Gold prices tumbled yesterday, but the decline does not seem to be in line with what most news have reported. If you go to any major financial news provider today, you would see articles that talk about how the stronger than expected US Advance Retail Sales may have increased the probability of the 2nd QE taper in the upcoming FOMC meeting in 2 weeks time. This drove Gold prices lower as the need for inflation protection becomes lower.

This assertion seems to make sense prima facie, but price action does not agree with it. Firstly, the timing is – Advance Retail Sales was released at 8.30am EST (9.30pm SGT), but the sharp decline in Gold happened just before New York Noon. Furthermore, prices of Gold actually traded higher when the numbers were released, pushing steadily up until the sell-off happened. In order for the assertion to fly, prices should have at least traded marginally lower during early US session, instead of higher. Hence, it is clear that Gold prices isn’t really influenced by QE tapering, something that has been established previously.

Unfortunately, the alternative argument used on Monday’s price action – e.g. risk off appetite sending Gold prices higher – doesn’t work either. US stocks actually rallied during early market hours, which would have drove Gold prices lower if the alternative reasoning is correct. That being said, if we ignore the inexplicable early US session rally, risk appetite remains a good explanation for price action yesterday and today. Looking at S&P 500 futures, the decline of Gold from 1,255 high yesterday coincide with the rebounding of the low in S&P 500 after the surprise sell-off in S&P 500 which was not prompted by any news releases. Similarly, the continuation of bearish sell-off right now coincide with the overall bullish “risk-on” sentiment that has permeated the Asian session which has spilled over to European bourses as well.

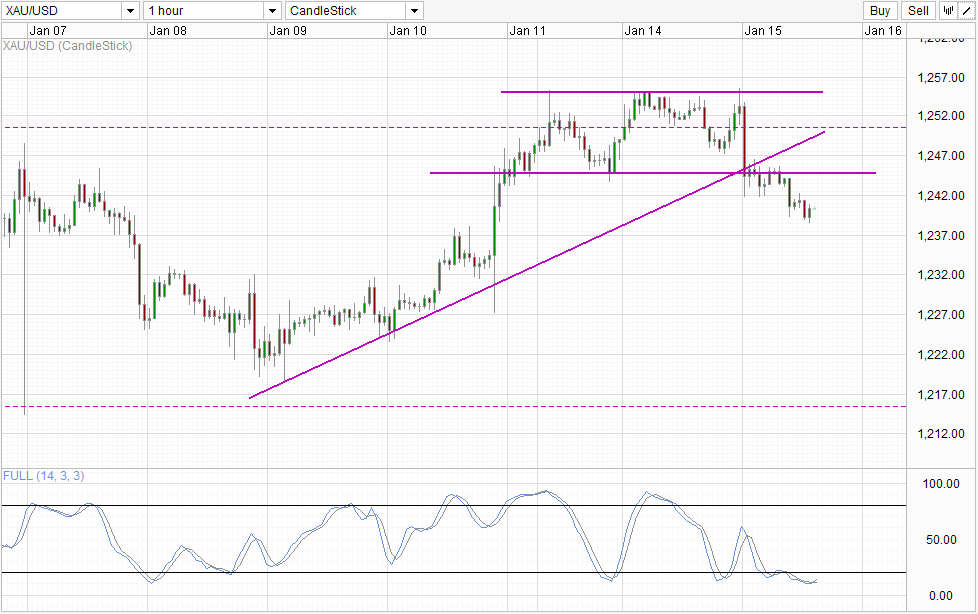

Hourly Chart

Certainly this may leave a bad taste to some purist that demands to know the reason for every ebb and flow of price movement. In this regard, the only plausible explanation for the rally would be financial institutions buying up Gold during the time period. Why are they doing this? The reason isn’t entirely clear right now but we’ve definitely spotted large institutions buying up Gold without specific reasons in the past. The only issue is that we do not have any evidence that this is indeed happening – not now at least. Luckily for us, COT numbers will be able to reflect this as the data is taken every Tuesday. If we see Friday’s COT numbers reflecting increasing speculative long positions, the hypothesis will stand.

From a technical perspective, it is no surprise that the sharpest of current bearish momentum came after 1,255 resistance was tested and held, while current leg of bearish momentum similarly came after 1,245 soft support turned resistance held. Right now, prices appears to be pulling back slightly with Stochastic readings pointing slightly higher within the Oversold region. Hence, a test of 1,242 soft support turned resistance is possible, and price may still push up to 1,245 in the near term should “risk on” abates. Similarly, if 1,242 holds, price may continue its decline to 1,237 and subsequently 1,232 soft support.

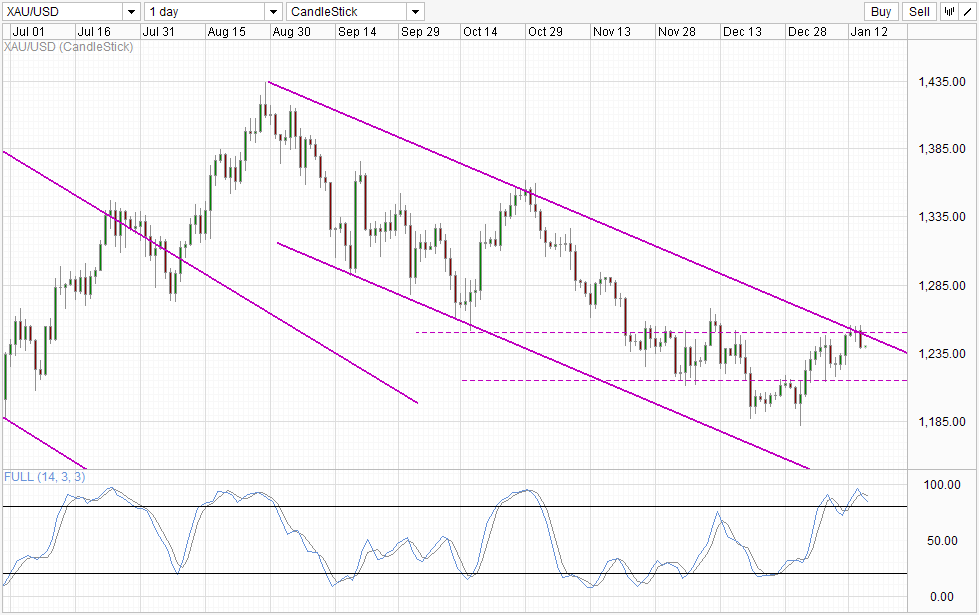

Daily Chart

Daily Chart is much more bearish, as prices have successfully rebounded off Channel Top and has traded back into the 1,215 – 1,250 consolidation range. Stochastic readings agree with this bearish outlook with Stoch curve forming a top. If price manages to breach 1,215 in conjunction with Stoch curve pushing below the “support” of 75.0, bearish acceleration may take place which can bring us to Channel Bottom quickly with 1,185 – 1,215 providing interim support.

More Links:

GBP/USD – Drops Below Key Level of 1.6450

AUD/USD – Returns to Below Resistance Level of 0.90

EUR/USD – Remains Steady Under Resistance Level at 1.37

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.