AUD remained bearish despite better than expected Trade Balance released today. November Trade Balance pushed to a 5 month low, coming in at -0.12B AUD versus -0.30B AUD expected. This should have been a bullish catalyst for AUD as this is an indication that less money is flowing out of the country. However, AUD /USD failed to stay above 0.894 support and we’re now trading below the consolidation floor with prices attempting to test the 0.894 support turned resistance.

To be fair it should be noted that bearish sentiment in AUD/USD was already high. Fellow Risk Currencies GBP/USD and EUR/USD actually rallied during US session yesterday, and even though AUD/USD did push up, the magnitude is smaller than the other 2. Prices also started pushing lower sharply just before the Trade Balance numbers were released, most likely due to the bearish rejection of 0.897 resistance. However, it should be noted that risk appetite in Australia is actually bullish with the main stock index ASX 200 gaining more than 0.25% right now. Hence, it is clear that the bearish sentiment is strong, and one suspect that AUD/USD may be even lower if not for the bullish push from Trade Balance numbers.

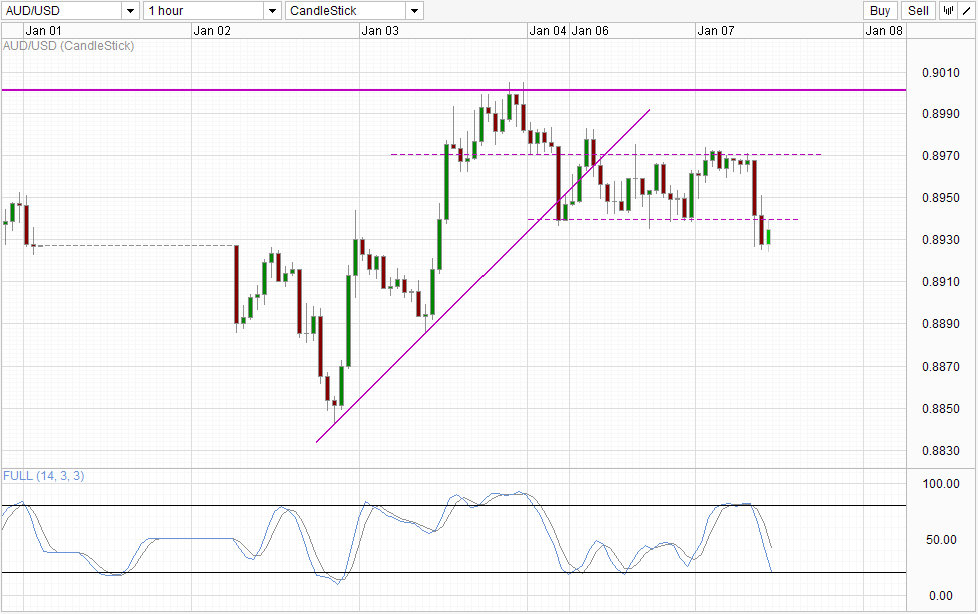

Hourly Chart

Given this strong bearish backdrop, it is unlikely that price may be able to climb back above 0.894, and a push towards recent swing low of 0.885 is possible. However, given that Stochastic readings are close to Oversold region, bears may find significant support from 0.89 round figure and soft support seen during the 1st 2 days of trading in 2014.

Should 0.894 is indeed breached, the bearish outlook will need to be revised as it suggest that the bearish rejection from 0.897 may be a little bit too aggressive and we may see bullish acceleration may occur towards 0.897.

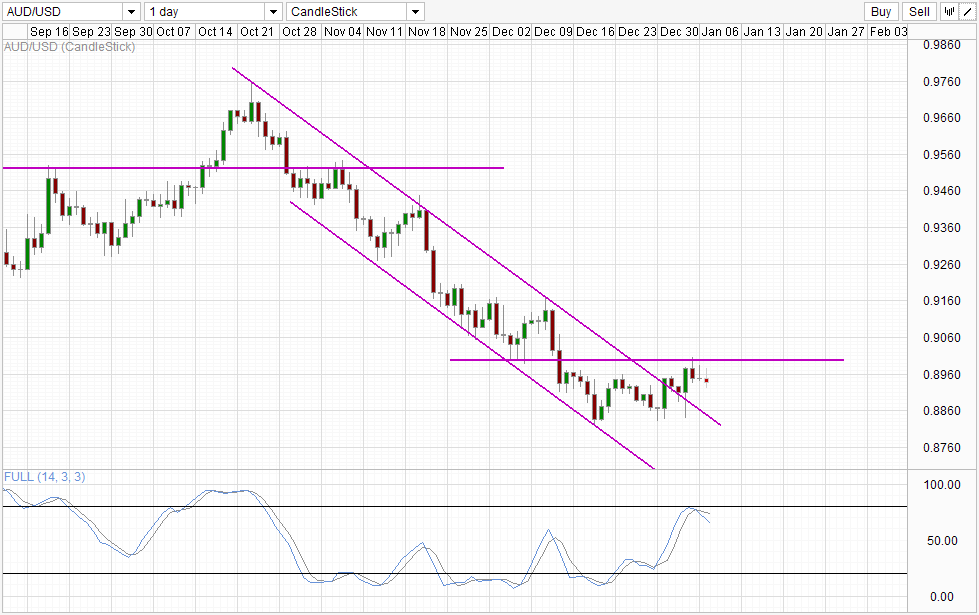

Daily Chart

Bearish outlook on Daily Chart remains in play with 0.882 and Channel Top as bearish targets. With that in mind, even if prices does push up higher in the short-run, do not expect 0.897 to be broken and a retest of 0.894 remains likely should the S/T bullish scenario occurs.

More Links:

GBP/USD – Pound Active as UK, US Services PMIs Dip

USD/CAD – Higher As Markets Await US PMI Release

USD/JPY – Yen Continues to Pressure Greenback

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.