US stocks kicked off 2014 in the red despite stronger than expected US economic numbers. Initial Jobless Claims fell to 339K vs an expected 344K, while Continuing Claims where also much lower at 2,833K vs 2,890K. On production front, Markit US PMI for December (Final) was revised higher to 55.0 vs initial estimates of 54.7, while ISM Manufacturing came in at 57.0, once again beating analysts forecasts of 56.8. To round it up further, growth in Construction Spending for the month of Nov was higher at 1.0% vs 0.6% expected and beats previous month’s 0.9% which was already revised higher itself.

Even though most of the data mentioned above are not your major hitters, we did have a rousing victory for bulls as all the data released were more bullish than expected. Even if prices do not rally higher, at the very least we should have seen prices staying stable and not lower. Also, we are not able to use the old excuse of “tapering fears” to justify yesterday’s price action – stock markets actually rallied to record highs after record highs following Fed’s tapering announcement 3 weeks ago. Hence, the only feasible explanation would be that traders are taking profits.

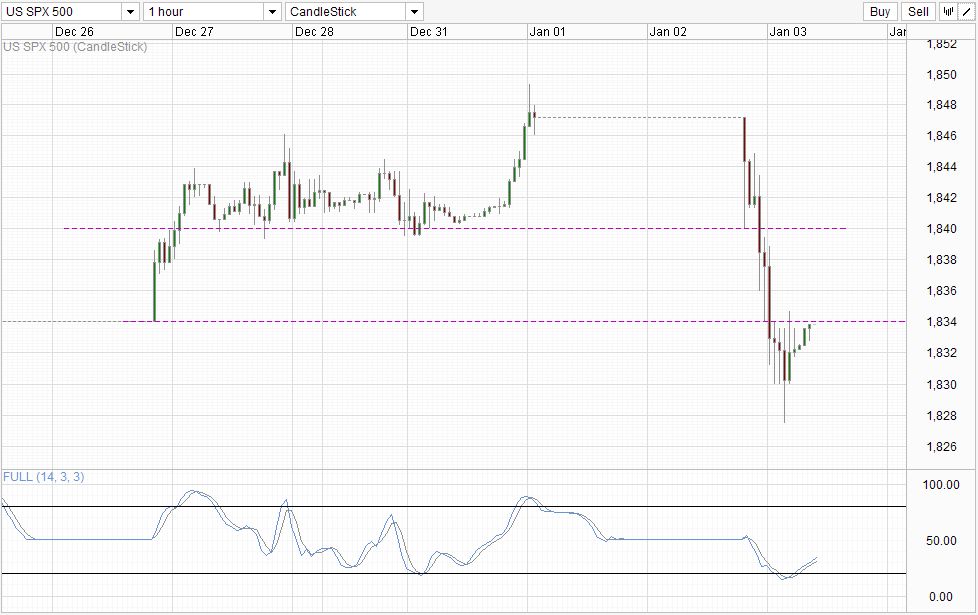

Hourly Chart

Considering that yesterday’s sell-off started on the onset of 2014 trading lend credence to this hypothesis. Furthermore, prices pushed up higher during New Year’s Eve for no good reason as well, which adds further downside risks yesterday, and explains why the sell-off was so aggressive and even manage to break 1,840 soft support during European trading session.

So what comes next?

By understanding yesterday’s decline, we need to ask ourselves this: Has the bearish correction ended? To a certain extent we can classify post Christmas rally as “wrong”, as markets were thin and the rally wasn’t supported by volume – a key indicator for sustainability of any trend movement. This criticism also applies to price action leading to Christmas, but it is harder to pinpoint. But such distinction may not be necessary as prices are currently trading around Christmas Eve levels after finding support from 1,826 – the same soft floor on 23rd and 24th December. Hence, yesterday’s decline appears to have only corrected the “wrong” portion of December’s rally, and this is in no way an indication that overall sentiment has changed nor bullish momentum has reversed.

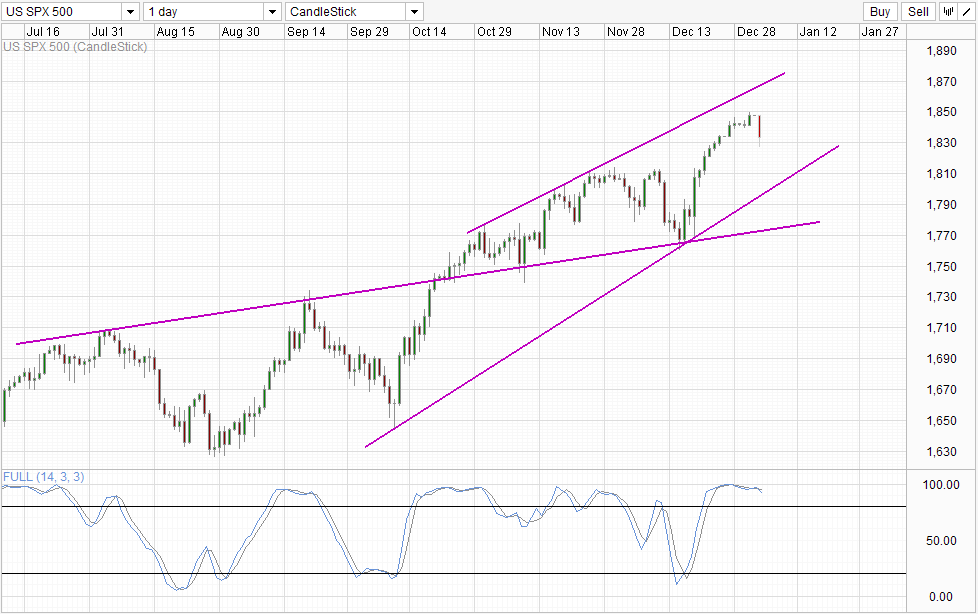

Daily Chart

This is not saying that prices cannot trade further lower though, just that we will need more confirmation for proof of bearish reversal. From the daily chart, we can see that Stochastic curve is pointing lower after staying Overbought for an extended period of time. A bearish cycle signal is not yet in play, but will open up a push towards lower wedge and perhaps confluence with 1,810 resistance turned support. But even in this scenario, overall bullish bias will remain intact, and the tendency for prices to rebound higher towards upper wedge remain high.

Bullish scenarios from here should not be ruled out as well. Prices have yet to tag the upper wedge, and the possibility for further bull run in the next few days remain. Furthermore, considering that we had a rather good Santa Rally, which may encourage traders to go in more aggressively this month in order to capture the January Effect. Bottomline: Do not rule out the bulls yet.

More Links:

USD/JPY – Rangebound to Start New Year

EUR/USD – Euro Loses Ground Despite Solid PMIs

WTI Crude – Bullish API Inventory Numbers Unable To Inspire Stronger Outcome

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.