Prices of Gold fell today, in line with the overall risk off sentiment that is permeating the Asian session. This is not the first time Gold has been observed being correlated to risk in recent days, as prices have been increasing steadily since 8th Feb – the same time when global stocks started recovery. However, back then there was good reason for the positive correlation – New Fed Chairman Yellen was scheduled to speak on monetary policy on 11th Feb, and stimulus speculation (e.g. expecting Yellen to go easy on tapering) is a reasonable explanation for a climb in both stocks and gold.

Right now there isn’t any fundamentally good reason for price to be trading lower. Some may say that the decline in Gold could be due to the disappearance of stimulus speculative play as Yellen affirmed that the pace of QE taper will continue. But this assertion does not fly when we consider that prices actually traded higher on Tuesday post Yellen’s speech. Prices continued to climb higher yesterday as well, bringing us a new 3 month high but that may be easier to explain away as US stocks were looking shaky with S&P 500 and Dow Jones Industrial Average both clocking in losses. But if we were to accept that risk-off sentiments would drive Gold prices up, then this morning’s bearish Asian session (Nikkei 225 -1.79% and Hang Seng Index -0.54%) should have driven Gold higher instead of lower. Hence, all attempts to explain Gold prices behaviour cannot adequately account for the entire period, and is only valid on a piecemeal basis.

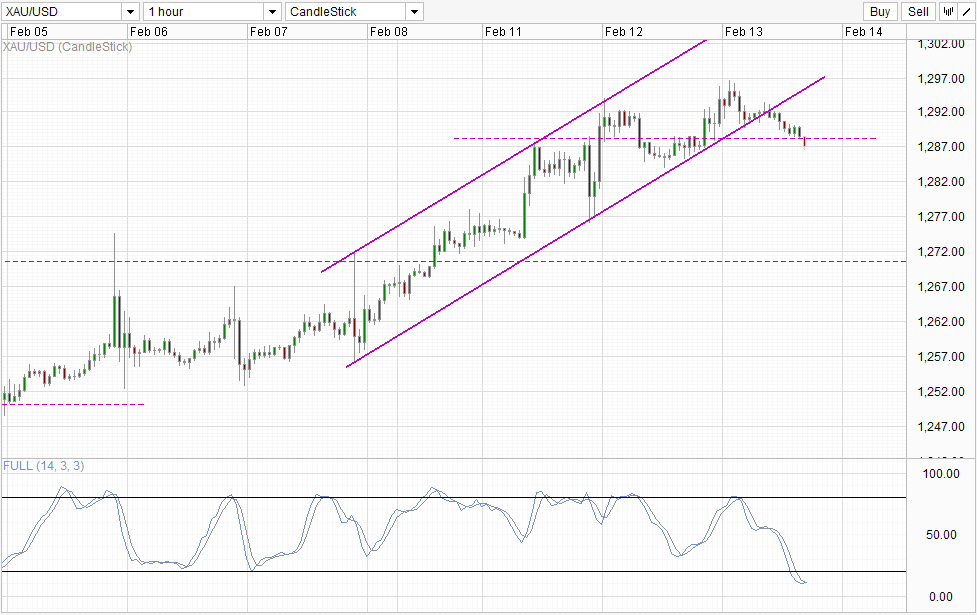

Hourly Chart

This makes predictability of price direction low, and even though prices have broken below the soft support of ,1288 and rising Channel Bottom, there is no guarantee that further sell-off is incoming. Stochastic readings is deeply Oversold, and the uptrend that has been in play is not fully invalidated as well. Hence, do not be surprised that prices can still reverse from here and actually affirms the uptrend as we would have yet another sequence of higher highs and higher lows.

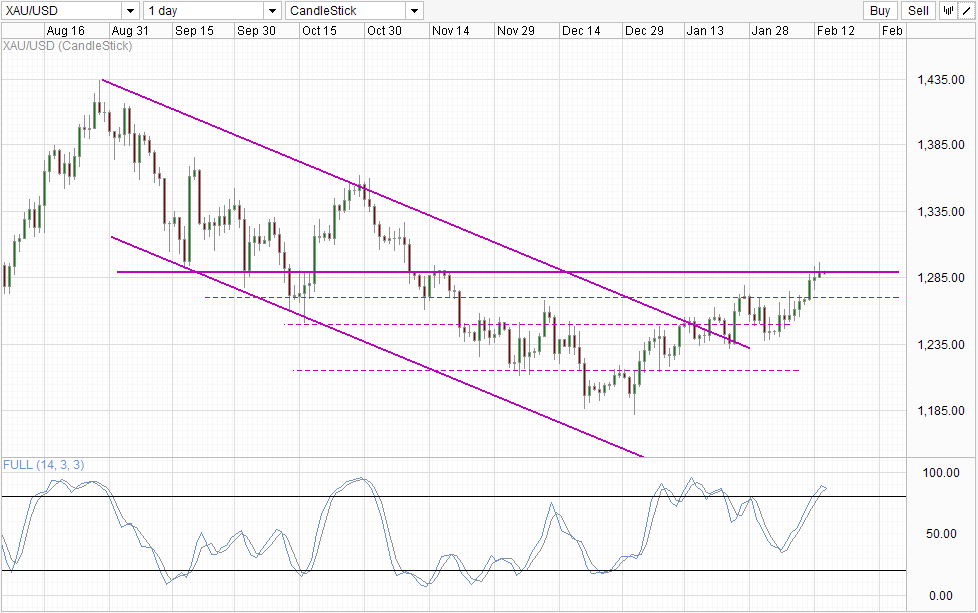

Daily Chart

Daily Chart affirms this notion as well, as price is in the midst of breaking the 1,290 resistance. Price may be under 1,290 right now but there is no evidence of a convincing bearish rejection. As such, trend traders’ default position should be assuming that the uptrend is still intact until evidence to the contrary surfaces. Stochastic curve may be pointing lower now and looking likely to cross Signal line soon, but it should be noted that Stochastic counter-trend signals are never as reliable during strong trends. As such, traders trying to pick top in Gold right now will need to be careful, but considering that price did see huge long tail candles last week (see hourly chart above), keeping stop losses tight may not be effective either as strong whipsaws may knock your stop losses out even though overall direction may not have shifted.

The old adage may be helpful here – when in doubt, do nothing. Conservative traders seeking the best probability trades will do well to leave gold alone for now until more information/clarity emerge.

More Links:

WTI Crude – First Sign of Potential Bearish Reversal

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.