Turkish Lira has given up most of its post rate hike gains, a move that is not really unexpected as the sharp hiking of rates is just a temporary defensive move highlighting the desperation of the Turkish Central Bank.

This move was supposed to attract foreign investors to pump money into Turkish banks in order to earn the high interest rates, and/or start investing into Lira denominated assets which will start to fuel economic growth. However, given that global risk appetite is deteriorating, it is not surprising that investors are unwilling to pump money into Turkey as they would rather keep funds close to themselves in order to weather a potential storm. This is especially true when we consider that US traders are at record leveraged levels when it comes to stock purchases – and any spare cash right now during this crisis will help to sustain all their current margin positions.

Furthermore, it should be noted that this is not the first time Turkish Central Bank has hiked rates so aggressively. The last time they did so in 2001, the Foreign Investment did not come as the dot com bubble has just burst and nobody has cash to spare. Hence instead of saving the Lira and revitalizing the economy, the higher rates stalled local businesses activities into a gridlock and the Central Bank had to reduce rates drastically once more, crashing Lira and gave birth to hyperinflation. Certainly the problems today isn’t as bad as before, and current weekly repo after the hike ( standing at 10%) is a far cry from 2001’s peak of 300% and 1994’s 500%. As such, even if this latest rate hike is unable to save TRY, it is likely that the detrimental effect will be kept in check, and a 2001 style meltdown should not be coming in the immediate future.

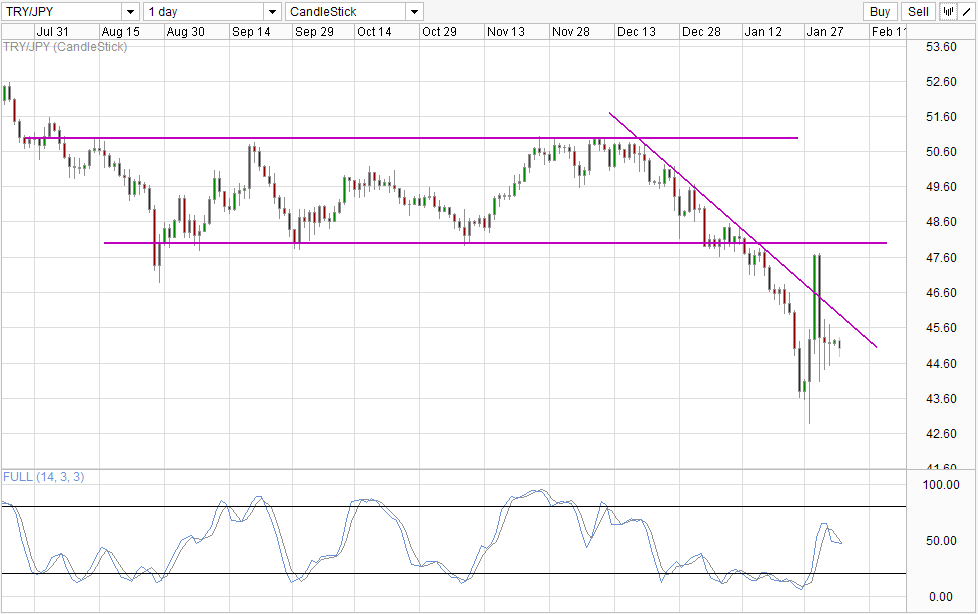

TRY/JPY

This is little comfort for TRY holders though, as the weakness against majors has resumed. For TRY/JPY, prices is back below the descending trendline, opening up a potential move towards recent swing low of 42.87. For now prices appears to be supported with higher lows seen in the past 3 daily candles, but this trend is set to change today based on current price levels. Stochastic curve was on the verge of crossing higher but that will most likely change if price heads lower from here, and the stoch peak will be confirmed, adding additional bearish pressure favoring a move towards 42.87.

