AUD/USD continue to climb higher on Monday morning, extending the gains following the weaker than expected NFP print last Friday which sunk USD. However, it should be noted that this bullish momentum is no knee-jerk reaction, with prices continue to climb up higher despite Australia main stock index ASX trading lower, and a sharp drop in Investment Lending which grew at a paltry 1.5% vs previous month’s 6.8%. Job advertisements have also shrank by 0.7% M/M once again, highlighting the weakness of Australia’s economy.

The only bullish economic number was the slightly better than expected Home Loans which came in at 1.1% versus the expected 1.0%, but that only matched previous month’s growth rate. Nonetheless, it is possible that speculators believed that this would dampen Central Bank RBA’s enthusiasm to cut rates in the near future. Another alternative explanation could be that market is overreacting to bullish news but discounts bearish news because of current inherent bullish sentiment.

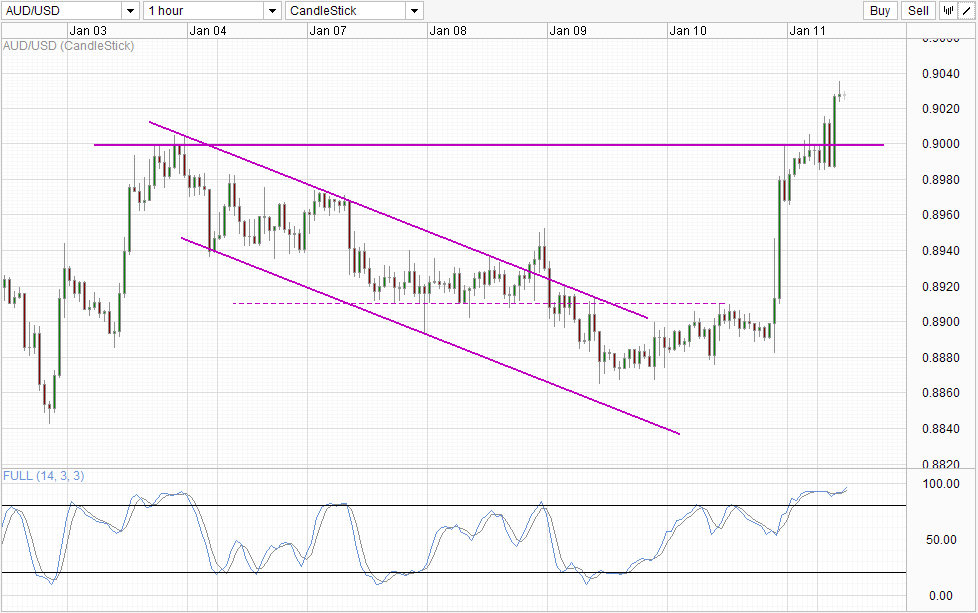

Hourly Chart

Technicals also support a strong bullish momentum, where prices have managed to clear the 0.90 resistance and the swing high of 3rd Jan. Even though Stochastic is deeply Overbought, both Stoch and Signal curves are pointing higher with the difference widening – suggesting that bullish momentum is building up once again.

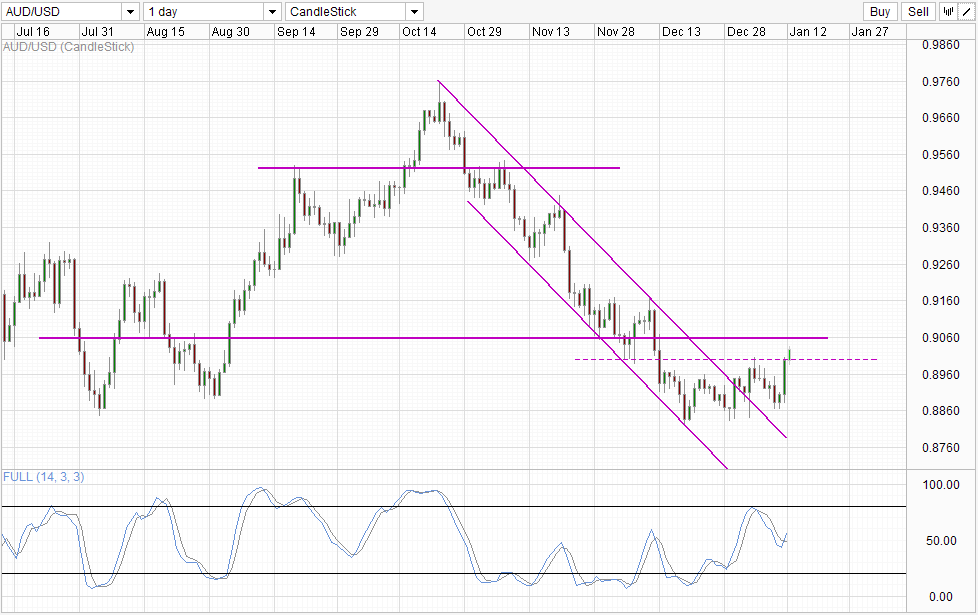

Daily Chart

0.906 is the immediate target for the short-term bullish breakout of 0.90, but long-term wise we could potentially see a correction back towards 0.916 – 0.920 if 0.906 is broken. Stochastic indicator is bottoming out here right now, and it is likely that Stoch curve will be within Overbought region when price is between 0.916 – 0.920. That being said, the divergence between recent price peaks versus stoch peaks suggest that bearish pressure is still very much in force, and the likelihood of a 0.906 break is slim.

More Links:

Week in FX Europe – BoE And ECB Hold Rates As NFP Disappoints

Week in FX Americas – December NFP Below Expectations But Unemployment Rate at 2008 Low

Week in FX Asia – China Displaces US From Top Trading Nation Spot

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.