Gold prices traded lower on a temporary reprieve of bearish pressure. Price traded below 1,250 during early US session but quickly bounced back to 1,256 by the time US session closed. This is not really surprising when we look at Stocks and other risk correlated currency that suggest that the bullish recovery is more likely a technical pullback/dead cat bounce. Hence, it is likely that demand for Gold will remain as market is still cautious and will continue to seek safe havens assets.

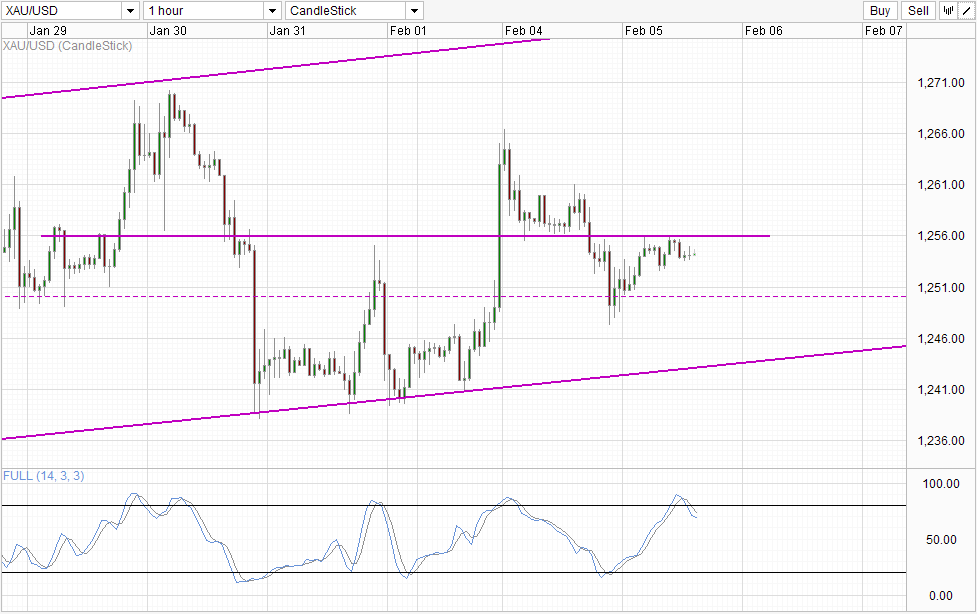

Hourly Chart

Hence, given the fundamental backdrop, we should be able to expect Gold price to push above 1,256 which will open up a move towards 1,266 – 1,270 ceiling marked by previous 2 swing highs. However, before a break of 1,256 is observed, the possibility of a move towards 1,250 is still possible. This possibility is low as Gold remained lifted despite the improving risk sentiment during Asian hours, with European stock futures a mixed between bullish and bearish, the S/T bullish pullback narrative doesn’t appear to be applicable for Eurozone today, which will keep prices supported against any selling activities.

From a technical perspective, even though a new bearish cycle signal has been formed by Stochastic, gradient of Stoch curve has declined and we may actually see a short-term rebound in stoch curve/prices similar to what has been observed back on 30th Jan.

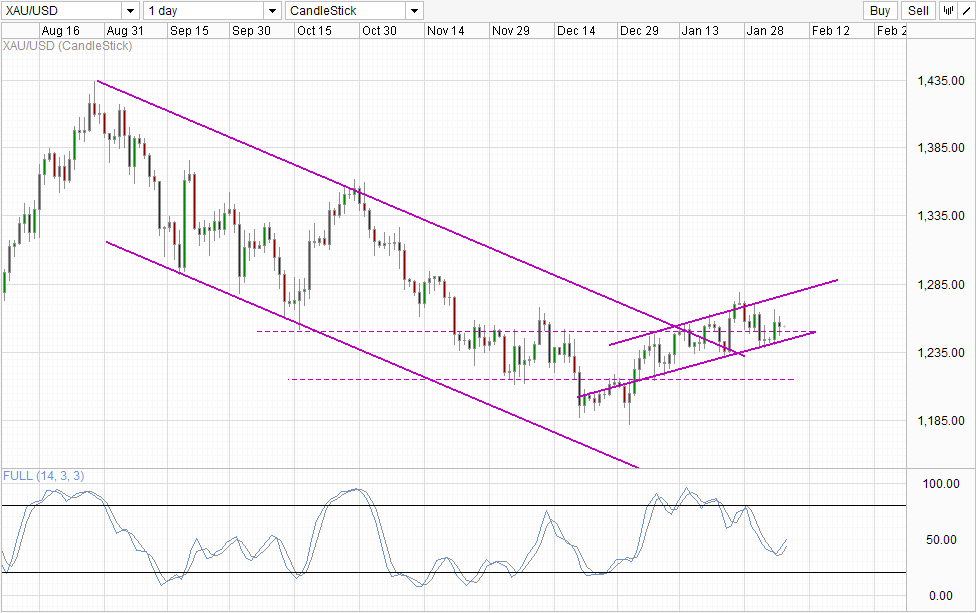

Daily Chart

Daily Chart favors bullish scenarios as well. Prices is rebounding off the Channel Bottom in search of Channel Top, while Stochastic indicator is also showing a bullish signal echoing what line studies is saying. However, Stoch curve should ideally push above 50.0 and perhaps even 60.0 in order to affirm that the bullish momentum is strong. This is necessary as the long-term fundamentals still favor weaker gold prices as inflation risk becomes lower due to lower QE purchases. This notion becomes even stronger when market is bearish as inflation will fall in a recession. Hence, as long as Fed does not start increasing QE purchases in the near future, inflation should be lower and the demand for inflation protection such as Gold will remain lower. On the other hand, the only reason for higher Gold prices would be safe haven flows, but even in this case it is debatable whether Gold is really a good safe haven asset as prices are still much higher compared to the historical average ignoring the past 5 years. Given that there are definitely much better safe havens available such as USD and JPY which are both on the cheaper end, it is hard to imagine current Gold demand growing by leaps and bounds even if stock markets start to collapse.

Given all these, with the added consideration that trend is still bearish, a bullish trade will be considered counter-trend which will require much more caution when entering into.

More Links:

GBP/USD – Bounces Off Support at 1.6250

AUD/USD – Breaks Through 0.88 to Three Week High above 0.89

EUR/USD – Consolidates around 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.