US stocks traded lower yesterday following stronger than expected employment numbers compiled by private firm ADP, increasing the fears that the Fed will accelerate the pace of tapering for their current QE program. This fear was confirmed when minutes of the FOMC meeting where the 1st taper took place was released, with the minutes reflecting hawkish sentiments from voting members who believe that inflation is a credible threat. On top of that, policy makers “had become more confident” that cutting QE will not hinder US economic recovery, suggesting that more cuts may be happening soon, maybe as early as end Jan when the first scheduled meeting chaired by Yellen will take place.

Or so you’ve been told by numerous financial newspaper today.

Don’t get me wrong, the likelihood of further tapering has indeed grown higher after the release of this minutes. However, the hawkishness of this minutes shouldn’t really come as a surprise, and anybody hoping for a dovish sentiment from the minutes will be deluding themselves considering that this is the meeting where they started tapering. Of course voting members will be comfortable and confident that cutting QE will not impact recovery efforts, if they thought otherwise they wouldn’t have voted to cut to begin with. Further tapering has always been on the books, the only question is when. Unfortunately, the minutes did not reflect any sign of a timeline in play, and it suggest that Yellen and the 2014 voting group will be able to make their own decision when to do it, and there isn’t evidence that this new gang will do it as soon in Jan. There is nothing new and out of the norm from the minutes, and to say that market reacted bearishly due to higher tapering chances is lazy to say the least.

What about the fact that stock prices decreased? How do you explain that?

If you look carefully at stock prices, you would notice that S&P 500 only shed 0.39 points or 0.02%, that is hardly a “decline”. Dow Jones Industrial Average did fare worse at -0.41%, but Nasdaq 100 actually gained 0.27%. Considering that Nasdaq 100 has a higher historical beta (correlation to risk appetite), it would be strange to see the much more risk sensitive Nasdaq 100 gaining on a day where the rest of the market is supposedly pessimistic.

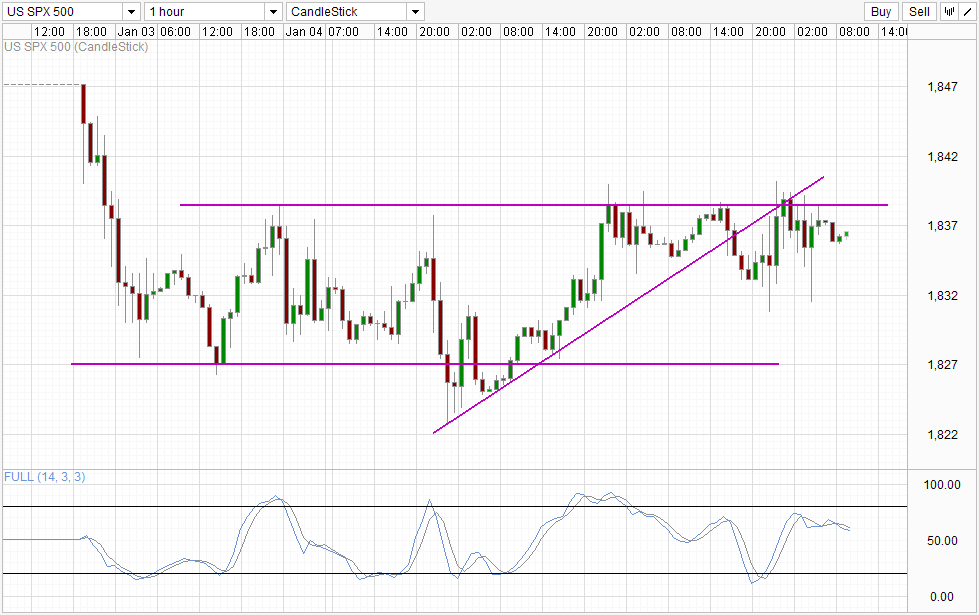

Hourly Chart

Price action on S&P 500 does not reflect a picture of fear and concern. Prices remain stable, and for all the supposed bearishness due to a stronger than expected ADP employment number, S&P 500 actually ended up higher in the same hour when the economic news was released. It is likely that 1,833 provided some soft support as well, with prices actually started to push higher an hour before the scheduled release, but that also affirms that bearish sentiment arising from the taper fears (if any) isn’t strong if it can be rebuffed by a soft support level.

With technical influences seemingly more important right now, it is possible that we will see a retest of 1,833 once more with price rebounding off 1,838 ceiling once more. Stochastic readings agree as both Stoch and Signal lines are pointing lower after peaking just when price has been rejected by the aforementioned ceiling.

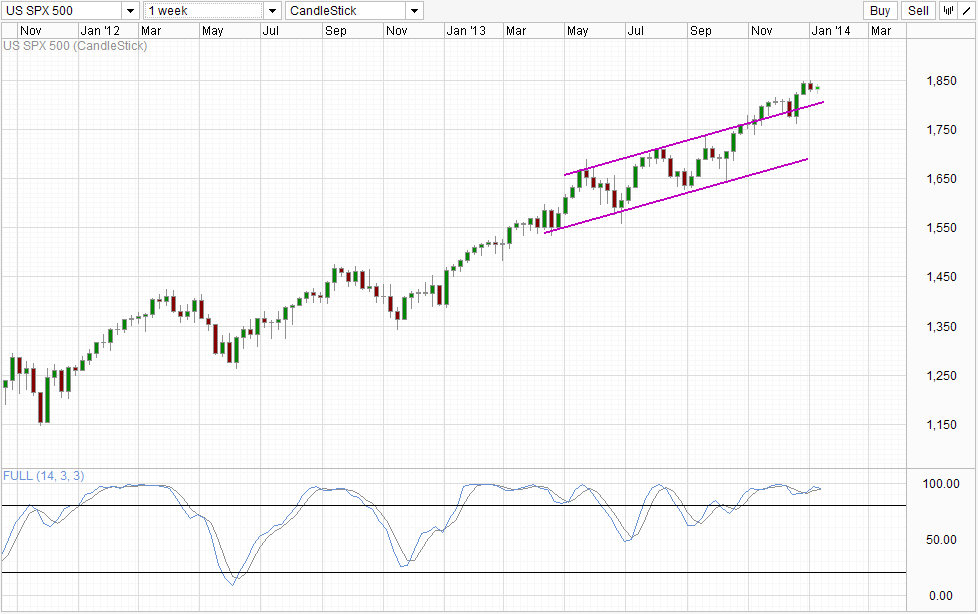

Weekly Chart

Perhaps an even stronger argument against “risk off” appetite right now can be seen from Weekly Chart. It has been mentioned before that S&P 500 is crying out for a bearish reversal after not having one for the entirety of 2013. As such, bears should not need too much encouragement in order to produce a test of Channel Bottom. The failure to do so is yet another strike against so called tapering fears, and suggest that yesterday’s reaction may simply be volatility at play. Also, this implies that broad sentiment for S&P 500 may actually still be bullish, and traders should keep that in mind as we approach NFP tomorrow.

More Links:

GBP/USD – Pound Gains Ground After Strong US Employment Data

USD/CAD – Loonie Slumps As Pair Tests 1.08

AUD/USD – Little Movement As ADP Non-Farm Payrolls Shines

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.