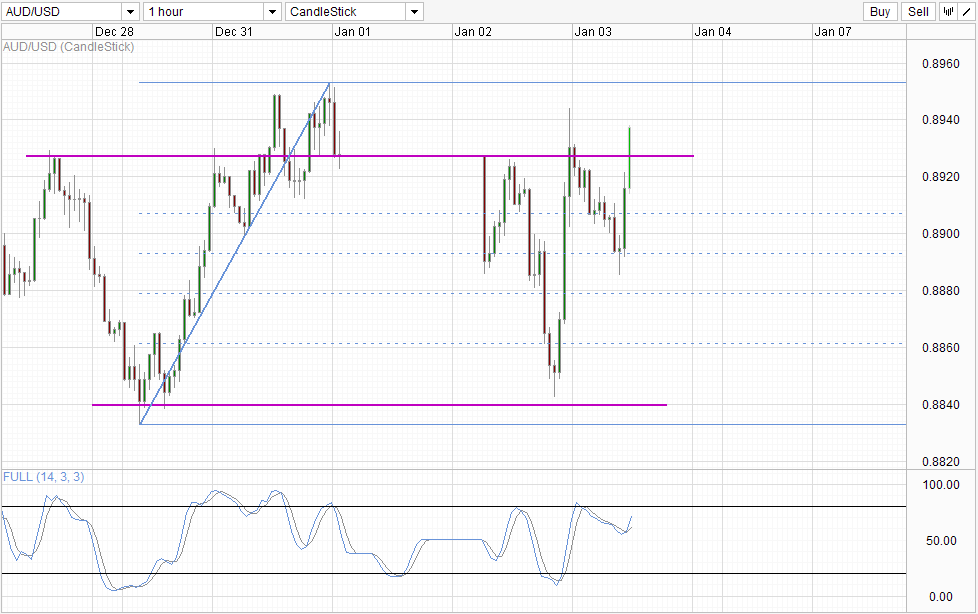

If anybody tells you that normal trading has resumed, simply point to him/her AUD/USD hourly chart. Prices have traded to a low of close to 0.884 yesterday, before pushing all the way up to above 0.894 for a total of 200 pips round trip within 12 hours. It should also be noted that the stupendous rally that happened during early US session was not seen in EUR/USD nor GBP/USD, suggesting that AUD/USD may be moving on its own right now.

Hourly Chart

The above observation suggest that AUD/USD is in a state of flux and strong volatility should continued to be expected. In this regard, current break of 0.8926/27 may not be a strong indication of bullishness but a mere reflection of the high volatility. Certainly a push towards recent swing high of just above 0.895 is possible, but do not expect strong bullish follow-through beyond. In similar fashion, do not assume that bearish sentiment is strong even if price fail to hold its ground above the resistance turned support. Looking at recent historical action, it is likely that price may find support on either the 38.2% or 50.0% Fib retracement and more whipsaw between 0.884 – 0.895 can be expected until normalcy returns.

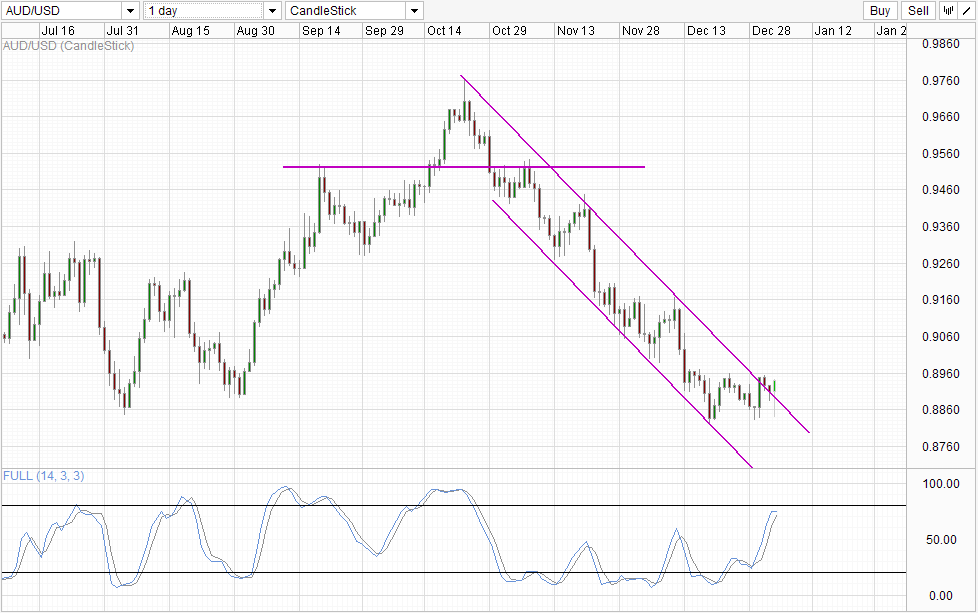

Daily Chart

Daily Chart suggest that a bullish Channel Breakout is in play, but bulls will need to break the aforementioned 0.89 in order to confirm the breakout. Interestingly, current bullish venture isn’t able to tilt stoch curve to point higher, and current bullish momentum which has started post QE Tapering on 18th Dec remains at risk of reversing. Even in the event that price breaks 0.895 resolutely and manage to push Stoch curve higher once more, we are too near the Overbought levels for current bullish momentum to have any sort of significant follow-through. A test of 0.903 is possible but it is also equally likely if not more that prices may falter at the 0.90 round figure.

More Links:

EUR/USD Technicals – Either Direction Possible After Stabilizing

GBP/USD – Steady As UK Manufacturing PMI Dips

S&P 500 – Hangover from New Year as Price Decline On Profit Taking

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.