The Greenback continues its marauding run against Emerging Market Currencies, and SGD isn’t sparred even though it is considered a much stronger financial hub compared to the rest of its Asian counterparts. Since the start of 2014, SGD has weakened against USD by 0.8%, and this trend doesn’t seem to be reversing with the uptrend both on the short and long term.

The reason for the upward trajectory is easy to understand – USD remains primed for further growth due to the impending end of stimulus package. The improving US economy and rising US stock prices help to encourage global institutional funds to re-enter North America once more, fuelling the growth in USD.

On the other hand, Singapore’s economic growth is under scrutiny right now. The housing market is cooling, which will deter foreign funds from entering as foreigners make up a high percentage of private home purchases on this island state. Recently it was reported that Non-Oil domestic exports (NODX) has grown, but in reality the actual number is much lower due to mistakes made in trade data collection. After the new revelation, analysts has re-evaluate their forecasts, and some has estimated that NODX for full year 2013 would have decreased more than 5% y/y. This would also mean that GDP estimates will need to be revised lower, and that is certainly not good news for SGD which was already weakening when higher than expected NODX and GDP numbers were published.

Latest CPI data continues the bearish economic picture – December’s CPI grew +1.5% y/y versus analysts consensus estimate of +2.0%. This is also on the lowest end of the forecast band by Central Bank MAS, and a far cry from previous months of more than 2.0%. All these point to a long-term uptrend for USD/SGD in 2014 and perhaps in 2015 – 2016 as USD/SGD move closer towards the historical average level.

Hourly Chart

This morning’s weaker than expected HSBC Chinese Manufacturing PMI numbers didn’t do SGD any favours either, pushing price further up as USD strengthen on safe haven flows. However, it should be noted that USD/SGD was already trading above 1.28, showing that price is already bullish to begin with. Currently price is trading within a narrowing wedge, and price has just recently rebounded off the upper wedge, which opens up a potential move back towards 1.28 which will be confluence with lower wedge if the move transpire within the next 12 hours or so. Stochastic readings agree with a bearish cycle signal just newly formed, and the fact that bullish reaction towards the weaker than CPI news has been muted suggest that S/T bullish momentum is not as strong as we think.

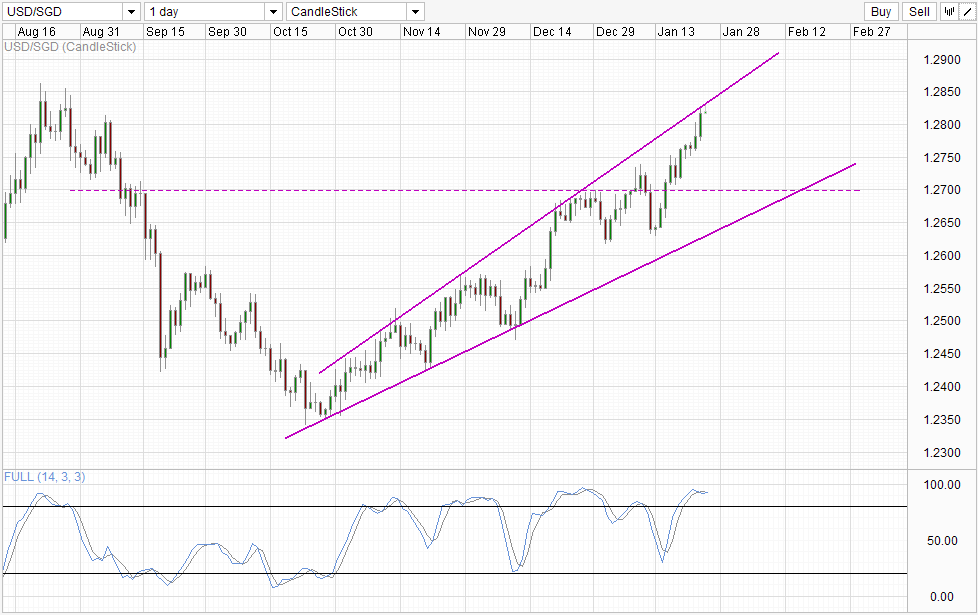

Daily Chart

Daily Chart also show USD/SGD hitting the upper wedge with Stochastic readings currently deep within Overbought region. Furthermore, price will be facing further resistance from the previous swing high seen in August 2013, limiting upside opportunity and increasing the likelihood of a bearish pullback towards Bottom wedge or at least around 1.27 support whichever comes first.

Nonetheless, it should be noted that any short positions from here would be counter-trend, and that would present higher risks. This risks increases when we consider that there is no evidence on the Daily Chart that bullish momentum is reversing. All we have is signs that a bearish pullback may/should be coming soon, and that could happen perhaps 50 pips or even 100 pips higher. Furthermore, there is also no guarantee that a bearish cycle will be able to take flight fully before the long-term bullish momentum reverts. As such, traders should exercise extreme caution especially since FOMC meeting is just round the corner, and USD is bound to suffer volatility as we head towards the major risk event.

More Links:

NZD/USD Technicals – Bearish Below 0.83 But L/T Follow-through unlikely

GBP/USD – Looks to Threaten Resistance at 1.66 Again

AUD/USD – Returns to Key 0.88 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.