The recent emerging market turmoil actually helped SGD strengthen against SGD as regional funds escape their respective beleaguered economies and get into the only Triple A rated country in Asia with a stable outlook by all 3 major rating agencies – allowing SGD to shave off more than 1 Singapore cent against USD.

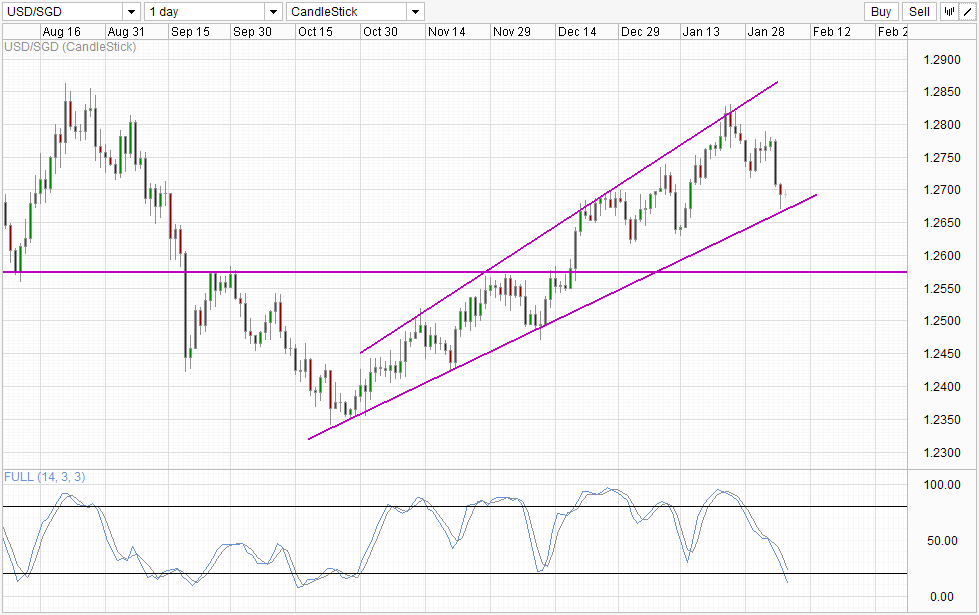

Daily Chart

Currently, price is sitting just above the lower wedge, and the possibility of price rebounding from there is high given that Stochastic readings are already within the Oversold region which favors bullish scenarios moving forward. Furthermore, from a fundamental basis, it is likely that a large part of the funds that have come into Singapore should be from within the region, a region that is not known for its deep pockets. As for funds that originated from out of the region, it is more likely that they would prefer to shift their money into traditional safe havens such as USD and JPY which are cheaper compared to their historical average, unlike SGD which is actually higher than the historical average. As such, it is unlikely that this safe haven flow into Singapore will continue for long, which impairs the long-term bullish potential of SGD even before we take into consideration that foreign funds are leaving Singapore as well.

On a comparative basis, USD is also slated to strengthen in 2014 due to continued QE tapering. This acts yet another bullish driver for USD/SGD, which makes long-term bearish follow-through below the lower wedge unlikely. This view is echoed from a technical perspective which says that prices will find further support around 1.262 – 1.265, potentially sending prices back up into the wedge once again.

Short-term momentum is still to the downside though, as price has found it hard to break the 1.27 ceiling. With descending Channel Bottom coming into play in the next few hours, it will be hard to imagine USD/SGD able to find the bullish strength to break it unless something drastic happen during US market today. If not, immediate bearish direction towards 1.2675 is favored. Stochastic readings agree with this outlook as Stoch curve appears to have peaked. However, given that Stoch curve has since made a slight U-turn pointing higher after peaking, traders wishing to participate in the USD/SGD downward momentum may wish to seek further confirmation of Stoch level breaching 60.0 in conjunction with price breaking 1.269 soft support in order to ascertain the strength of short-term bearishness.

More Links:

EUR/USD – Consolidates around 1.35

AUD/USD – Breaks Through 0.88 to Three Week High above 0.89

GBP/USD – Bounces Off Support at 1.6250

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.