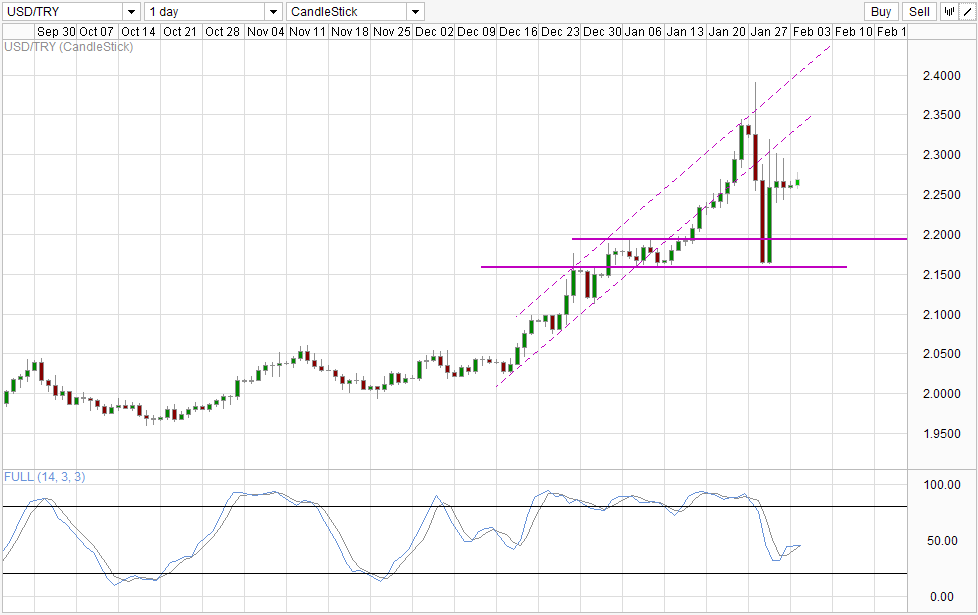

USD/TRY

Similarly, the bull trend on USD/TRY is also back on track, with prices staying above the 2.25 round figure after breaking 2.195 ceiling. Stochastic indicator looks similar to TRY/JPY where Stoch curve was about to cross the signal line to produce a bearish signal. However, given that momentum is on the upside right now, it is more likely that Stoch curve will start to pull away from the Signal line, and provide further credence to the bullish cycle signal even though Stoch curve did not enter the Oversold region.

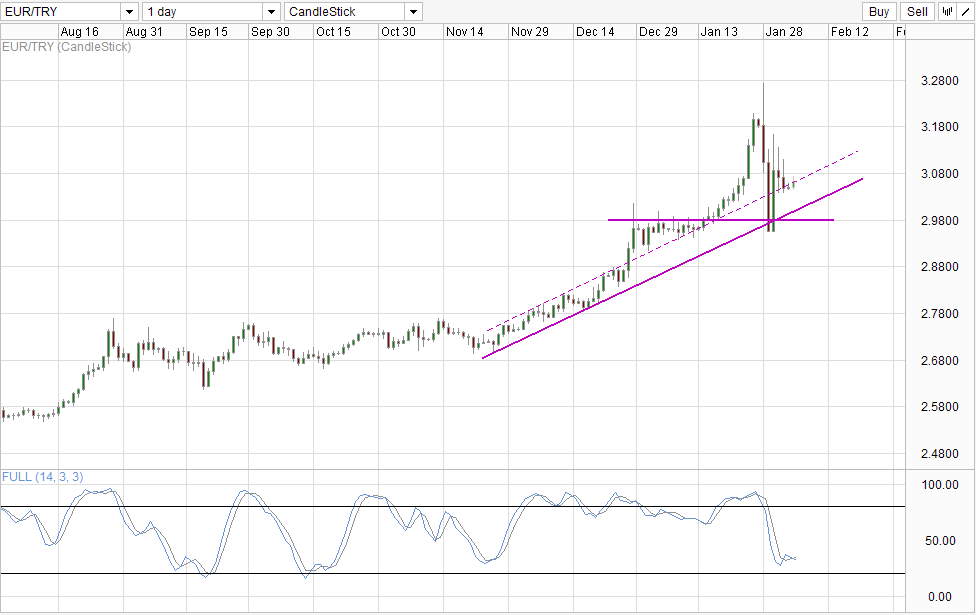

EUR/TRY

EUR/TRY is the weakest amongst the 3 major TRY pairs with prices actually facing resistance from the higher rising trendline. Stochastic readings have also crossed, unlike the other 2 pairs. Given that broad TRY weakness is seen, it is likely that the trendline will be broken and a breakout will occur eventually. Hence traders who have yet to sell Lira and wish to find entries may wish to keep a lookout on EUR/TRY for the next potential entry.

More Links:

GBP/USD – Eases Below Support Level at 1.6450

AUD/USD – Consolidates Below Key Level of 0.88

EUR/USD – Drops Sharply to Two Month Low Below 1.35

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.