The recovery in AUD/USD continues this morning, extending the gains seen on Friday. This rally seems to be going against risk trends which saw Nikkei 225 gapping 300 points lower and trading a further 100 points lower during early Asian hours. The contagion does not stop at Japanese stocks, with Hong Kong’s HSI trading more than 450 points (2.06%) lower, Kospi 25 points (21.29%), and Australia’s ASX 22 points (0.42%) lower. Hence, it is surprising that a “risk currency” such as AUD managed to go against broad trend, when other risk currencies such as EUR and GBP and neighbours NZD are trading flat if not lower.

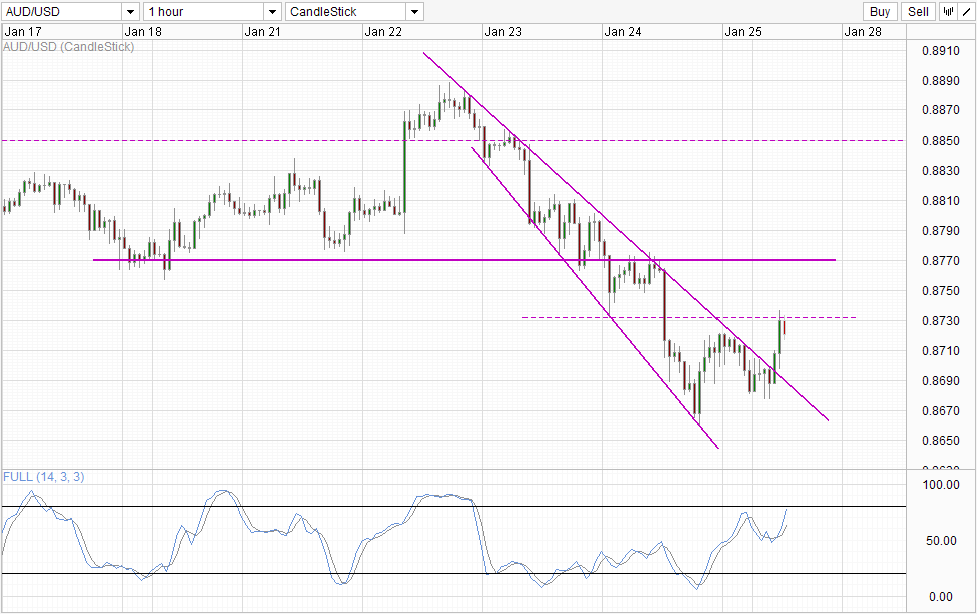

Hourly Chart

That being said, this is not the first instance where AUD/USD managed to buck the trend. Prices actually pushed higher last Friday during early US, midday European session despite risk trends being equally if not more bearish then. Hence, this morning’s rally can be interpreted to be the bullish extension of the recovery efforts from Friday. If that is indeed true, then it will be unlikely for prices to continue pushing higher as this is not a shift in sentiment/direction, but a mere correction. Right now, prices are already facing difficulties trying to push beyond the 0.873 resistance, and even if prices break above the 0.873 resistance, 0.877 will most likely hold as bullish momentum is nearing Overbought now and will definitely be Overbought should current price continue higher.

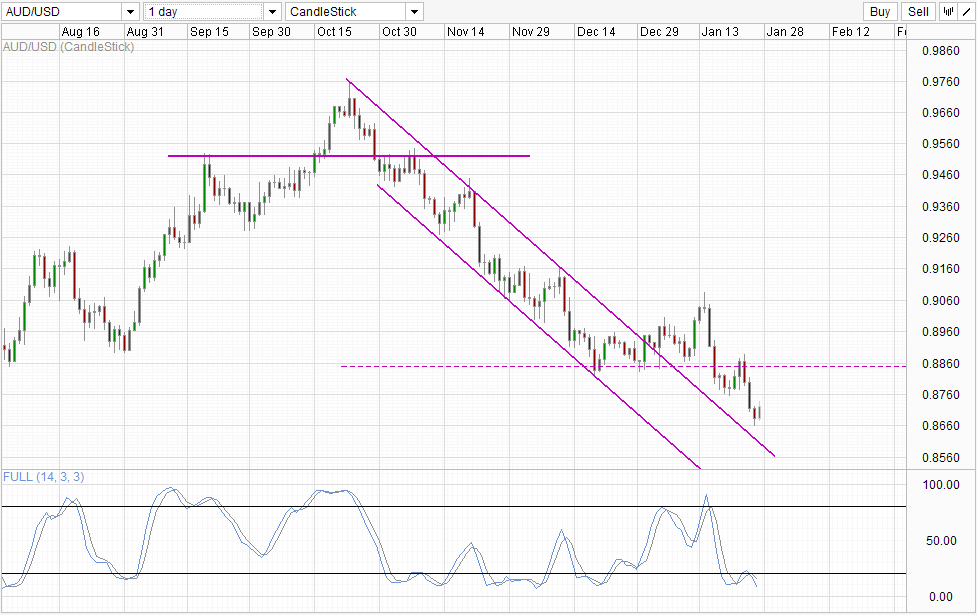

Daily Chart

Daily Chart shows that current bearish momentum may be a little bit overstretched, but we may still have some room for bearish move as prices have yet to tag the Channel Top. Also, Stochastic readings are still pointing firmly lower with distance between Signal line widening, suggesting that immediate bullish pressure may not be present – coherent with the Short-Term analysis.

Fundamentally, with broad market sentiment continuing being extremely bearish, it is unlikely that current recovery will be able to last long against risk flow. Furthermore, AUD continues to look soft both on Aussie Economy and lower rates outlook by RBA. USD on the other hand is slated to rally on QE tapers and expected rate hike beyond 2015. Thursday’s RBNZ rate decision may also sink AUD further if the Central Bank decides to hold rates/keep a less hawkish outlook. This is because RBNZ has been extremely hawkish in the late 2013, and if the Central Bank change tact, it is likely that AUD traders will expect RBA to be even more dovish – and rate cuts will be even more forthcoming in Q1 2014.

More Links:

Week In FX Americas – The Loonies’ Week from Hell

Week in FX Europe – Contagion, contagion, contagion!

Week in FX Asia – China Manufacturing Disappoints as Emerging Markets Drop

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.