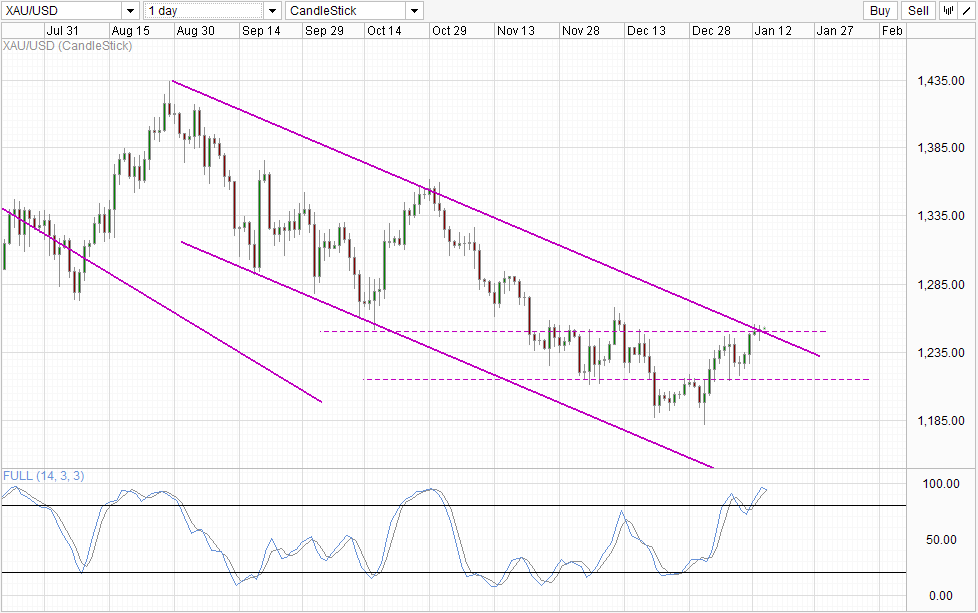

Gold extends gains for a third consecutive session driven by the risk-off sentiment during US session. Prices cleared the 1,250 round figure resistance and hit a high of 1,255.13, breaking the descending Channel Top seen on Daily Chart in the process. Since then, there has been significant pullback during Asian session today but 1,250 held – a good sign that bullish momentum remains intact.

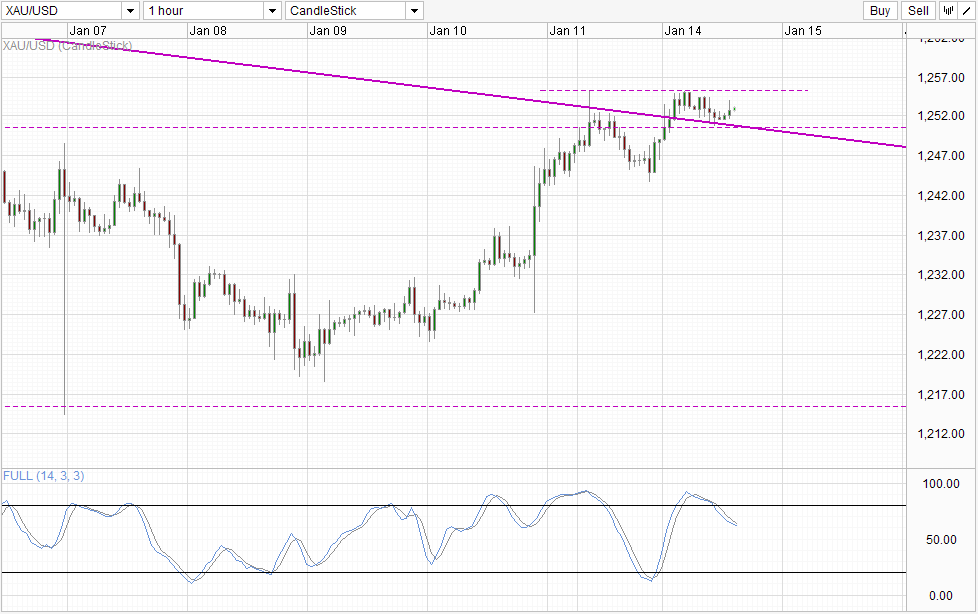

Hourly Chart

However, not all technical studies point to strong bullish momentum. Firstly, current rally has failed to overtake the highs of early Asian trade yesterday. Also, Stochastic readings are currently in the midst of a bearish cycle, favoring a more comprehensive test of 1,250 and the descending Channel Top. Nonetheless, it should be noted that it is possible for Stoch curve to reverse from here given that a Stoch trough was seen last Friday in conjunction with the NFP rally. Hence traders should not be surprised if Stoch curve does make a U-turn here, but prices should have broken 1,255.25 should that happens in order to indicate a strong bullish extension scenario.

Daily Chart

On the Daily Chart, we could see strong bullish acceleration higher in the near future should the Channel Breakout is confirmed. Stochastic indicator on the Daily Chart favors bearish scenarios though with Stoch curve already crossing Signal line. However, readings have yet to cross below the 80.0 level, and as such a proper bearish cycle signal is not ready. This does not mean that bulls are safe though – prices still have to face numerous resistances above such as 1,270, 1,290 and 1,300 round figure. Given that Stochastic readings is already Overbought, and long term fundamentals remaining bearish for Gold, it seems reasonable to believe that Gold will likely falter at any of the previous mentioned resistance – if the Channel Breakout is confirmed that is.

As a side note, yesterday’s price action should put to rest about the supposed “taper relief” that entered into the market following the dismal NFP print. It seems that the post NFP rally is simply a reflection of risk off sentiment driving safe haven assets higher. This would also mean that the FOMC meeting at the end of Jan may not help to push Gold prices strongly either way, and traders hoping to see Gold rally further should Yellen choose not to taper may find themselves disappointed.

Then again, should risk off sentiment continue to grip the market, we could see gold prices continue to climb up higher on safe haven flows. But this is unlikely to last long unless there is a catastrophic decline in US stock prices – a scenario that is difficult to fathom given that FOMC members appear to be rather confident that the economic recovery narrative remains on track. This once again agrees with the original technical outlook where heading towards 1,270, 1,290 and even 1,300 is possible, but pushing higher beyond becomes much less possible.

More Links:

NZD/USD Technicals – Seeking 0.84 Consolidation Top

AUD/USD – Moves to One Month High above 0.9080

EUR/USD – Resistance Level at 1.38 still Looms Large

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.