Tumultuous day for NZD/USD. Prices pushed to a low of 0.8261 during early Asian session yesterday despite strong/healthy economic numbers from New Zealand. However, that could be explained given the overall risk aversion that started during US session on Wednesday which pushed NZD/USD from a high of 0.8346 coupled with the 6 month low HSBC Chinese Manufacturing PMI which drove prices below the 0.83 support. S/T Given all these, bias is certainly on the downside in the S/T even though our analysis suggest that L/T bearish follow-through was going to be unlikely.

Hence, the strong recovery in prices that drove NZD/USD higher and allowed 0.834 resistance to be tagged briefly is still regarded as a surprise. This is even more amazing when we consider that the rally came when risk appetite during US session was bearish, which should have drove risk currencies such as NZD lower especially since that seemed to be the case on Wednesday. Because of this, it is actually not surprising that prices collapsed shortly after, as the fundamental reasons for NZD/USD to rally so quickly so fast is weak at best, and non-existence at worst.

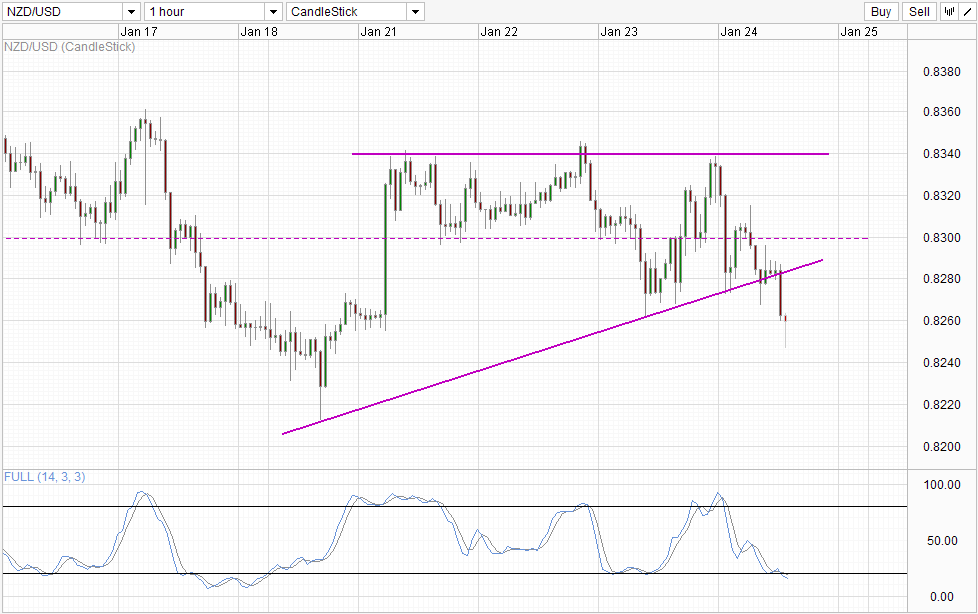

Hourly Chart

Nonetheless, it is clear that the hand of technicals continue to influence price action. It is no coincidence that yesterday’s rally stopped at the 0.834 resistance, and the subsequent pullback managed to find support from the rising trendline that represented the recovery efforts between Monday and Wednesday. The rebound off rising trendline which stalled around 0.83 is further evidence that trendlines, levels support and resistances are of huge relevance now. Hence, with prices breaking the rising trendline right now, the likelihood of price hitting the swing low seen on Monday becomes higher especially if 0.826 support is broken.

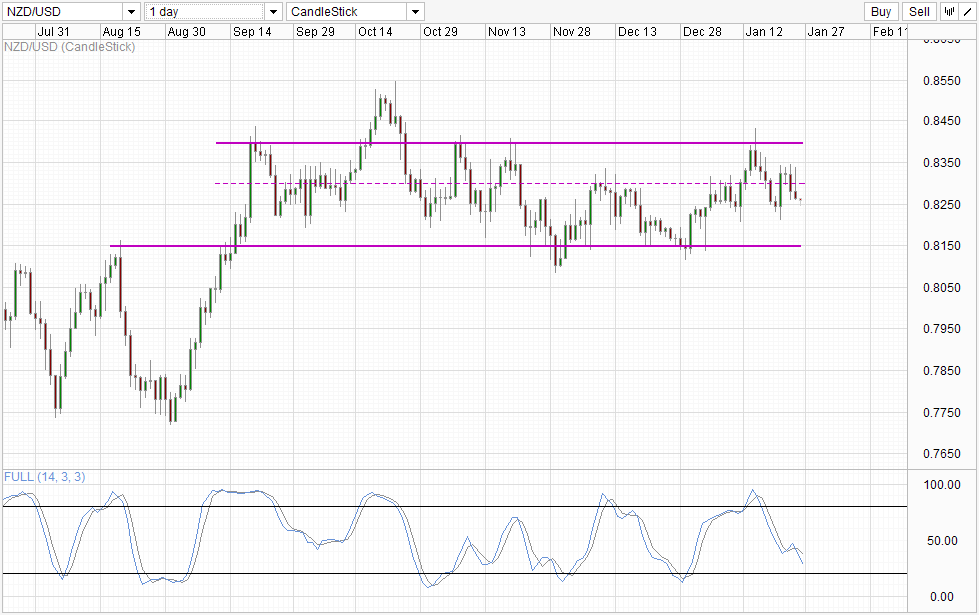

Daily Chart

Direction on the daily chart is also bearish, with prices in the midst of the 2nd half of the bearish cycle which should bring us to 0.815. However, prices may still find significant support above 0.82 with many dips rebounding off the level seen since September 2013. This is actually in line with Stochastic readings on the Hourly that shows that the bearish momentum is already Oversold, suggesting that prices may not actually go down south too far even though pressure is certainly on the downside. This outlook remains in line with fundamentals with NZD and USD both vying to be one of the biggest gainer in 2014. Hence, we may see yet more unexplained rallies and sell-off as a result of having 2 strong currencies pitting against each other.

More Links:

AUD/USD – Drops to New Low Below 0.8750

EUR/USD – Surges Back to Resistance at 1.37

GBP/USD – Surges to New Multi-Year High Above 1.66

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.