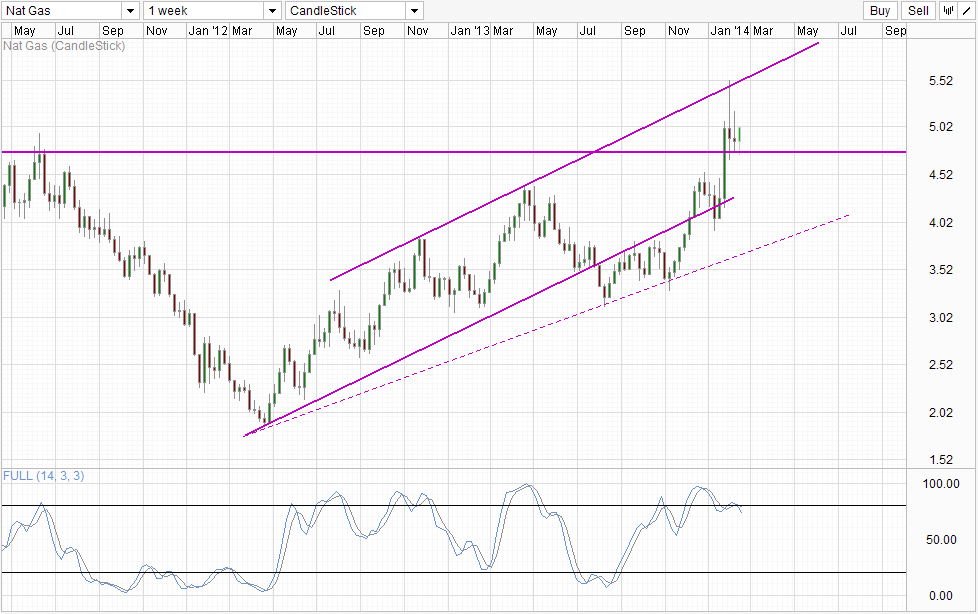

Weekly Chart

From a technical perspective, prices momentum still remain bullish, but we need to verify if the recent decline from 5.50+ constitute a bearish rejection from Channel Top (one that is not exactly drawn precisely and may not even be relevant). Clearing the 4.75 support level will be a good confirmation to go with Stochastic readings which is showing early stages of a bearish cycle. Should this happen, a move towards Channel Bottom and potentially all the way towards lower wedge may be possible.

More Links:

WTI Crude – Quest Above 100.57 Part Deux

Gold Technicals – Bullish Momentum Not Letting Up

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.