Australia Dollar continues its descend against Greenback, with prices unable to mount any significant bullish response despite stronger than expected Retail Sales, highlighting the strong bearish undertone of the battered currency pair which is pulled down by a strengthening USD due to QE tapers and weakening AUD on lower interest rate outlook. To be fair, technicals played an important part as well, as prices actually did rally for a bit when the economic numbers were released, only to be rejected by the combine resistance of 0.891 and descending Channel Top.

Also, other fundamental news such as a shrinking Building Approvals and weaker than expected Chinese CPI and PPI were not favourable for AUD/USD. Then again, Australian stocks managed to remain bullish, closing higher by 0.16% even though the rest of the Asian stocks were sliding heavily lower following the cue from US. Hence, it can be argued that these bearish news aren’t that bad, and the decline seen right now is more of an indication of inherent bearishness in AUD/USD right now.

Hourly Chart

With this in mind, likelihood of prices hitting Channel Bottom is high. However, do not expect price to keep going lower indefinitely given that Stochastic readings are already within Oversold region. Furthermore, given the strong technical influence, a rebound towards Channel Top cannot be ruled out even under current bearish backdrop. Looking at how price reacted after tagging Channel Bottom, we can see that bullish reaction isn’t the greatest. Hence should prices do rebound after tagging Channel Bottom, we could see price moving up towards 0.888 – 0.89 resistance band (using 3rd Jan swing low as reference) and trade sideways within the 20 pip range until Channel Top is touched (similar to how price was staying between 0.891 – 0.893 yesterday).

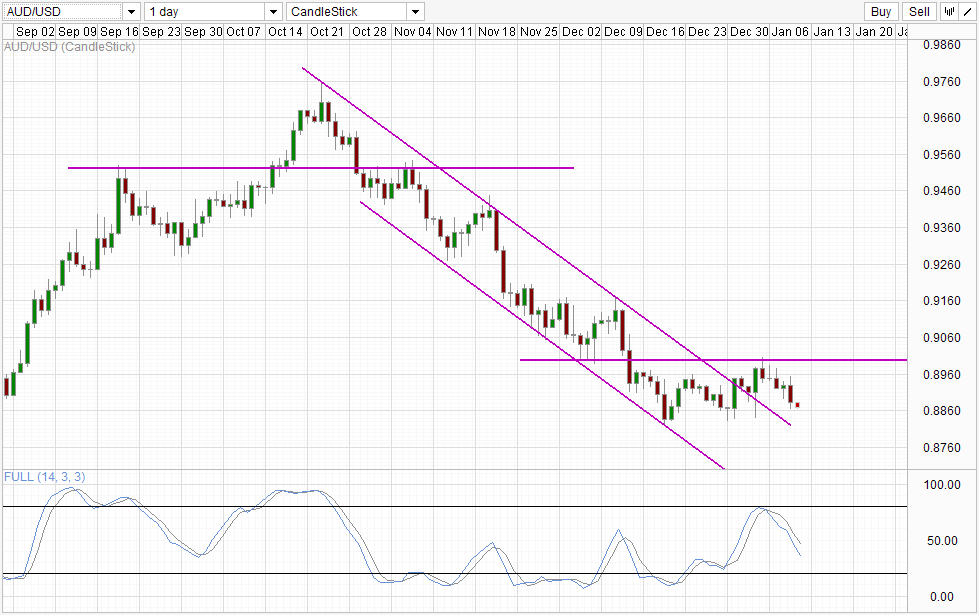

Daily Chart

Bearish momentum on the daily chart is ongoing, with price heading towards the 2013 low of 0.892 which may be the confluence with Channel Top if bearish momentum suddenly accelerate from here (unlikely from S/T analysis). Looking at Stochastic levels, it is likely that Stochastic readings will be in the Oversold region when that happens, favoring a rebound off Channel Top with 0.892 becoming the support turned resistance.

More Links:

EUR/USD Technicals – Heading Lower With 1.358 Broken

USD/CAD – Loonie Slumps As Pair Tests 1.08

GBP/USD – Pound Gains Ground After Strong US Employment Data

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.