Crude Oil didn’t perform as well as Stocks or Gold, but nonetheless bulls would be glad that a full bearish reversal has been averted with prices rebounding off the lows made during European hours. We didn’t close at a new high, but at the very least WTI prices did manage to have a higher high (albeit slightly), and thus keeping the Higher Highs, Higher Lows sequence and maintaining the uptrend that has been in play since 4th Feb.

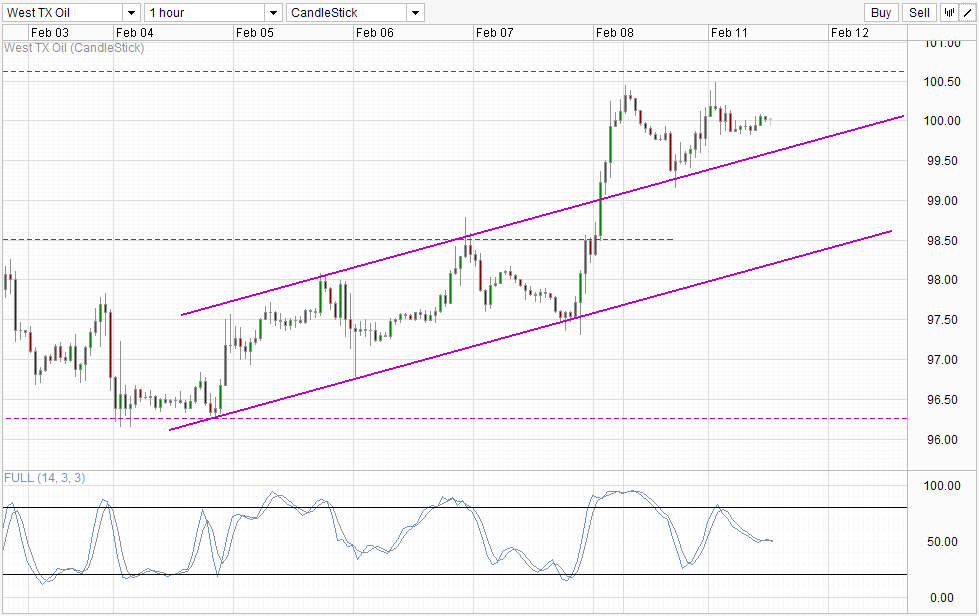

Hourly Chart

Currently, prices is back above the 100.0 round figure, and perhaps move importantly above the soft support/resistance level around 99.8. In our analysis yesterday we have established that underlying sentiment in Crude can be ascertained as bullish if prices managed to rebound higher without getting close to the 98.5 support, and in this regard price action has passed. Furthermore, the point of reversal is in line with the Channel Top support, suggesting that current price levels is more than adequately supported, opening up the possibility of a push towards the 100.57 resistance once more.

However, the ability for price to climb beyond 100.57 is definitely in doubt, as there isn’t any strong fundamental reasons that support such a move, at least not now. One even wonders if Crude will be enjoy strong rallies even if Yellen surprises the market with a dovish testimony to the House of Commons later today, as WTI appears to be lagging the rest of the other risk correlated assets. Hence, do not be surprise if 100.57 resistance remain intact even if US stocks and Gold push much higher after today.

This would also mean that the risk of a bearish pullback becomes higher, and certainly if price remain under 100.57 for an extended period of time, we will see prices trading back within the rising Channel by default which opens up Channel Bottom as a viable bearish target, at the same time potentially breaking the Higher Highs/Higher Lows sequence and invalidating the bullish momentum we are enjoying right now.

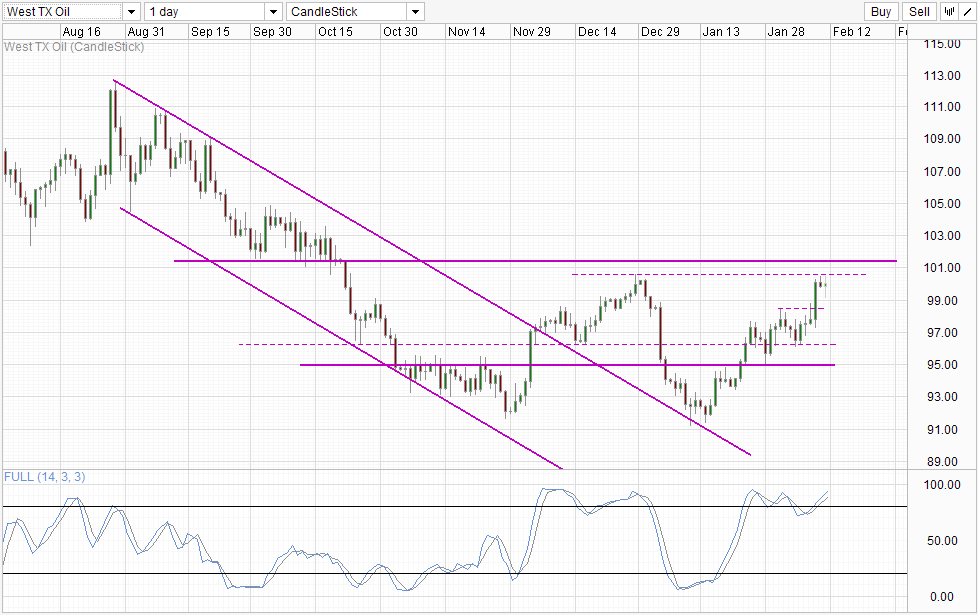

Daily Chart

Price Action on the Daily Chart concurs with Stochastic readings already being deeply Overbought even before 100.57 is broken. Even if 100.57 is breached, we have another 101.5 resistance lying in wait, and should price fail there, the overall bearish theme that has started since the decline in August 2013 will remain intact and the risk of a long-term reversal towards 2014 lows becomes possible.

WTI bullish proponents will point to the possibility of Keystone XL pipeline approval as potential upside risk to WTI which can propel prices up higher. That may actually be wishful thinking though, as market may have already priced in such a scenario already. Latest comment by Canadian Prime Minister who said that the approval of the pipeline is “inevitable” did little to push prices up yesterday, suggesting that the market is already immune/fully saturated with long positions relating to Keystone XL, and we could actually see a buy the rumor/sell the news scenario playing out if the approval does happen.

More Links:

GBP/USD – Moves to One Week High Shy of 1.6450

AUD/USD – Threatening the Resistance Level at 0.90

EUR/USD – Making a Push Through Resistance at 1.3650

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.