EUR stayed relatively stable against the onslaught of USD last Friday, closing at 1.3678 – slightly lower than Thursday’s US closing level of 1.3695. Compared to other risk currencies such as GBP, AUD and NZD, this stability of EUR in the face of sharp risk aversion is a strong testament to its underlying bullish strength.

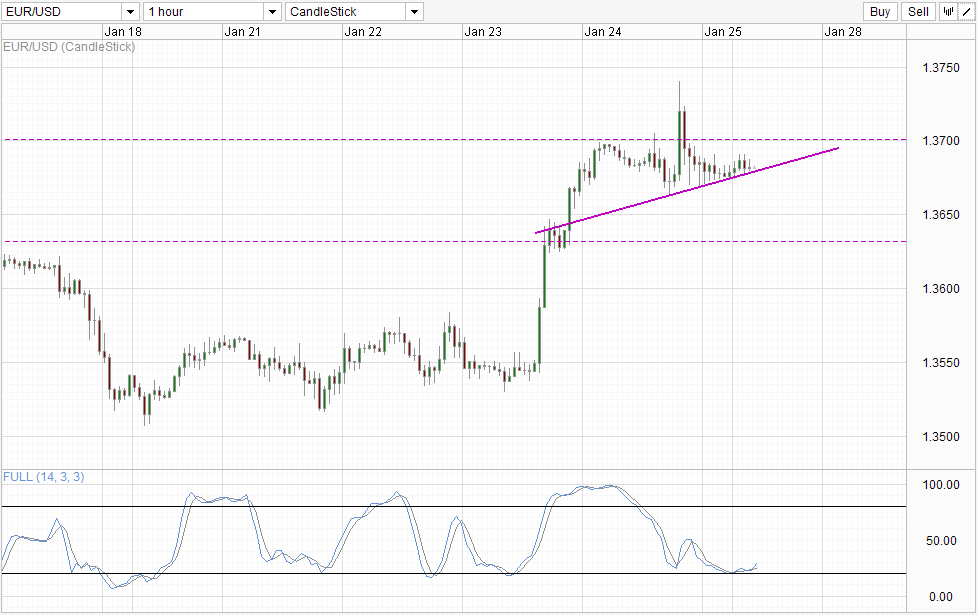

Hourly Chart

Currently prices are staying above the rising trendline, suggesting that the short-term bullish momentum that managed to break 1.36 round figure and more importantly 1.363 significant resistance (see Daily Chart below) is still in play. Stochastic readings are pointing higher right now, favoring a rebound off the trendline towards 1.37 once more. Should the bullish cycle in Stochastic indicator take flight, it is highly possible that 1.37 can be broken and prices may even be able to reach beyond Friday’s high on this bullish cycle alone.

Downside risk on EUR/USD is lower, as price will be able to find support from 1.366 (current consolidation swing low) if the trendline is broken, and even 1.363 if 1.366 is unable to withstand any short-term bearish pressure. Furthermore, with Stochastic curve close to Oversold, it will take a really tremendous bearish push in order to send EUR/USD much further lower (e.g. 1.355). Given that market is already undergoing huge bearish pressure due to the landslide in US and now Asian stocks, it is unlikely that bearish sentiment can go a few notches up higher – and the likelihood of EUR/USD collapsing here is low.

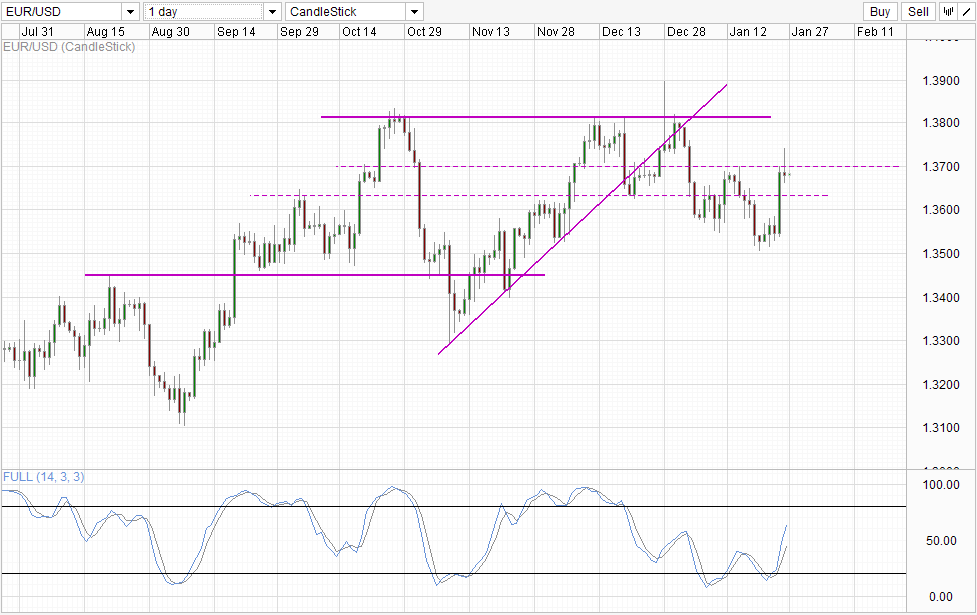

Daily Chart

Daily Chart is less optimistic though, as price action has set up a potential Evening Star candlestick pattern. Hence, Short-term bullish momentum is necessary in order to prevent further bearish pressure. Should price remain at current level, the Evening star pattern will not be formed, and at the most bearish would simply be a bearish rejection of 1.37, which will bring us to 1.363 support instead of opening up 1.35 as the immediate bearish target.

However, it should be noted that the failure to break 1.37 would mean that the Triple Top pattern remains in play, and a long-term move towards 1.33 and 1.31 remains on the cards. Even if prices managed to push beyond 1.37, it is unlikely that the ceiling of 1.3815 will be breached given that Stochastic curve is already above 50.0, and there isn’t much room for bullish momentum to go. Hence, this bullish venture may simply turn into a Quadruple Top pattern, and the risk of strong bearish responses moving forward remains.

Fundamentally, there isn’t anything significant that should have allowed EUR to be so bullish in 2014. Certainly the recovery narrative of Euro-Zone is there, but the pace of recovery is still slower compared to that of US. Some may say that interest rate expectations for ECB is no longer as negative as before, but it should be noted that EUR was staying relatively supported even when Draghi suggested that negative interest rates were possible. Furthermore, prices of EUR/USD did not rally this morning despite latest comment by ECB Governing Council member Klaas Knot playing down the need for lower policy rates in the near term. Hence, current strength in EUR may simply by volatility at best, or irrationality at worst and that is certainly not a good formula for Long-term bullishness in EUR/USD.

More Links:

Week In FX Americas – The Loonies’ Week from Hell

Week in FX Europe – Contagion, contagion, contagion!

Week in FX Asia – China Manufacturing Disappoints as Emerging Markets Drop

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.