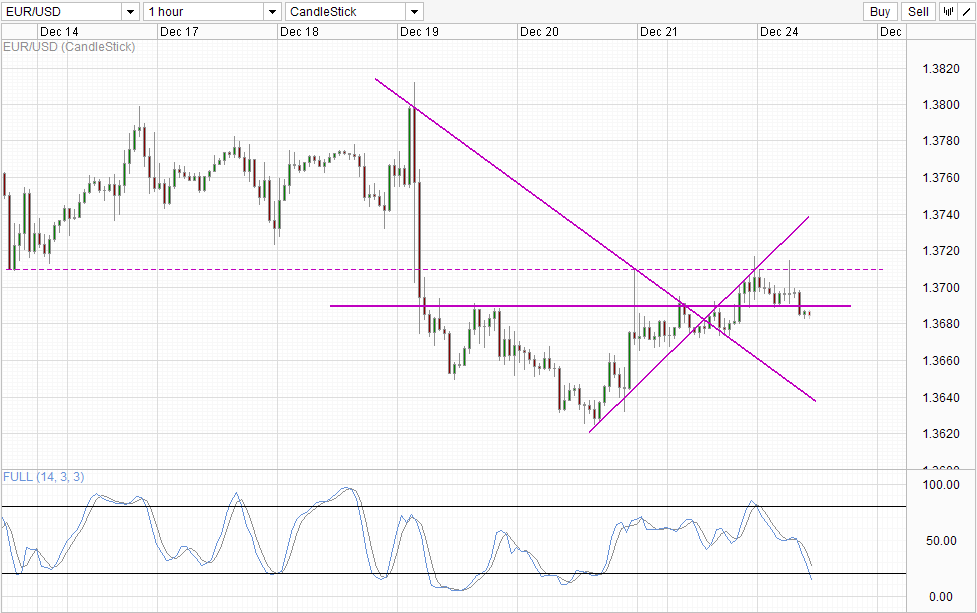

Hourly Chart

Our analysis yesterday which stated that EUR/USD will remain broadly supported turned out right after all, but it should be said that the push above 1.37 was still rather unexpected. Prices have since climbed down back below the 1.369 resistance and back within Monday’s pre bullish breakout consolidation zone, but price should remain buoyant with Stochastic readings suggesting that sell-off is already Oversold. This increases the likelihood of 1.367 support holding and open up possibility of 1.369 retest.

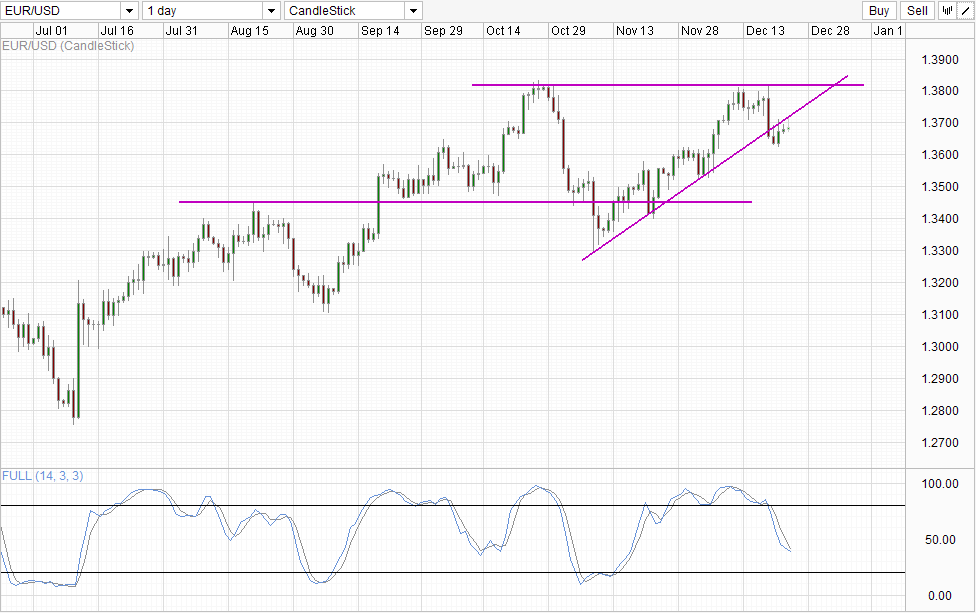

Daily Chart

However, long-term prospect for EUR/USD remains bearish according to Daily Chart. Yesterday’s rally failed to climb above the rising trendline, suggesting that the post FOMC QE Tapering bearish breakout remain in play, and bearish push from here will be favored. Nonetheless, Stochastic readings also allow for the possibility of a short-term rebound, with Stoch curve potentially rebounding off the “support level” of 40.0, which may even spark a full bullish reversal from there should price manage to climb back above the rising trendline.

On the fundamental note, USD is expected strengthen in the long-term while EUR is expected to weaken as highlighted in yesterday’s analysis. That being said, traders should note that we could be seeing hot money flow back into Euro-Zone as traders/speculators who have enjoyed the great gains in US stocks may be over confident and start investing into European stocks, which will drive up EUR in the short-term. But this hot money flow may end up as a double edged sword as the outflow will be equally if not stronger should market start to lose confidence in Eurozone once again.

More Links:

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.