Stable is how one would describe AUD/USD right now. Despite more bad news for AUD/USD in the form of AIG Construction Index which came in at 50.8 – a far cry from previous month’s 55.2 – AUD/USD has been holding up quite nicely with prices staying within a tight 30 pips range of 0.891 – 0.894. This consolidation range was formed following the strong slide yesterday during Asian hours leading towards European session.

To be honest, this consolidation isn’t surprising as the decline wasn’t inspired by anything fundamental and basically came out of nowhere. As such, there is very little reason to believe that prices would be able to enjoy strong bearish follow-through following the break of 0.894 support. In the same vein, it is no wonder why the AIG Construction Index failed to get any bearish traction.

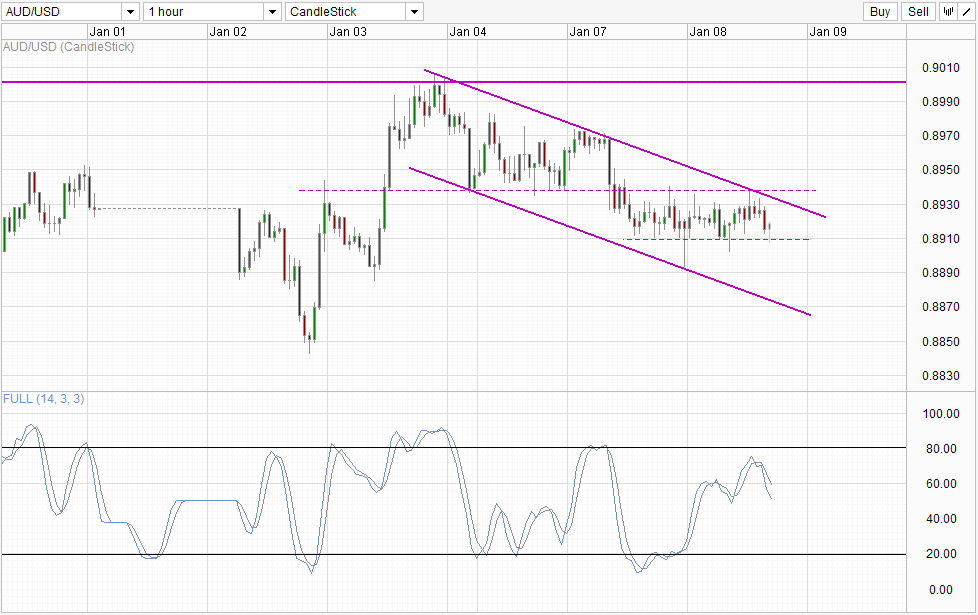

Hourly Chart

Based on the observations listed above, it is difficult to label AUD/USD as inherently bearish. Instead, technical influences appear to reign right now. Even though price was mostly trapped within the 30 pip range, price action did manage to tag both Channel Bottom and Channel Top, suggesting that the Descending Channel is alive and well, suggesting that a push towards Channel Bottom may be possible in the near future. Stochastic readings agree with a top recently formed. Should Stoch curve push below recent swing low of 50.0 in conjunction with prices breaking 0.891, the likelihood becomes even higher.

However, in the event that 0.891 holds even with Stochastic breaking 50.0, the likelihood of a rebound towards 0.894 or at least Channel Bottom becomes higher. Given that volatility may be high with Fed releasing the FOMC meeting minutes later today, both bearish and bullish scenario cannot be discounted, and traders will do well to observe the aftermath to determine if current technical bearish bias remains valid post announcement.

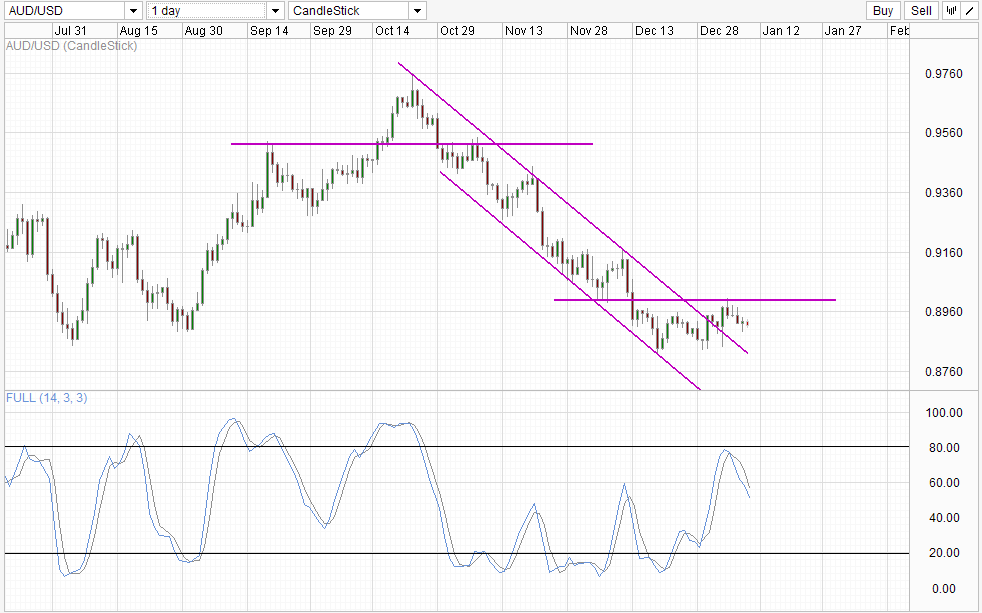

Daily Chart

Long-term trend for AUD/USD remains bearish though, with price currently within a bearish cycle as indicated by Stochastic following the rejection of 0.90 resistance. Looking at the clear divergence between consecutive higher Stoch peaks and falling prices, current bearish cycle has a higher likelihood of a strong follow-through which may allow bears to break into the descending Channel once again. Today’s Fed’s minutes may provide the necessary catalyst if the minutes include some form of timeline for future QE tapers. However that is going to be unlikely (just a hair away from wishy thinking) as that was Bernanke’s last chairing meeting, and most likely would have left the exact timing of tapering to his successor Yellen in future meetings.

Hence, do not be surprised if AUD/USD actually continue to trade sideways after the event, which does not invalidate long-term bearish bias but certainly would delay any strong bearish extension for a while.

More Links:

Gold Technicals – Bearish Bias In Play But S/T Bullish Correction Still Possible

EUR/USD Technicals – No Immediate Bearish Threat Below 1.363

S&P 500 – Clocking 1st Gain In 2014

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.