Gold prices have stabilized after the flash sell-off during US session where a singular trade of 4,200 contracts was made, sending gold tumbling lower by $30 per ounce which triggered a 10 second trading halt. Prices recovered quickly within the same minute, but the bearish damage has been done with market getting jittery and pushing lower in the next half a dozen hours that followed.

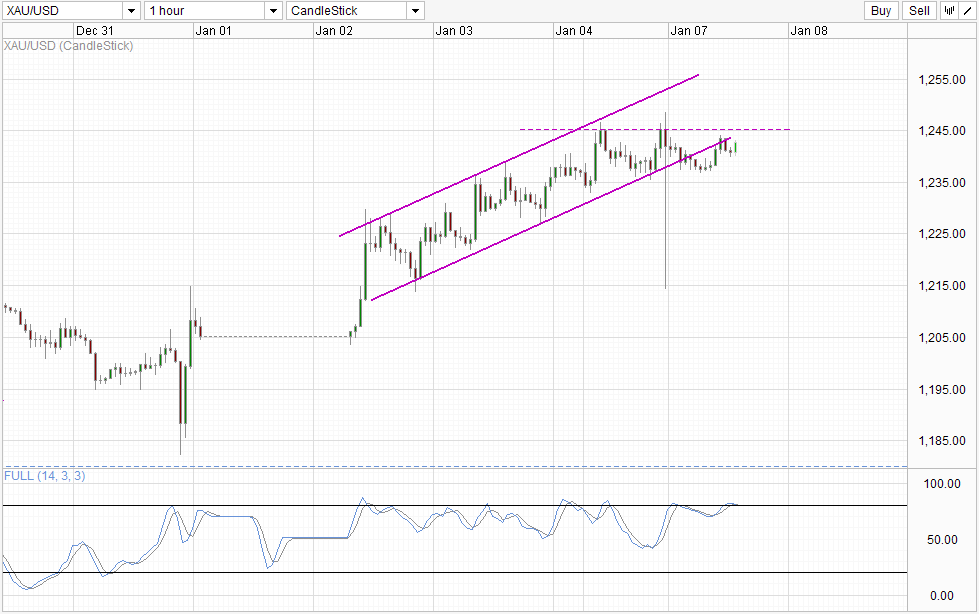

Hourly Chart

This subsequent decline broke the rising Channel that has been in play since the start of 2014 and suggest that bullish momentum may be reversing. Prices did recover for a 2nd time but this bullish push has been rebuffed by Channel Bottom, affirming the bearish bias. Currently we are on our way to test the Channel Bottom once again but the likelihood of it succeeding is low especially since bulls will be squaring off with the 1,245 resistance level on top of Channel Bottom this time round. Stochastic indicator also favor a bearish push Stoch curve appearing “toppish” and seems likely to push below the 80.0 level and trigger a bearish cycle signal. 1,235 is the first obvious S/T bearish target but prices can realistically go all the way to the opening levels of 2014 should if the bullish pressure is indeed invalidated.

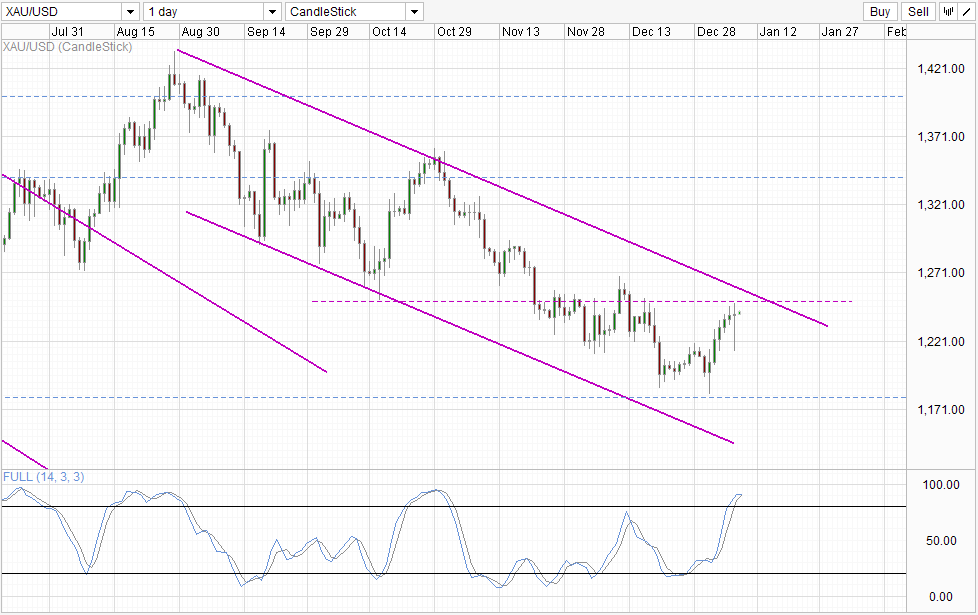

Daily Chart

Long-term chart continue to reflect bearishness, with the 1,245 rejection even more significant on the Daily Chart. Nonetheless, despite this bearishness we could still see prices potentially pushing up slightly higher just to test Channel Top before moving lower. Alternatively, price could still remain around current levels before finally tagging Channel Top next week before pushing lower once again. Stochastic readings similarly appear “toppish” just like those one the Hourly Chart, but we are still a distance before a bearish cycle signal is formed. Hence, do not assume that prices will automatically move lower from here as bullish scenario in the short-term is certainly possible.

More Links:

AUD/USD Technicals – Bears Ignoring Improved Trade Balance, Higher Stock Prices

EUR/USD Technicals – Bears Maintain Pressure Despite Bullish Pullback Yesterday

GBP/USD – Pound Active as UK, US Services PMIs Dip

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.