No surprises from latest BOJ policy announcement. Governor Kuroda affirmed that the Central Bank will maintain current stimulus package, repeating all the bullish rhetoric that he has been saying before nominated/elected into the hot seat back in late 2012. Nonetheless, this non-event managed to quell some rumours about BOJ potentially lowering the inflation target 1 year on after the onset of current stimulus package on concerns that the initial target may be too lofty and unrealistic. With the Central Banker coming on record to say that current target and loose monetary policy remains on track, speculators and investors alike interpreted this as a sign that BOJ is willing to implement further stimulus package to hit the 2% target by hook or by crook, resulting in renewed confidence that Yen weakness will continue.

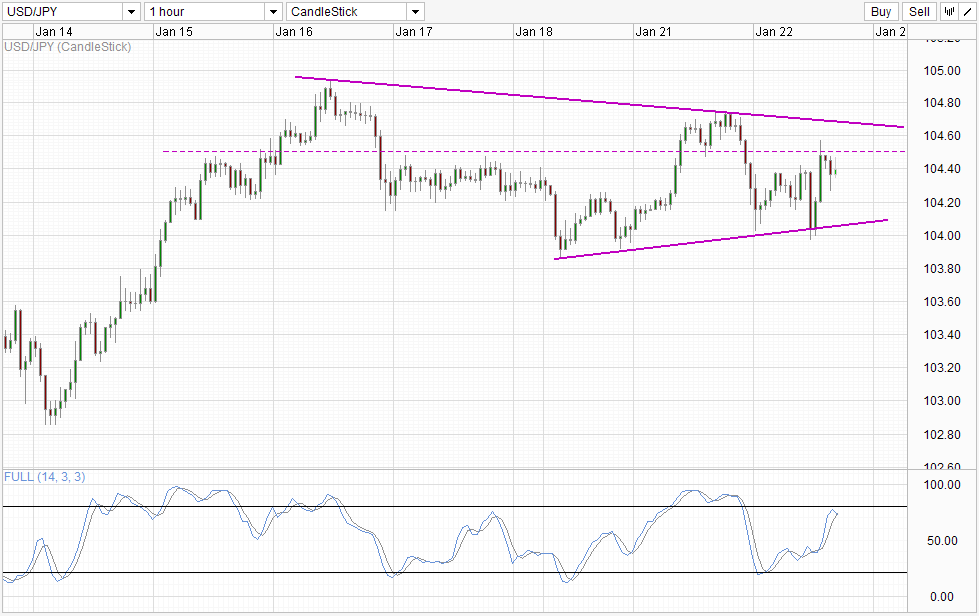

Hourly Chart

However, it should be noted that Kuroda did not actually promise that BOJ will implement any additional stimulus package anytime soon. The only thing that Kuroda said was that the Central Bank will make “policy adjustments” as needed, and saying that they are aiming to achieve the 2% price target as early as possible. Furthermore, Kuroda mentioned that downside risks to Japanese economy is receding while growth will exceed potential after July this year. Given all these, the Governor said that BOJ will continue current policy assuming no further downside risks appear down the road.

This sounds reasonable, but it should be noted that it does nothing to address market’s concern. It is clear that market is unsettled because they think that the so called economic growth/recovery has not been up to snuff. With Kuroda remaining as upbeat as before, it is clear that he does not share the same sentiment of the market. Therefore, it will be strange to say the least that Kuroda has appeased market’s concerns when he does not even acknowledge that there is a problem. This is not saying that there is indeed a problem, and market could proved to be overly paranoid. But the point is that market has actually sent USD/JPY higher after BOJ’s announcement even though their fears should theoretically still remain.

Hence it is not a surprise to see USD/JPY actually pulling lower despite not being able to test yesterday’s high nor even stay above 104.5 for a considerable length of time. The post BOJ announcement rally is unwarranted and the gains therefore has a higher probability of being pared.

From a technical perspective, price has traded back within the consolidation zone of last Friday. This suggest that the breakout which happened post BOJ has now been invalidated, and the immediate bearish target of 104.2 is possible, and may even go as low as 104.0 should the bearish momentum that started on 16th Jan remains in play. Stochastic readings agree with a new peak forming, adding bearish technical pressure.

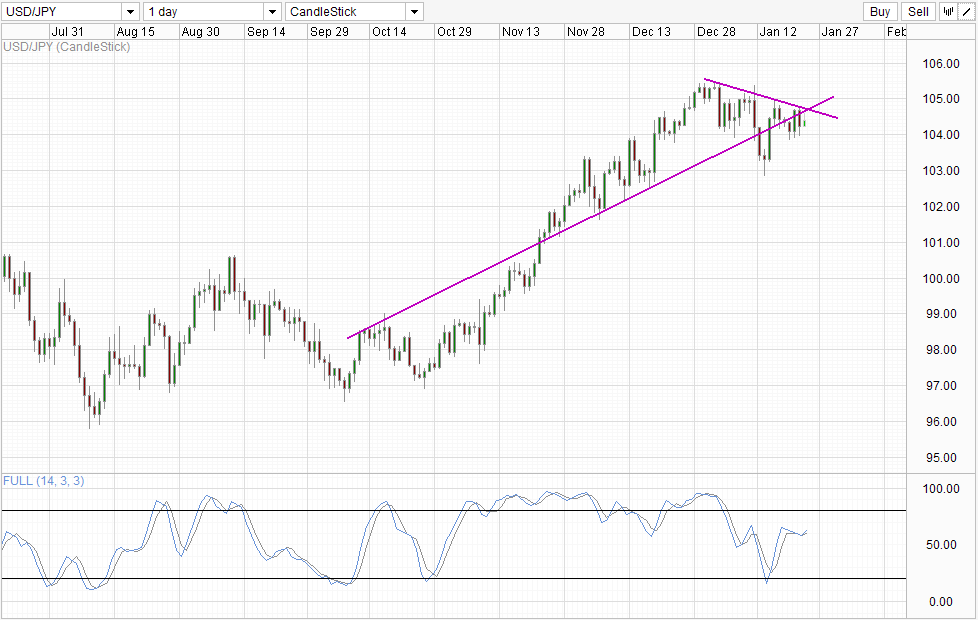

Daily Chart

Daily Chart shows that the long-term uptrend is currently under threat, with prices falling steadily since the peak made on 1st Jan. Considering that BOJ has done nothing to truly assure the market today, the likelihood of current feel-good factor dissipating and USD/JPY trading lower is higher. From a technical perspective, if 104.0 is broken, 103.0 becomes the next bearish target, and should the aforementioned level gets broken as well we could see bearish acceleration as the uptrend momentum will be invalidated.

More Links:

GBP/USD – Breaks Through Resistance at 1.6450

AUD/USD – Surges to One Week High near 0.8870

EUR/USD – Crawls back above Key 1.3550 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.