Kiwi dollar remains firmly on the backfoot today. Prices was already depressed during yesterday’s US session led by a hint of stimulus concern which drove USD higher, with prices staying close to 0.83 round figure support during early Asian hours. Strong economic numbers (ANZ Job Advertisements and Business NZ Performance of Manufacturing Index) released (5.00 -5.30am SGT) probably helped 0.83 to hold initially, but the support level eventually caved, resulting in a strong bearish push and hitting a low of 0.8261.

Hourly Chart

The main reason for this decline seems to be technical pressure, as price was constantly pressed lower by the descending trendline that was in play since the decline during early US session. The break of 0.83 is further fuelled by the surprisingly weak Manufacturing PMI data compiled by HSBC, which has hit a 6 month low with a 49.6 print. This also suggest that the Chinese manufacturing sector is actually shrinking, versus the expectation of a modest growth at 50.6.

However, it is interesting to see prices rebounding up even before 0.826 support is tagged, when price should have been able to trade much lower given that bears are on a roll fresh off the 0.83 break. This implies that overall sentiment isn’t as bearish as we think it is. Also, the rebound in prices allow a new channel to be drawn, suggesting that technical pressures still remain rather strong. Given all this, the likelihood of price breaking the newly formed descending Channel becomes lesser, and a push towards Channel Bottom and the swing low around 0.821 is possible should bearish rejection is confirmed.

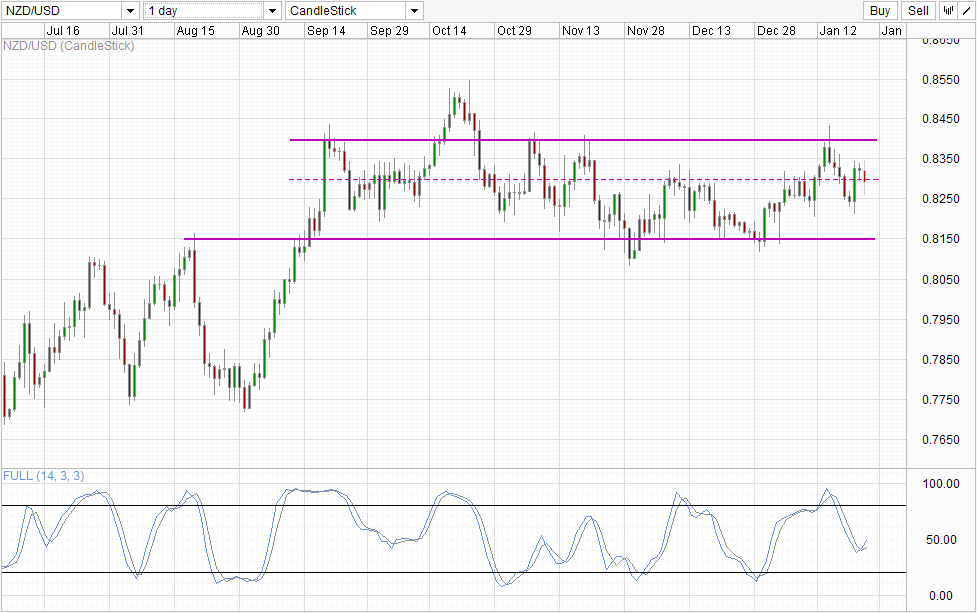

Daily Chart

This notion is echoed by Daily Chart, that goes further to suggest that the ultimate bearish target should be 0.815 as the bearish push from consolidation ceiling remains intact. Stochastic readings are pointing up currently, but it is possible that stoch curve may reverse given the precedence in the past which makes 50.0 a “resistance”.

Fundamentally, it is possible that prices are bearish for now because FX traders are looking at the FOMC rate decision next week and believe that the Fed will implement the next taper. There are a few issues with this view – firstly, timing of QE tapers should not really impact USD direction in the long run because it is a given that stimulus will have to end someday, and the date is likely to be in 2015. Secondly, market reaction towards bullish/bearish economic numbers are no longer inverted, suggesting that traders are no longer concerning themselves over whether such news will persuade/dissuade Fed to implement the next tapering action. Hence, traders hoping that next week’s FOMC outcome will drive NZD/USD lower in the long-run will find themselves disappointed when the dust have settled even in the event that Fed implement a new taper. Furthermore, RBNZ will be making its own policy announcement a few hours following FOMC announcement which can negate the bearish impact of any tapering action.

More Links:

GBP/USD – Looks to Threaten Resistance at 1.66 Again

AUD/USD – Returns to Key 0.88 Level

EUR/USD – Continues to Loiter around the Key 1.3550 Level

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.