SGD took a hit this morning following a weaker than expected GDP announcement. Q4 GDP fell 2.7% (annualized) Q/Q, the first decline in 5 quarters and more than twice that of analysts consensus estimate of -1.3%. Nonetheless, 2013 remains a positive year for the South-East Asian state, with full year GDP growth at 3.7% vs 1.3% in the previous year, and higher than the Government 2.5-3.5% forecast which was already revised higher back in August. Prime Minister Lee has also reiterated a forecast of 2-4% in 2014, citing that “Asian prospects are still positive” with European and American economies stabilizing. Together with Central Bank MAS keeping SGD on a mild appreciative path, long-term trend for SGD should remain bullish.

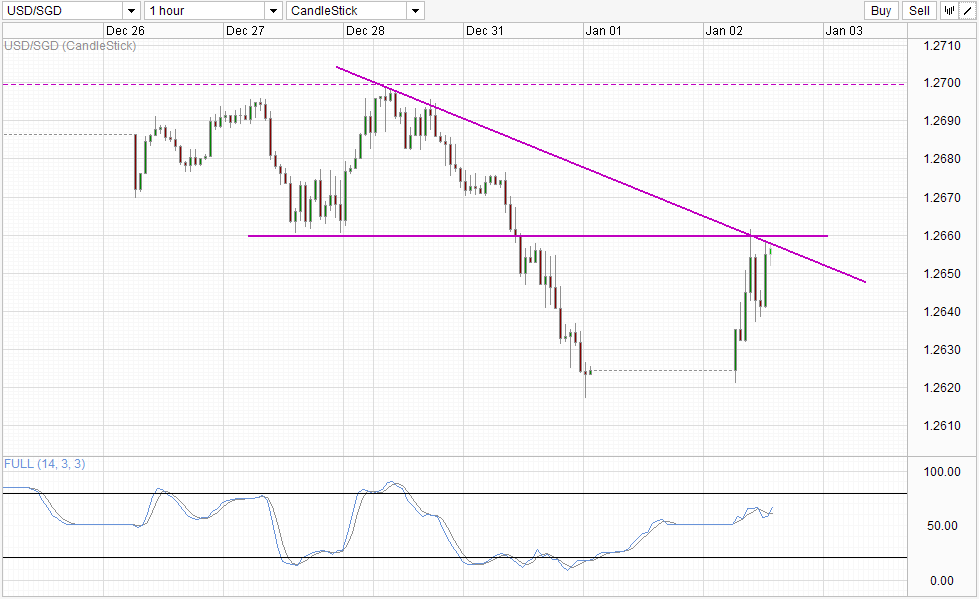

Hourly Chart

Hence it is interesting to see USD/SGD maintaining this morning’s elevated levels. Prices did pushed lower after the initial reactionary rally post GDP release, but bullish trend recovered quickly, allowing price to test the descending trendline once again. To be fair, prices were already rallying before the GDP figures were released, and that is attributable to the strengthening of USD which pushed EUR/USD and AUD/USD lower as well. But this strengthening of USD was not inspired by anything significant, and may well be a pure volatility move. Going by this reasoning, when price rebounded off the 1.266 resistance and confluence with descending trendline after the GDP print, we should have seen stronger and longer sustaining bearish reversal especially since overall bias has been on the bearish side since the decline from 28th Dec.

The fact that bearish response is found lacking shows that bullish pressure is strong, which increases the chance of price breaking descending trendline and possibly even 1.266 in current attempt. Stochastic readings agrees as well, with a bullish Stoch/Signal cross after threatening to top earlier.

That being said, traders should keep in mind that fundamental strength will continue to pull USD/SGD lower, hence the likelihood of USD/SGD reverting lower without testing 1.27 remains high, a notion agreed by Stochastic which is close to the Overbought region.

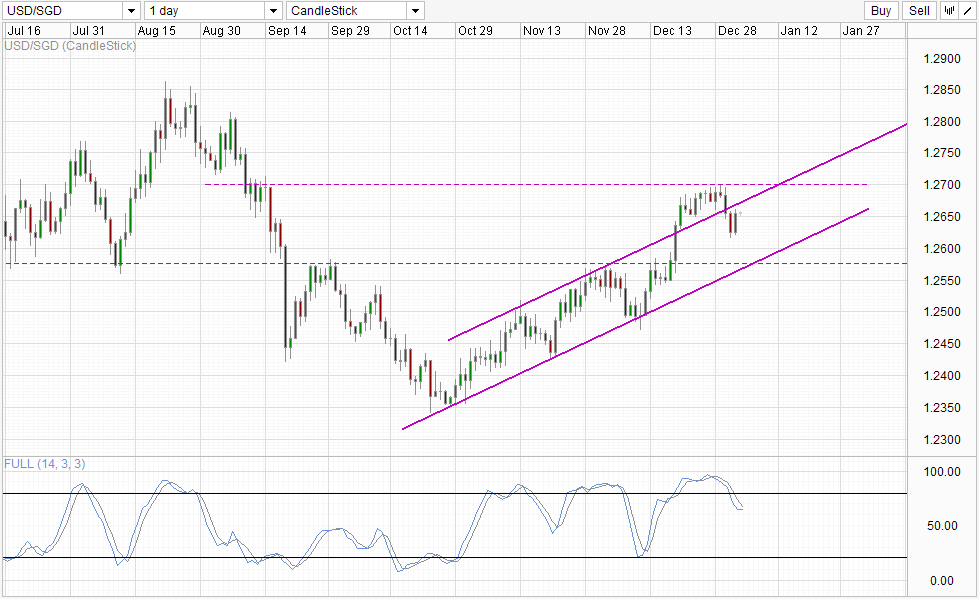

Daily Chart

Price action on the Daily Chart is coherent with Short-Term analysis. Price have broken into the rising Channel which should open up Channel Bottom as a viable bearish target, but currently there may be another retest attempt of Channel Top, in line with the Short-Term bullish outlook.

Moving forward, with USD expected to continue its strengthening run with more QE tapers in the horizon, USD/SGD will be pulled in 2 opposite directions. Realistically and historically, USD factors tend to trump SGD fundamental factors as SGD circulation can never fathom to match that of the Greenback. As such, long-term outlook for USD/SGD will remain bullish, and current Channel should remain intact even if prices test Channel Bottom in the near future.

More Links:

USD/CAD – 2013 In Review

AUD/USD – 2013 In Review

GBP/USD Technicals – Biggest Gainer In H2 2013 Leading 2014 Charge

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.