Kiwi dollar has been trading lower today despite improved risk appetite during Asian sessionwhich saw Nikkei 225 climbing 2.17% and Hang Seng Index by 1.08% at the time of writing. Prices did climb up higher during early US session led by strong rally in US stocks. However, prices started to reverse quickly, falling back below the 0.825 ceiling turned support before the end of US session, making the earlier push above 0.825 a “fakeout”.

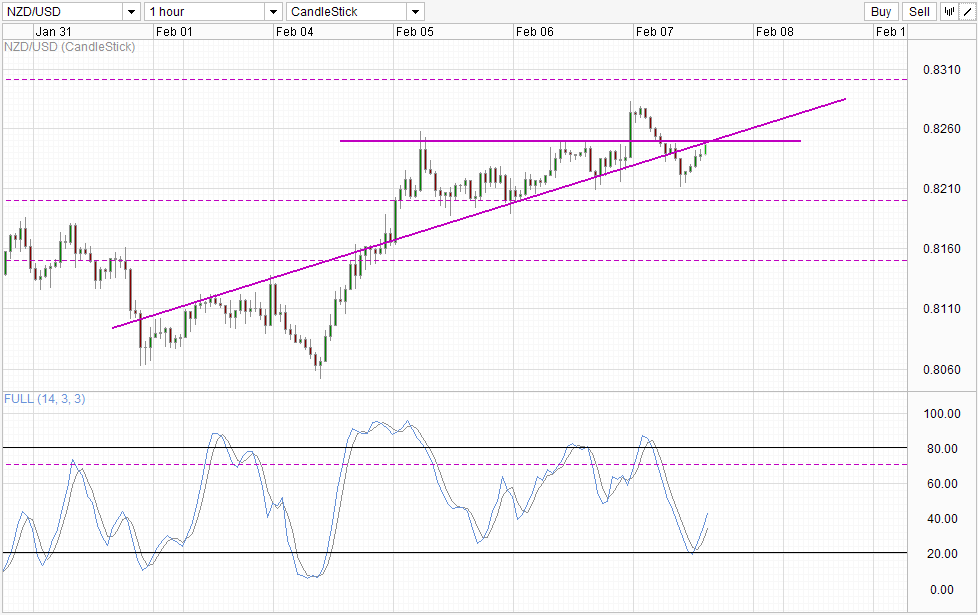

Hourly Chart

The failure to keep prices above 0.825 is a strong sign that market sentiment in Kiwi Dollar is not exactly bullish. This is not a new revelation as the muted reaction from a stronger than expected Employment Change on Wednesday already told us that. This notion is further reinforced during our Thursday’s analysis of price action. Hence, there was really no business for bulls to break 0.825 yesterday and hence the subsequent decline cannot be considered as surprising. This would also mean that the likelihood of prices breaking 0.825 and confluence with rising trendline right now will be lower. Stochastic readings are pointing higher but looking at historical Stoch movement suggest that there is a possibility of Stoch curve reversing here where other point of inflexions have been spotted. Hence, a move back towards 0.82 round figure is favored, but in the event that price does break above without any fundamental support we could see quick bearish reprisal just like what we’ve seen earlier today.

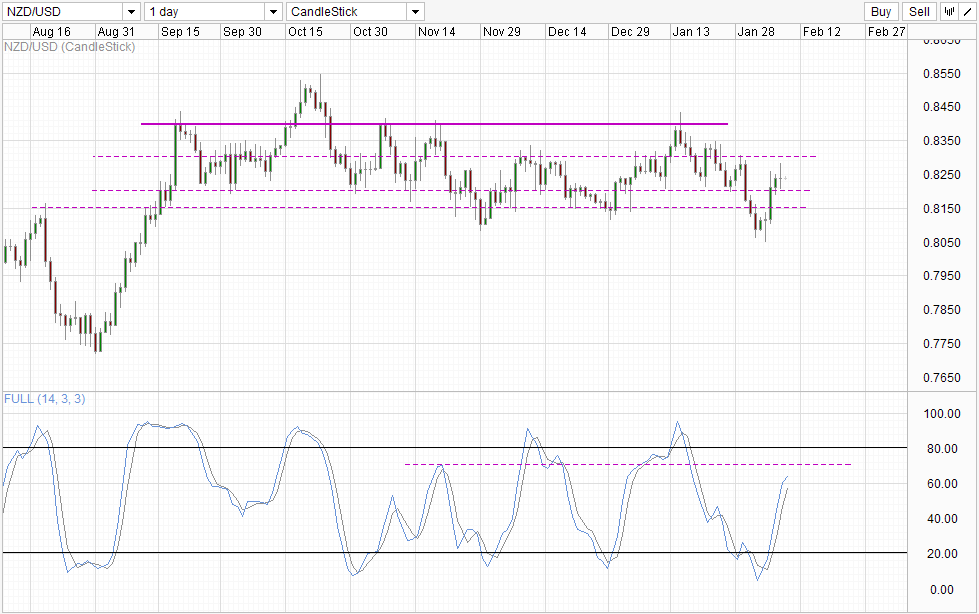

Daily Chart

Daily Chart similarly does not share with the bullishness. Stochastic readings is moving towards a “resistance” level of 70.0, while price the doji candlestick suggest that direction is indecisive. Nonetheless, as long as 0.82 support is intact, the “fakeout” of 0.815 and subsequent move into the consolidation channel cannot be ruled out, and traders must still take note of the mid-term scenario where 0.84 is the expected target. As such, bearish traders who want to participate in a potential move to 0.82 need to be more cautious as this can be regarded as a counter-trend move.

Today’s Non-Farm Payroll will help to shed some light on the supposed bearish sentiment. As US stocks/risk appetite can be expected to experience high volatility after NFP numbers are released, we should be able to see wild swings on NZD/USD as well. If 0.825 ceiling continue to hold even though initial direction post NFP is bullish, the underlying bearish sentiment will be affirmed and vice versa for 0.82 support.

More Links:

GBP/USD – Establishing Range Between 1.6250 and 1.6350

AUD/USD – Starting to Challenge Resistance at 0.90

EUR/USD – Surges Through Key Level of 1.3550

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.