Rupee has been relatively stable against the Greenback ever since the sharp decline of last Friday which occurred after the dismal NFP numbers were released. This stability occurred despite stronger than expected US economic news in the past 2 days which should have pushed USD higher and hence USD/INR higher. This muted response can be attributed to Sensex which continues to clock in mild gains in line with global positive risk appetite. With the main stock index remaining bullish, India will be able to enjoy continued inflows from overseas investors who will be willing to invest in the South Asia state which will keep Rupee afloat against a strengthening USD.

Hourly Chart

That being said, Sensex is currently trading lower in line with a mostly bearish Asian session today. This suggest that USD/INR may receive a short-term bullish push on Rupee weakness. Technicals agree with prices currently rebounding off Channel Bottom which opens up a move towards Channel Top. Similarly, Stochastic readings also suggest that a temporary bullish cycle may be occurring with Stochastic readings bottoming out at the level where previous troughs have been seen since Monday.

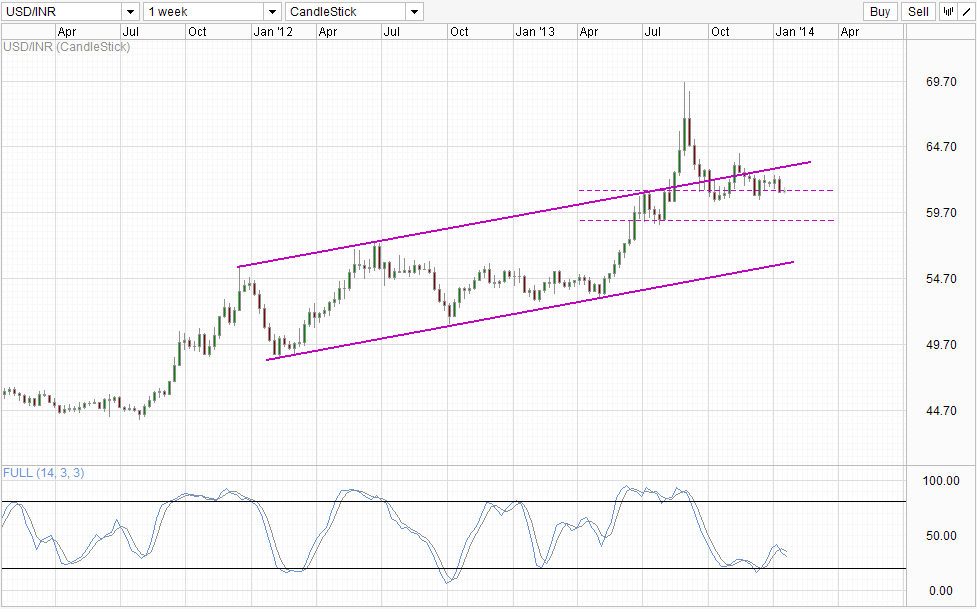

Weekly Chart

Weekly Chart suggest that bullish momentum may go even further than simply short-term channel top as prices are currently above the 61.3 level, suggesting that the breach into the 59.0 – 61.3 consolidation channel has failed – opening a potential move towards Channel Top on the Weekly Chart. However, direction of Stochastic curve remain lower, and further confirmation of the 61.3 rebound is needed considering that price is just around the 61.3 mark. Also, even in the event price trade higher from here out, bulls will still need to overcome the soft resistance around 62.5. Hence, do not be surprised if prices actually revert back lower, or perhaps continue to stay sideways as observed in the Short-Term chart as long as global risk sentiment remains the same.

More Links:

EUR/USD – Eases Away from Resistance Level at 1.37

GBP/USD – Drops Back to Support Level of 1.6350

AUD/USD – Returns to Familiar Territory Below Resistance Level of 0.90

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.