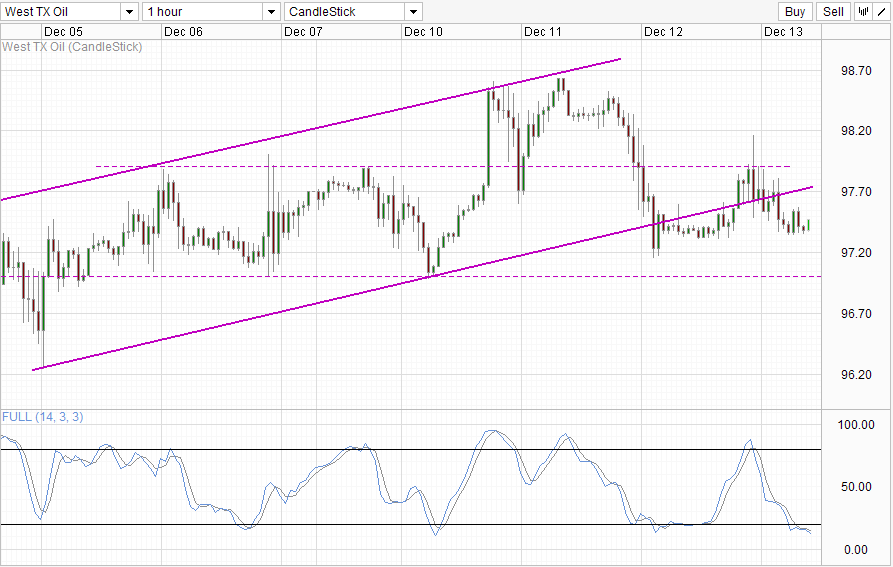

Hourly Chart

After the bearish beating on Wednesday, Crude oil rose on increased US refinery activity. Prices gained close to a dollar per barrel from trough to peak yesterday, but ultimately failed to overcome the soft resistance of 97.90 and came back down to around Wednesday’s closing levels by the time US session closed. This is not unexpected as overall sentiment for WTI and global Crude is bearish as global demand for crude is expected to fall with economic growth rates looking soft.

It should be noted that WTI is still slightly more supported/bullish than the global counterparts. For example, Brent-WTI spread has actually narrowed significantly during the past 2 weeks, coming down from above $19 to as low as $11 right now, showing the relative resilience of WTI which is largely due to bullishness that comes with the Keystone pipeline completion. As mentioned previously, the actual fundamental impact of the Keystone pipeline may have been overplayed as evident by latest Cushing OK Inventory numbers released by DOE. Hence, if we see the euphoria about Keystone die down, we could see pace of decline in WTI increasing further in order to catch up with the decline seen in the rest of the world.

From a technical perspective, price may be bearish but we should be able to find support between 97.0 – 97.3. Stochastic indicator agrees as well, with readings within the Oversold region and favoring a bullish rebound. This doesn’t mean that price will automatically push all the way up to 97.9, but certainly a push towards the Channel Bottom is possible. Based on inherent bearishness of WTI coupled with broad risk-off sentiment (DJI clocked in another triple digit loss yesterday), there is a higher likelihood that prices will not be able to climb up into the Channel, which will confirm the Channel Breakout and lead to stronger bearish sentiment moving forward.

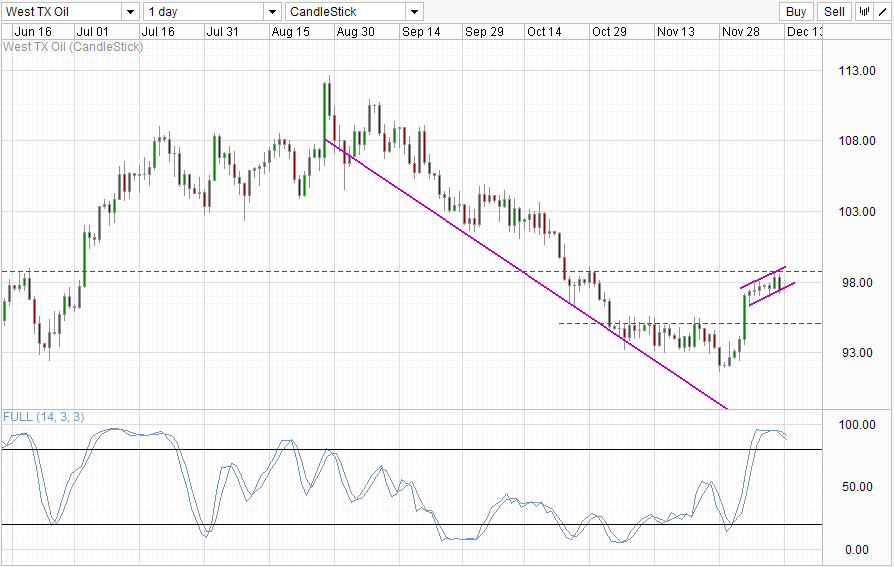

Daily Chart

Nothing much has changed on the daily chart because current price levels close to when we did our last analysis. We are still lacking a proper bearish cycle signal from Stochastic with price staying above the soft support of 97.0. Furthermore, bulls have yet to test 99.0 significantly, hence we could still see one last hurrah from bulls that could keep prices supported before price start to move lower.

More Links:

GBP/USD – Continues to Feel Supply Pressure from Resistance at 1.6450

AUD/USD – Drops Sharply to Three Month Low near 0.89

EUR/USD – Resistance Level at 1.38 Stands Tall

This article is for general information purposes only. It is not investment advice or a solution to buy or sell securities. Opinions are the authors; not necessarily that of OANDA Corporation or any of its affiliates, subsidiaries, officers or directors. Leveraged trading is high risk and not suitable for all. You could lose all of your deposited funds.