US stocks bounce back yesterday, snapping the 3 day losing streak. S&P 500 gained close to 11 points (0.61%), while Dow Jones Industrial Average push higher by more than 90 points (0.57%), reversing the losses suffered on Monday. Looking at price action of Futures, it is clear that the bullish momentum has started as early as Asian opening hours yesterday, continuing during the European session despite neither region reflecting extraordinary bullishness yesterday. Furthermore, the bullish rally wasn’t fazed by a much weaker than expected Durable Goods Orders, which came in at -4.3% vs 1.8% forecast. The Y/Y Case-Shiller Composite index was lower than expected as well, but US stock prices continue to climb. Certainly the higher than expected US Consumer Confidence helped fuel the bullish momentum, but it is impossible that stronger Consumer Confidence was a factor for rebuffing the weaker than expected economic numbers earlier as this number was only released at 10am EST while Durable Goods and Case-Shiller numbers were released at 8.30 and 9am EST.

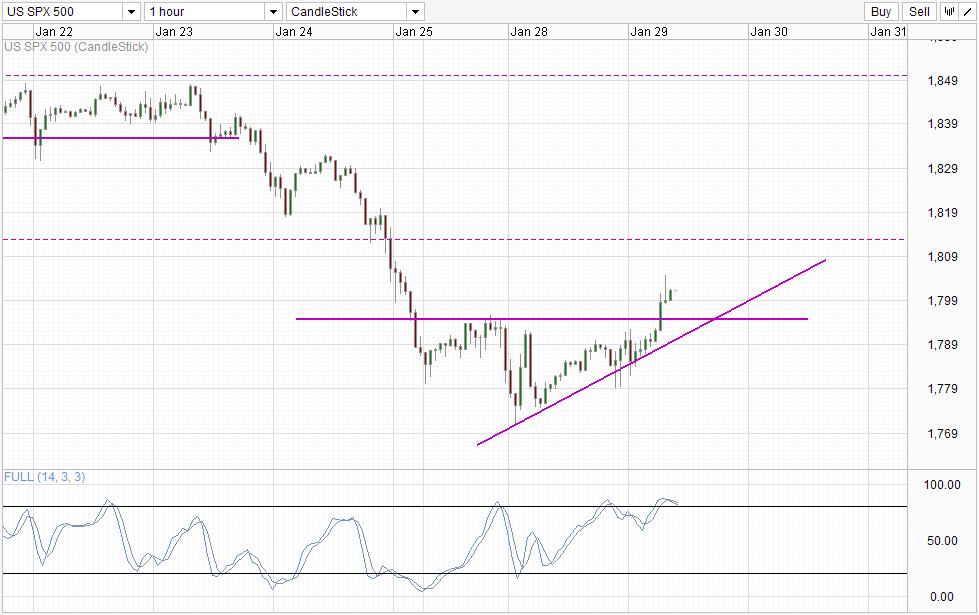

Hourly Chart

Hence, it is clear that US stocks is bullish inherently. The only question is why?

Yesterday’s analysis of Monday’s decline showed that bearish momentum was waning, but we did not really manage to find any strong fundamental reasons for stocks to reverse. Hence, the only plausible reason for this show of bullish strength would be a simple case of short-squeeze, where bearish traders have basically gotten ahead of themselves and sold too much and is unable to short further. The rally is a result of traders taking profit and covering their positions.

There is also the potential of traders seeking bargain buys after seeing that price has rebounded off 1,770 support. Generally catching falling knives isn’t a recommended trading strategy, but considering that traders today are the most leveraged on record, it will not be surprising to see higher risk taking appetite driving this rally on nothing other than the idea that current price is “cheap”. This would also mean that long-term bullish follow-through will be weak, and the strong downside risk narrative remains in play.

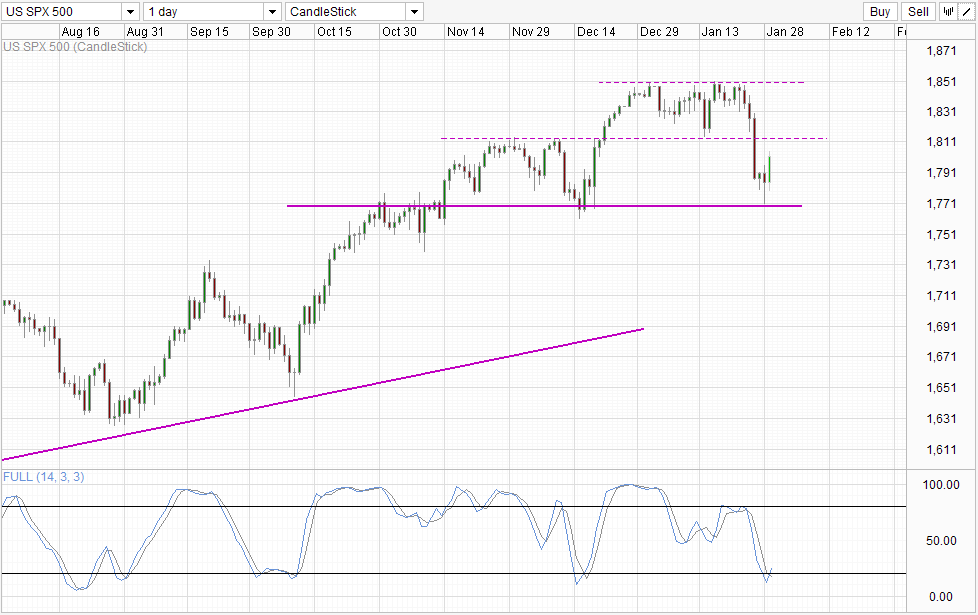

Daily Chart

But for now, a push towards 1,812 resistance cannot be ruled out, as bullish momentum is clearly in play right now. Stochastic indicator is also giving us early signs of a bullish cycle signal that could even take us to 1,850 if a full bullish cycle pens out similarly to the one we’ve seen between mid December to early Jan. Once again, this does not mean that bullish follow-through in the long-term is strong, as prices is likely to reverse lower at either of the resistance mentioned earlier. Long-term bearish risk remain as market appears to be over-leveraged and prices will definitely collapse heavily if de-leveraging occurs. The only thing that we can ascertain though is that today is not the day where bears will rule, and if that is a good enough reason for you to buy Stocks right now, do go ahead but be careful of the risks involved.

More Links:

GBP/USD – Resistance at 1.66 Level Stands Firm Again

AUD/USD – Rejected Again at Resistance Level at 0.88

EUR/USD – Remains Subdued Below Resistance at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.